- United States

- /

- Banks

- /

- NYSE:HTH

Uncovering October 2024's Undiscovered Gems in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 1.2% in the last week and rising 31% over the past year, with earnings projected to grow by 16% annually. In this thriving environment, identifying stocks that combine solid fundamentals with growth potential can uncover promising opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Hilltop Holdings (NYSE:HTH)

Simply Wall St Value Rating: ★★★★★★

Overview: Hilltop Holdings Inc. is a financial holding company that offers business and consumer banking services, with a market capitalization of approximately $1.99 billion.

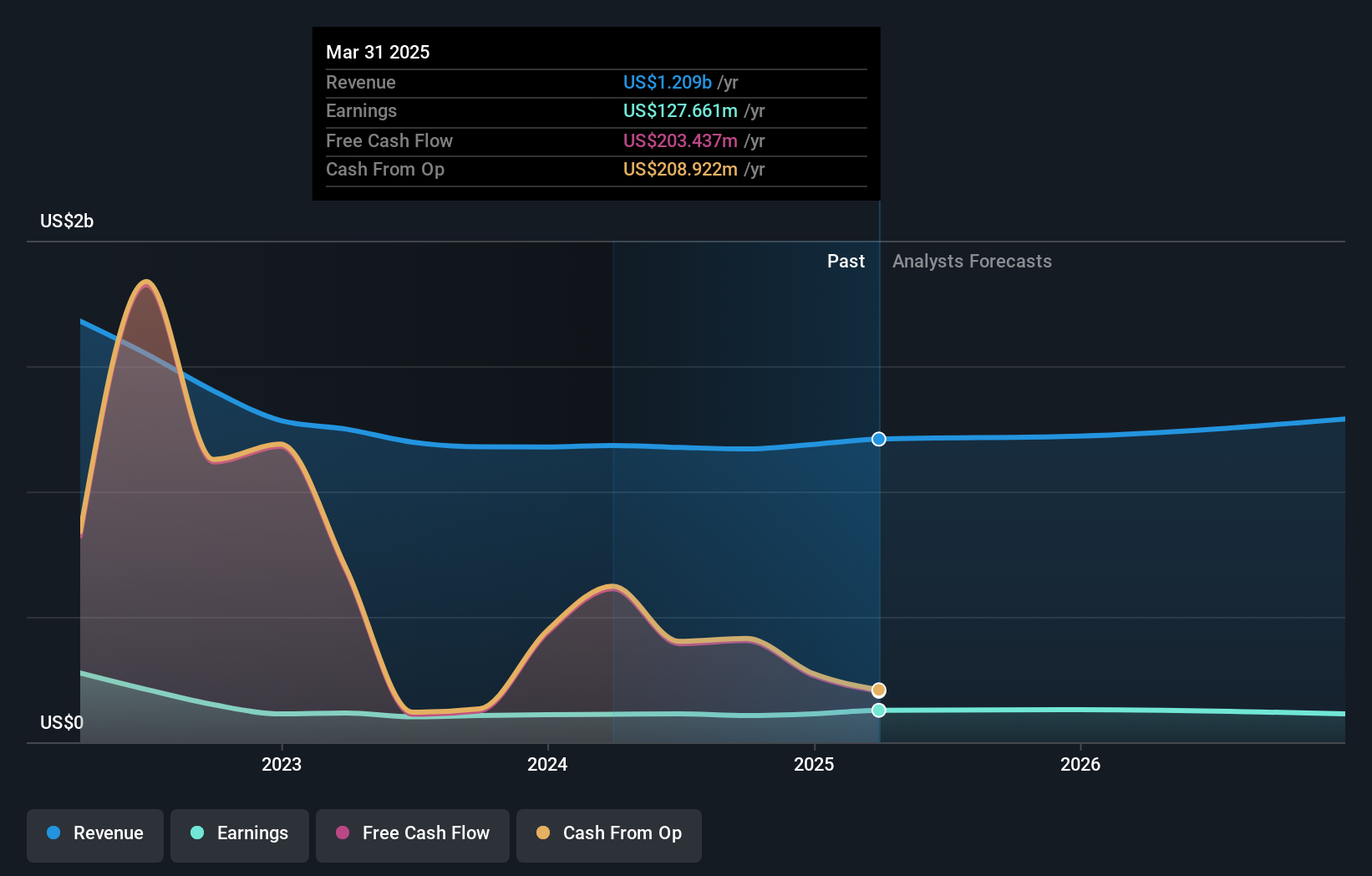

Operations: Hilltop Holdings generates revenue primarily from its banking ($410.73 million), broker-dealer ($460.64 million), and mortgage origination ($298.48 million) segments, with a smaller contribution from corporate activities ($6.47 million).

Hilltop Holdings, with assets of US$15.6 billion and equity at US$2.2 billion, showcases a robust financial stance. The company has a sufficient allowance for bad loans at 109%, reflecting prudent risk management given its bad loan ratio of 1.3%. Recent buybacks included 320,000 shares for US$9.91 million, indicating confidence in its own valuation. Earnings grew by 12% over the past year, outpacing industry trends despite forecasts suggesting a potential average decline of 2.3% annually over the next three years.

- Delve into the full analysis health report here for a deeper understanding of Hilltop Holdings.

Review our historical performance report to gain insights into Hilltop Holdings''s past performance.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market cap of $971.18 million.

Operations: IDT generates revenue through its communications and payment services internationally. The company has a market cap of approximately $971.18 million.

