- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:UNIT

Uniti Group (UNIT) Profit Margin Surges, But Future Earnings Decline Challenges Bullish Narratives

Reviewed by Simply Wall St

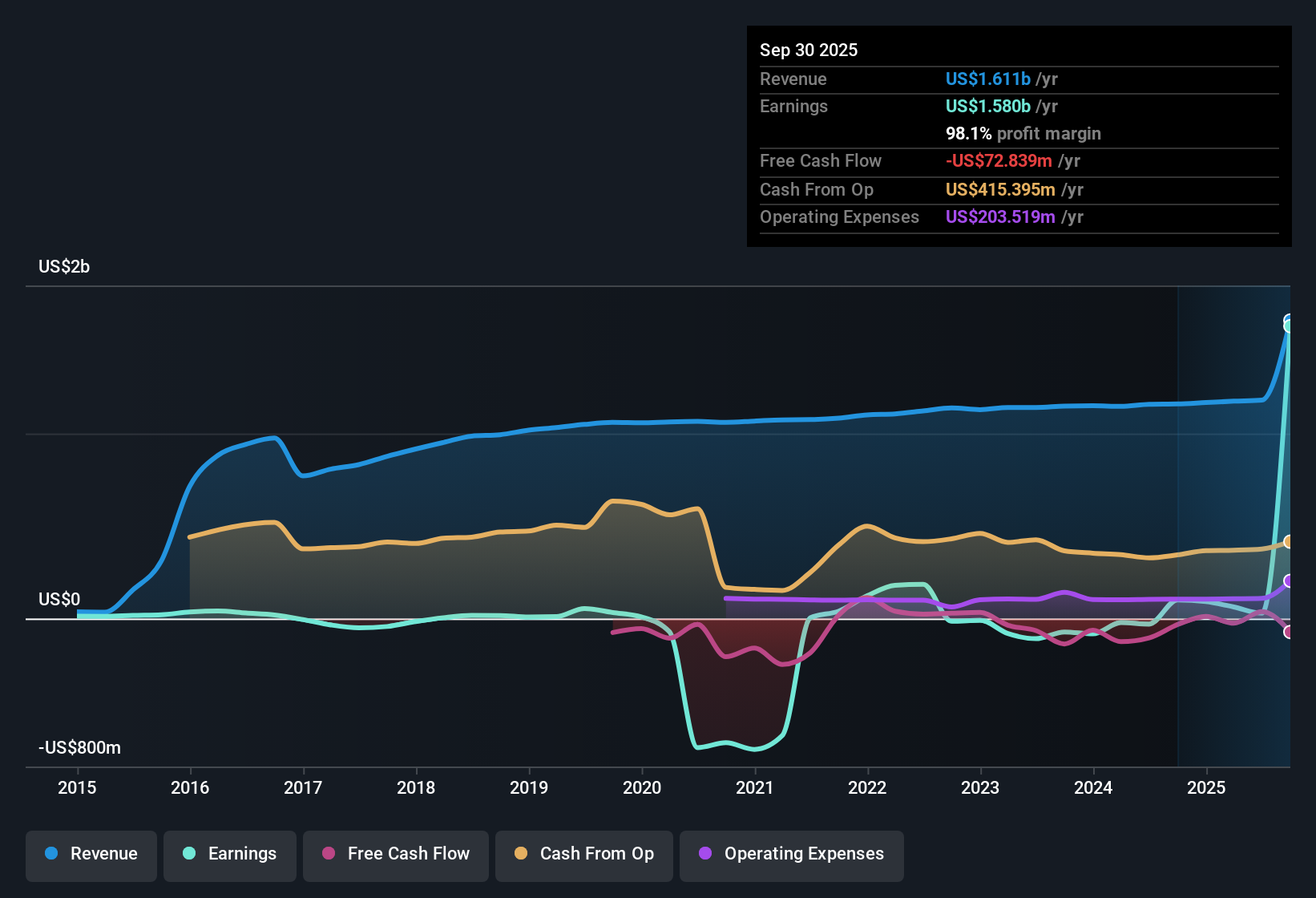

Uniti Group (UNIT) reported revenue growth forecasts of 18.9% per year, well above the US market’s 10.5% rate. Net profit margins soared to 98.1% from just 8.7% last year. EPS growth came in at a hefty 1,469% year-over-year, surpassing the five-year average of 74.8% and marking a clear swing to profitability over the period. Despite these eye-catching figures and a rock-bottom price-to-earnings ratio of just 0.9x (far below peers), future projections are less optimistic. The company is expected to see earnings drop 104.6% per year over the next three years, creating a complex scenario for investors who must weigh impressive recent momentum against a more cautious outlook.

See our full analysis for Uniti Group.Now let’s see how this latest set of numbers measures up when held against the major narratives around Uniti. Some assumptions might get confirmed, while others could face new questions.

See what the community is saying about Uniti Group

Fiber Build-Out Shifts Revenue Mix

- Fiber revenues rose 7% year-over-year, now making up an increasing share of Uniti's business while legacy voice and TDM products continue to shrink.

- Analysts' consensus view emphasizes that the aggressive push toward fiber, plus strategic deals with hyperscaler clients, is projected to drive recurring, higher-margin revenue and new growth opportunities.

- This mix shift is expected to boost long-term margins, helping to offset near-term profit pressure from declining copper-based services.

- Regulatory tailwinds around rural broadband and copper retirement are enabling Uniti to economically expand its addressable market and further stabilize revenue streams.

- See what management and Wall St agree on in the full Consensus Narrative. 📊 Read the full Uniti Group Consensus Narrative.

Capital Structure: Debt and Dilution Concerns

- The company shows evidence of negative equity and has grown share count by 0.85% annually, signaling reliance on refinancing and capital raises.

- Analysts' consensus view calls out how rising capital intensity for fiber expansion, coupled with substantial upcoming debt maturities and a leverage ratio near 5.5 to 6.0 times, brings ongoing refinancing risk.

- Critics highlight that cost per passing is projected at $750 to $850, which, together with high interest expenses despite refinancing (blended debt yield down 550 basis points in 2.5 years), may constrain free cash flow for several years.

- While pipeline deals remain strong, continued reliance on large anchor clients and persistent refinancing needs increase execution risk, particularly if funding conditions tighten in the market.

Valuation Remains a Double-Edged Sword

- Uniti’s price-to-earnings ratio stands at just 0.9 times, deeply undervalued relative to both the US telecom sector (15.4 times) and direct peers (14.2 times), yet forward projections suggest earnings could be challenged over the next three years.

- Analysts' consensus view notes that the consensus price target of 7.42 implies roughly a 23.7% premium over the current share price of $6.00, but to justify this, Uniti would need to sustain revenue growth and achieve a PE ratio of 90 times on 2028 earnings.

- What’s notable here is that while the valuation looks incredibly cheap today, sustaining the target upside depends on reversing expected profit declines—even small earnings shortfalls could quickly erase the perceived discount.

- Conflicting expectations among analysts, with price targets ranging from $4.00 to $11.00, further highlight that investor conviction is highly sensitive to near-term execution and operating leverage as Uniti pivots its business model.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Uniti Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? In just a few minutes, you can craft and share your own perspective. Do it your way

A great starting point for your Uniti Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Uniti’s heavy debt loads, refinancing needs, and negative equity present significant risks to its financial stability, even in light of recent revenue growth.

If you want investments shielded from these balance sheet pressures, uncover more resilient companies with stronger fundamentals through solid balance sheet and fundamentals stocks screener (1981 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UNIT

Uniti Group

Uniti (NASDAQ: UNIT) is a premier insurgent fiber provider dedicated to enabling mission-critical connectivity across the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)