The United States market has shown robust performance, climbing 1.5% in the last week and surging 33% over the past year, with earnings forecasted to grow by 16% annually. In such a dynamic environment, identifying stocks with strong fundamentals and untapped potential can offer exciting opportunities for investors seeking to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Karooooo (NasdaqCM:KARO)

Simply Wall St Value Rating: ★★★★★★

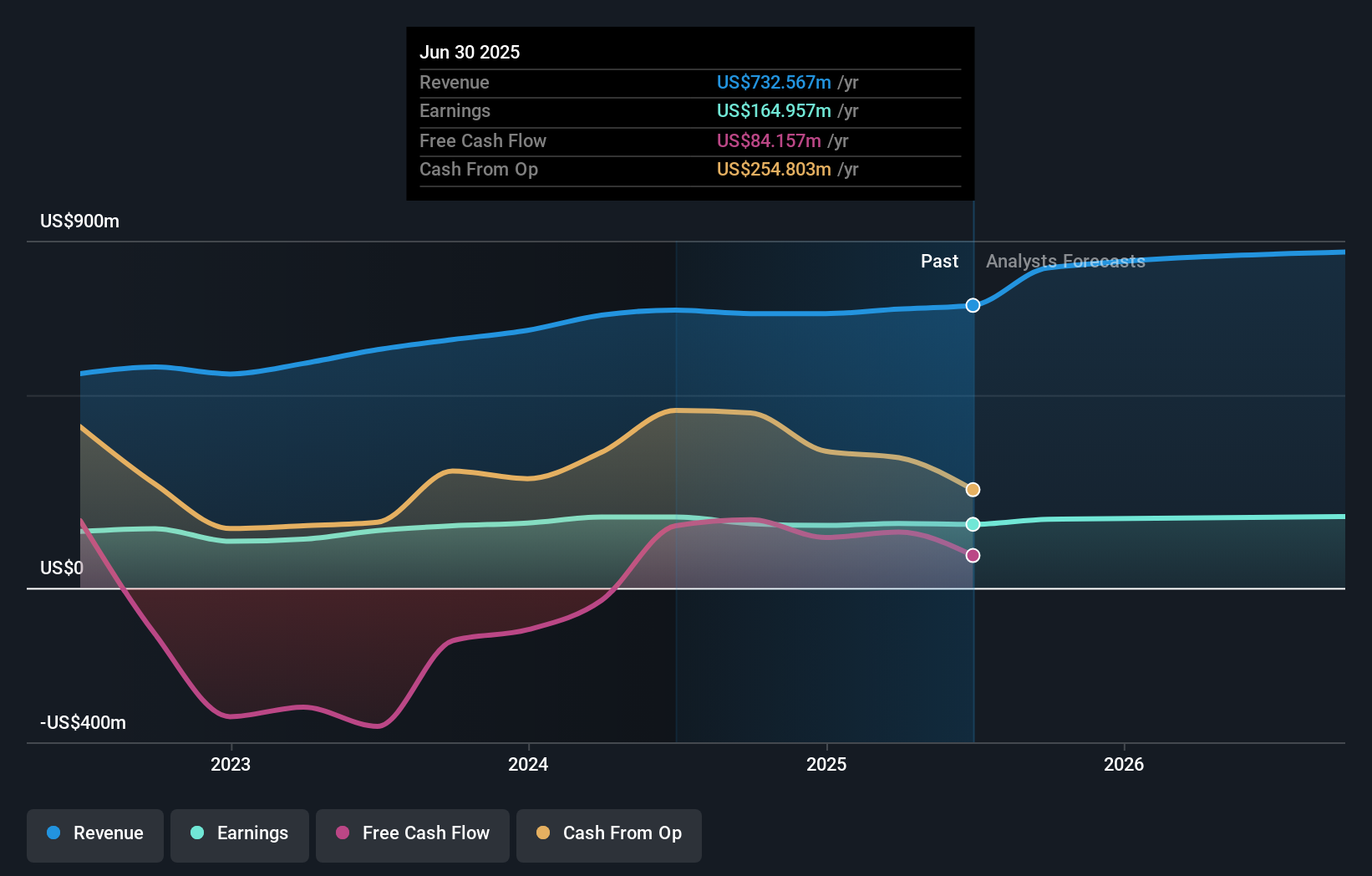

Overview: Karooooo Ltd. offers a mobility software-as-a-service (SaaS) platform for connected vehicles across multiple regions including South Africa, the rest of Africa, Europe, the Asia-Pacific, the Middle East, and the United States with a market capitalization of approximately $1.35 billion.

Operations: Karooooo generates revenue primarily from its Cartrack segment, amounting to ZAR 3.74 billion, with additional contributions from Karooooo Logistics at ZAR 355.99 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency in managing expenses relative to revenue generated.

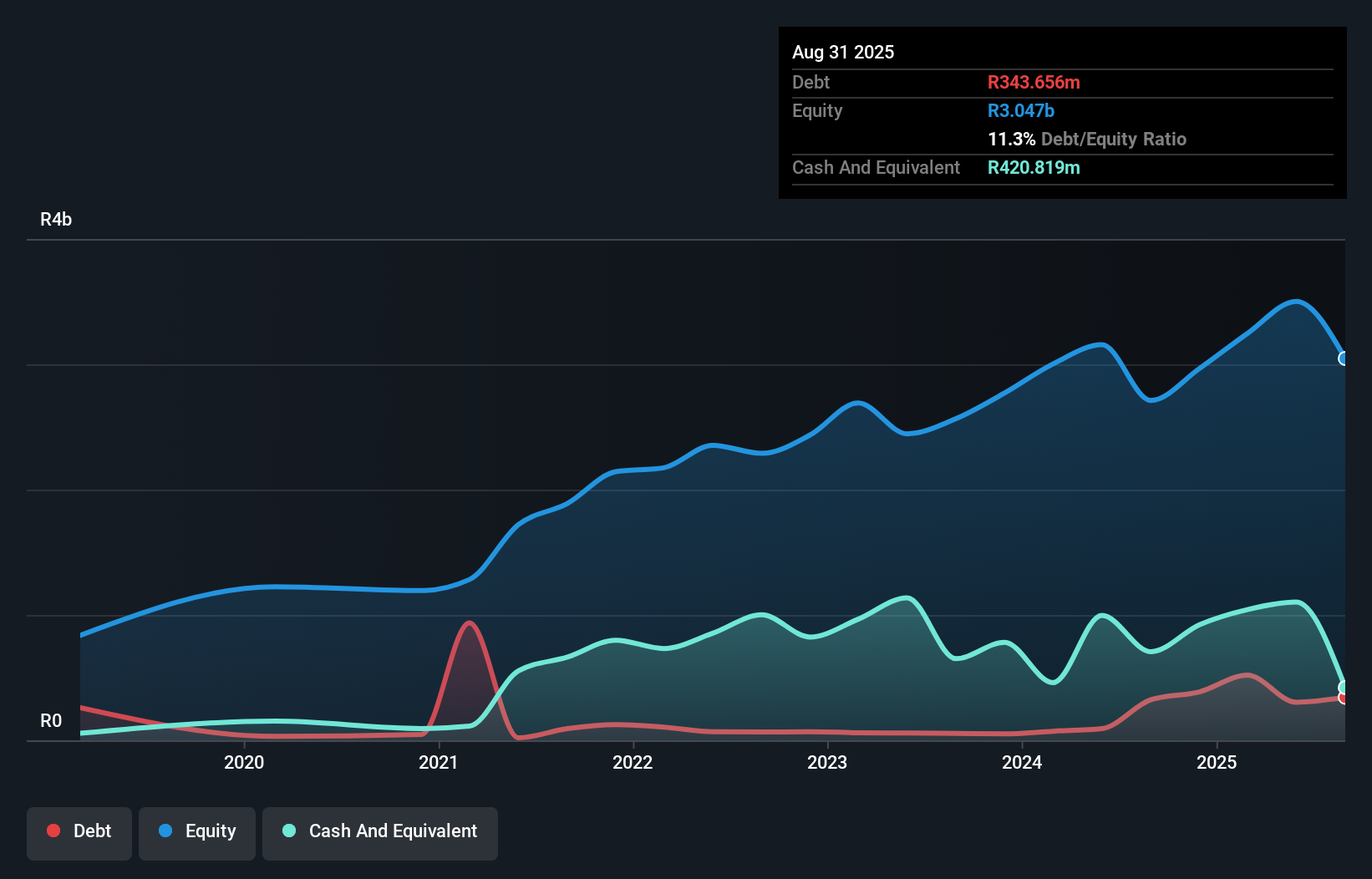

Karooooo, a dynamic player in the tech sector, has shown impressive growth with earnings up by 33.5% over the past year, surpassing industry averages. The company's debt to equity ratio has significantly improved from 21.7% to 3% over five years, indicating robust financial health. Recent reports highlight a net income of ZAR 211 million for Q2 2024 and sales reaching ZAR 1,107 million. Trading at about 31% below estimated fair value suggests potential upside for investors eyeing future gains.

- Click here to discover the nuances of Karooooo with our detailed analytical health report.

Gain insights into Karooooo's historical performance by reviewing our past performance report.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.85 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer and Commercial segments, with $401.69 million and $248.43 million respectively. The Corporate Services segment contributes an additional $46.78 million to the overall revenue stream.

Pathward Financial, with total assets of US$7.5B and equity of US$765.2M, showcases a robust profile by holding deposits worth US$6.4B against loans totaling US$4.5B. The company enjoys a net interest margin of 6.1% and maintains a sufficient allowance for bad loans at 1% of total loans, indicating sound risk management practices. Recent activities include the repurchase of 286,920 shares for US$14.99M and plans to divest its commercial insurance premium finance business, signaling strategic shifts in operations while continuing to deliver dividends to shareholders.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation operates in the communications and payment services sectors across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.21 billion.

Operations: IDT generates revenue primarily from its Traditional Communications segment, which accounts for $899.60 million, followed by Fintech at $120.70 million, National Retail Solutions (NRS) at $103.10 million, and Net2phone at $82.30 million.

IDT, a telecom player with no debt for five years, has shown remarkable earnings growth of 59.2% over the past year, outpacing the industry average of -18.2%. The company trades at 73.5% below its estimated fair value and boasts high-quality earnings. Recent financials reveal net income climbed to US$64.45 million from US$40.49 million last year, with basic EPS rising to US$2.55 from US$1.59. However, significant insider selling occurred in the last three months, which may raise some eyebrows among investors despite a positive free cash flow of US$37.98 million as of January 2024 and ongoing share buybacks totaling $48.52 million since 2016.

- Get an in-depth perspective on IDT's performance by reading our health report here.

Examine IDT's past performance report to understand how it has performed in the past.

Make It Happen

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 216 more companies for you to explore.Click here to unveil our expertly curated list of 219 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.