IDT, a nimble player in the telecom sector, shines with its impressive 59.2% earnings growth over the past year, outpacing the industry average of -26%. Trading at 73.5% below estimated fair value, IDT boasts high-quality earnings and remains debt-free for five years. Recent financials reveal net income climbing to US$64 million from US$40 million last year, while basic EPS rose to US$2.55 from US$1.59. The company also repurchased shares worth US$3.4 million recently, signaling confidence in its market position.

- Unlock comprehensive insights into our analysis of IDT stock in this health report.

Gain insights into IDT's historical performance by reviewing our past performance report.

Moove Lubricants Holdings (NYSE:MOOV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Moove Lubricants Holdings is involved in the formulation, manufacturing, distribution, marketing, selling, and servicing of lubricant products across South America, North America, and Europe with a market cap of $1.78 billion.

Operations: Moove Lubricants Holdings generates revenue primarily from its lubricant products, with South America contributing R$4.66 billion, Europe R$2.97 billion, and North America R$2.36 billion.

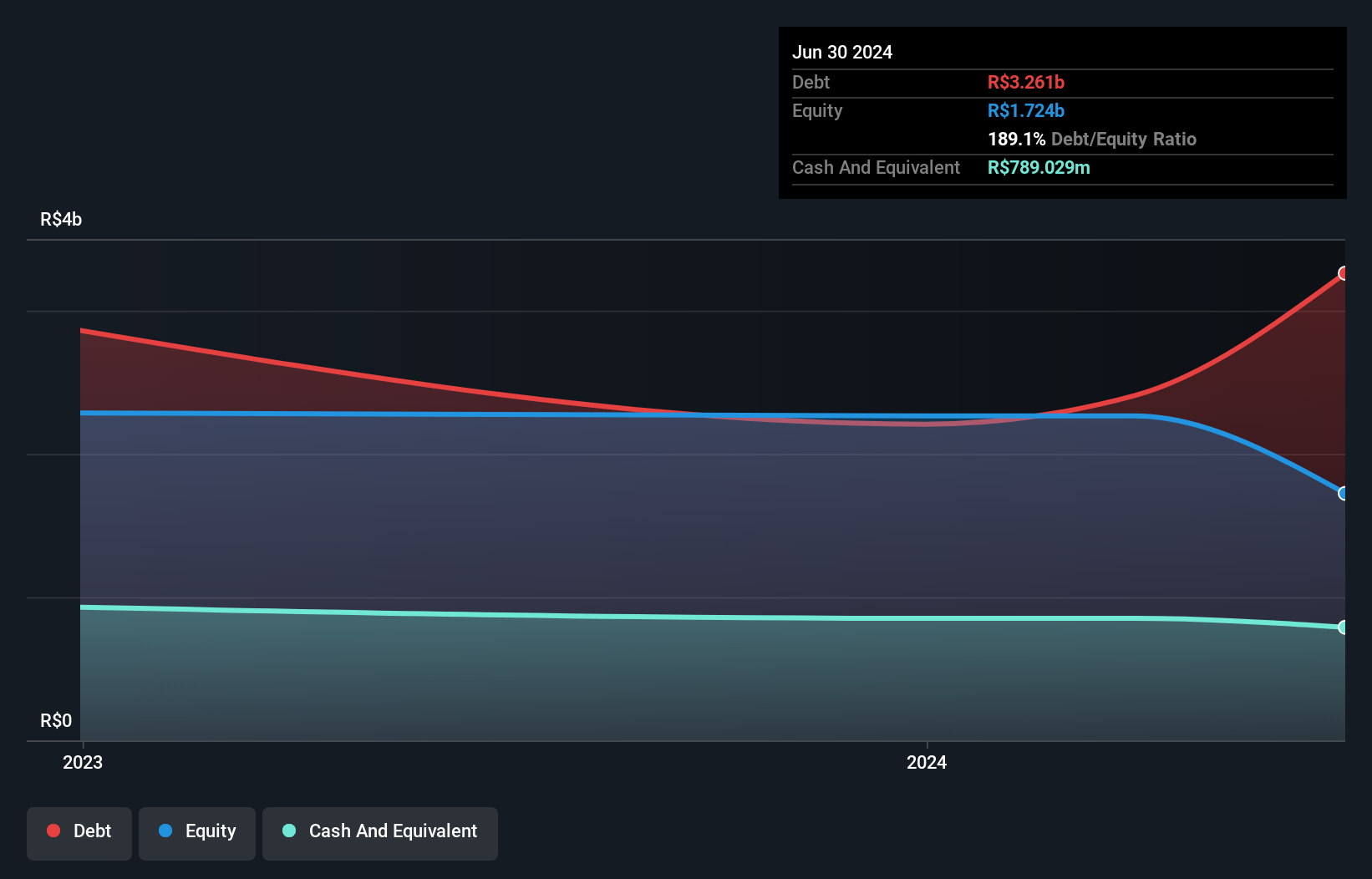

Moove Lubricants Holdings, a small player in the market, showcases impressive growth with earnings surging by 65% over the past year, significantly outpacing the Chemicals industry. Despite its high net debt to equity ratio of 143.4%, interest payments are well covered at 8.5 times by EBIT. The company's P/E ratio stands attractively at 17.7x compared to the broader US market's 18.2x, suggesting potential value for investors considering its recent $100 million IPO filing on September 16th, 2024.

- Click here to discover the nuances of Moove Lubricants Holdings with our detailed analytical health report.

Assess Moove Lubricants Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 224 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilltop Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTH

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives