- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

ImmunityBio And 2 Other Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As major U.S. stock indexes continue to set new records, driven by significant developments in tech and anticipation of Federal Reserve decisions, investors are keenly observing the market for potential opportunities. In such an environment, identifying stocks that may be priced below their estimated worth can offer intriguing prospects for those looking to capitalize on market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.85 | $13.55 | 49.4% |

| Super Group (SGHC) (SGHC) | $11.37 | $22.12 | 48.6% |

| ImmunityBio (IBRX) | $2.58 | $5.14 | 49.9% |

| First Busey (BUSE) | $23.24 | $45.91 | 49.4% |

| First Advantage (FA) | $14.11 | $27.18 | 48.1% |

| Fifth Third Bancorp (FITB) | $42.275 | $83.71 | 49.5% |

| Enovix (ENVX) | $11.68 | $23.23 | 49.7% |

| e.l.f. Beauty (ELF) | $131.70 | $251.92 | 47.7% |

| Corpay (CPAY) | $285.59 | $545.86 | 47.7% |

| Compass (COMP) | $7.93 | $15.19 | 47.8% |

Let's take a closer look at a couple of our picks from the screened companies.

ImmunityBio (IBRX)

Overview: ImmunityBio, Inc. is a commercial stage biotechnology company focused on developing next-generation therapies to enhance the natural immune system against cancers and infectious diseases, with a market cap of $2.62 billion.

Operations: The company generates revenue of $56.60 million from its development of advanced therapies aimed at strengthening the immune system to combat cancers and infectious diseases.

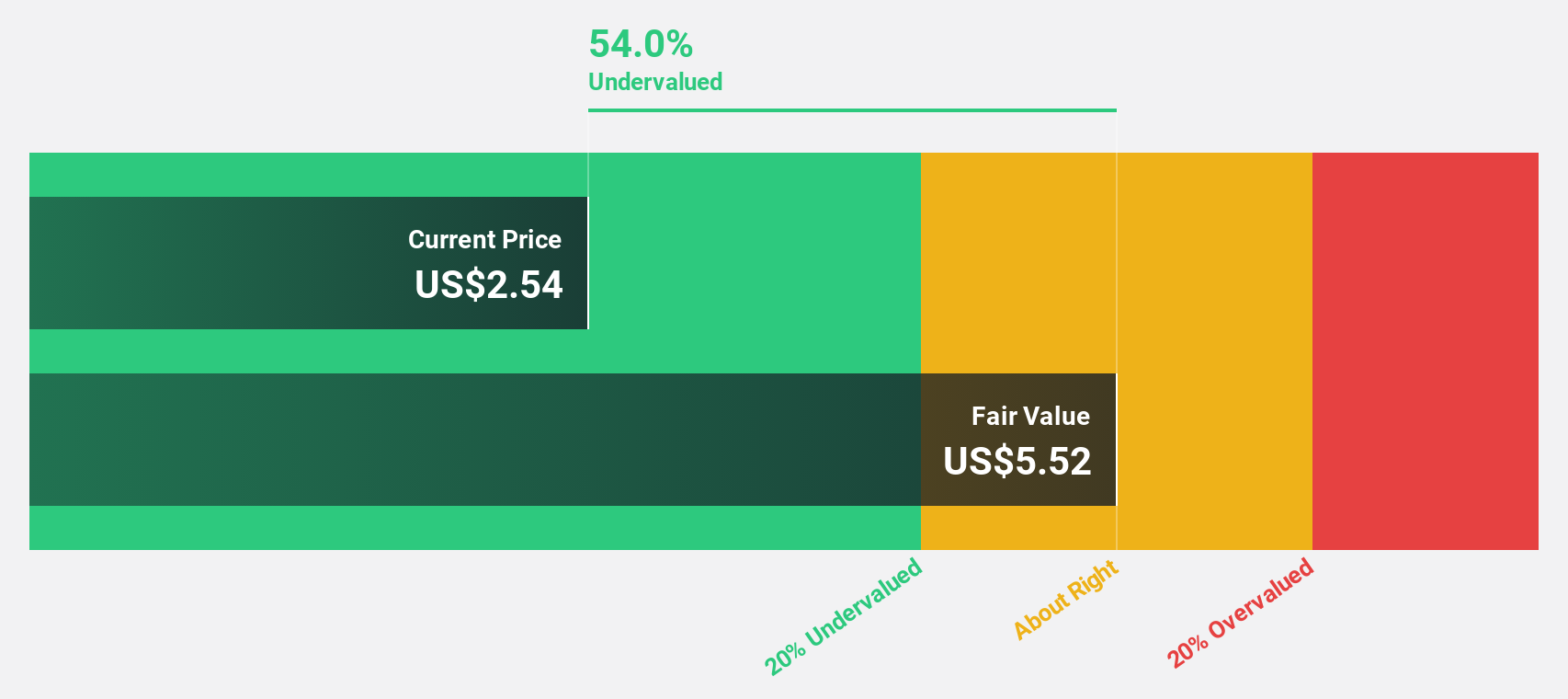

Estimated Discount To Fair Value: 49.9%

ImmunityBio shows potential as an undervalued stock based on cash flows, trading at US$2.58, significantly below its estimated fair value of US$5.14. Despite recent shareholder dilution, the company is forecast to achieve profitability within three years and expects revenue growth of 57.6% annually, outpacing the broader U.S. market. Recent promising clinical trial results for ANKTIVA in cancer treatment may further enhance its financial prospects and support future valuation improvements.

- In light of our recent growth report, it seems possible that ImmunityBio's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in ImmunityBio's balance sheet health report.

Array Digital Infrastructure (AD)

Overview: Array Digital Infrastructure, Inc. offers wireless telecommunications services in the United States and has a market cap of $4.36 billion.

Operations: The company generates revenue from its Towers segment at $241 million and its Wireless segment at $3.59 billion.

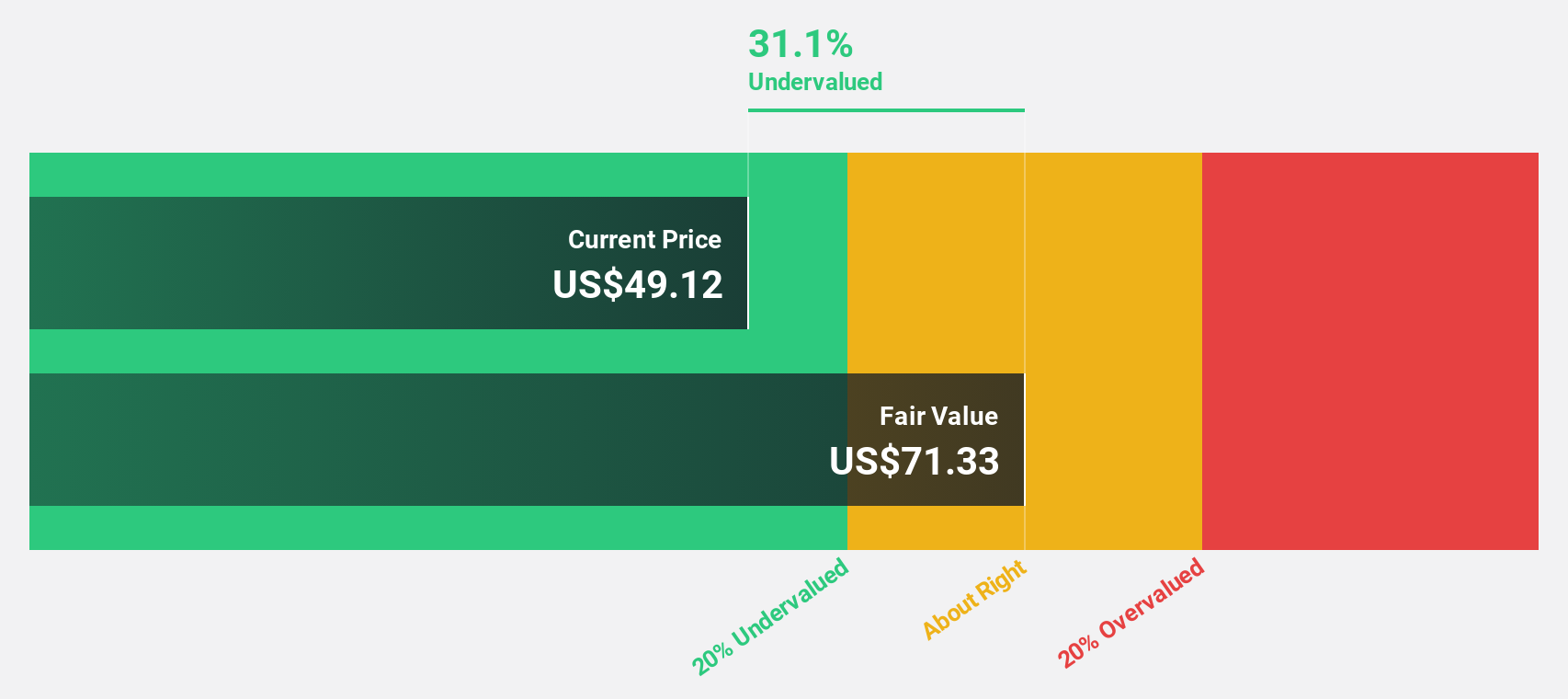

Estimated Discount To Fair Value: 28.7%

Array Digital Infrastructure, trading at US$50.78, is significantly undervalued with a fair value estimate of US$71.20. The recent transaction with T-Mobile has led to amendments in company bylaws and a special dividend payout of $23 per share. Despite expected revenue declines, the company's profitability is set to grow 61% annually over the next three years, and its return on equity is projected to reach 23.6%, highlighting strong cash flow potential amidst strategic restructuring efforts.

- Our expertly prepared growth report on Array Digital Infrastructure implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Array Digital Infrastructure.

CompoSecure (CMPO)

Overview: CompoSecure, Inc. specializes in the design and manufacture of metal, composite, and proprietary financial transaction cards for both domestic and international markets, with a market cap of $2.16 billion.

Operations: Revenue Segments (in millions of $):

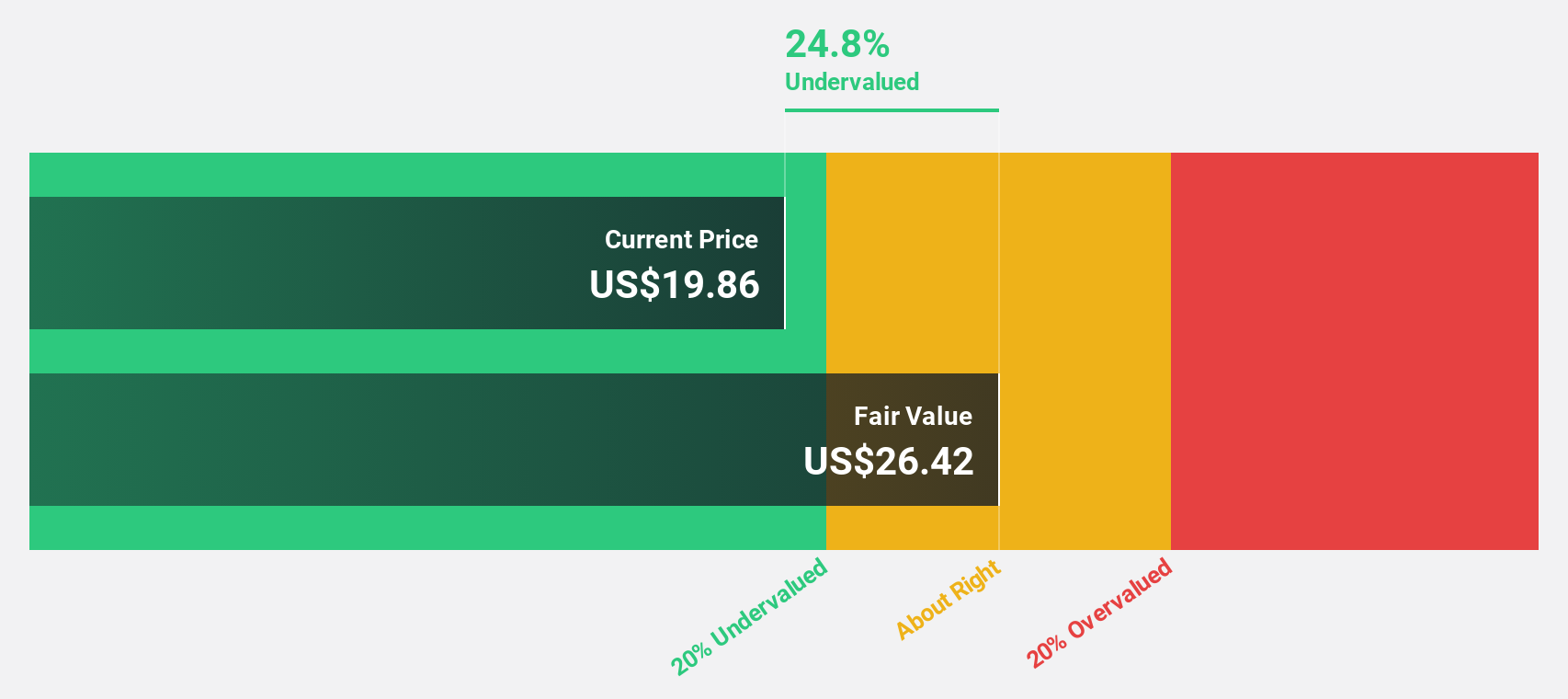

Estimated Discount To Fair Value: 21.8%

CompoSecure, trading at US$20.64, is highly undervalued with a fair value of US$26.41. Despite recent net losses and shareholder dilution, the company is expected to become profitable within three years, with revenue growth projected at 26.1% annually—outpacing the market average. The appointment of Mary Holt as CFO may enhance financial strategy amid these transitions. However, negative equity and insider selling present challenges that investors should consider when evaluating its cash flow potential.

- Insights from our recent growth report point to a promising forecast for CompoSecure's business outlook.

- Take a closer look at CompoSecure's balance sheet health here in our report.

Taking Advantage

- Click here to access our complete index of 183 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives