- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Launches US$1.2 Billion Offering With New Underwriters; Share Price Flat

Reviewed by Simply Wall St

T-Mobile US (NasdaqGS:TMUS) experienced notable corporate developments in the most recent quarter that coincided with a 16% rise in their stock price. The announcement of a new fixed-income offering with 16 co-lead underwriters could enhance financial positioning and market confidence. During the same period, T-Mobile's earnings were strong with significant revenue and net income increases. Share buybacks also possibly played a role in boosting investor sentiment, while broader market trends showed slight gains with the S&P 500 and Nasdaq up, amidst a general rebound from previous downturns, possibly reflecting positive investor sentiment towards tech and communication sectors.

We've identified 2 possible red flags for T-Mobile US that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The past five years have seen T-Mobile US achieve a total shareholder return of 219.18%, reflecting a remarkable trajectory. Contributing to this growth were strategic operational decisions, such as the expansion of T-Mobile's industry-leading 5G network, which bolstered its market position and enhanced competitive advantage. Moreover, key partnerships like those with SpaceX for satellite connectivity exemplified its innovative approach to service offerings. Concurrently, the company's aggressive share buyback programs, notably repurchasing shares totaling billions of US dollars, supported earnings per share growth, thereby increasing shareholder value.

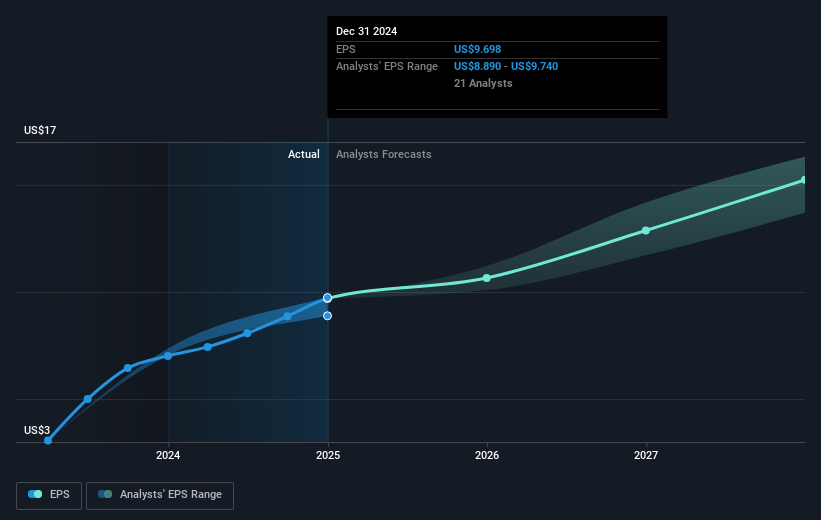

Laying the groundwork for its profitability was T-Mobile's strategic alliances, particularly its collaboration with NVIDIA to explore AI-native wireless networks aimed at pioneering future technologies like 6G. The company's robust financial performance, as demonstrated in its earnings reports, further underscored its success. In 2024, T-Mobile posted a full-year revenue of $81.40 billion, with a net income increase to $11.34 billion, reinforcing its financial health. These developments sustained a strong earning profile and facilitated T-Mobile's trajectory of growth and shareholder returns.

Gain insights into T-Mobile US' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives