- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS): Fresh Analyst Upgrade Sparks Reexamination of Valuation and Growth Potential

Reviewed by Simply Wall St

Wells Fargo just upgraded T-Mobile US (TMUS), citing the company’s standout 5G coverage and continued subscriber growth. The move comes as analysts gain confidence in TMUS’s future revenue prospects and overall industry leadership.

See our latest analysis for T-Mobile US.

Momentum is building for T-Mobile US, as the company continues to roll out new products and partnerships. Most recently, it has expanded its 5G network advantages, boosted cybersecurity capabilities, and enabled satellite connectivity for business and consumer clients. After a steady run so far in 2025, TMUS now trades at $230.09 and has delivered a one-year total shareholder return of 6.56% and a robust 68.5% over three years. This highlights the company’s knack for turning network leadership into meaningful long-term gains.

If you’re keen to see which other innovators are gaining traction, now is a great opportunity to explore fast growing stocks with high insider ownership.

Yet with shares trading near record highs and analysts raising price targets, the question becomes whether T-Mobile is still undervalued or if the market has already priced in its growth. Is there genuine upside left for new buyers?

Most Popular Narrative: 16.3% Undervalued

T-Mobile US’s narrative fair value is set at $274.85, well above the last closing price of $230.09. With this sizable gap, the market may be underestimating T-Mobile’s future growth catalysts. Here is what is driving the expectation of more upside.

Innovations such as the rollout of 5G Advanced and T-Satellite, alongside enhancements in digital platforms like T-Life, signal operational improvements that could drive margin expansion and future earnings growth.

Curious what is really powering this ambitious valuation? Behind these numbers are bold earnings and margin targets, plus a future profit multiple that might surprise even seasoned telecom investors. Uncover the forecasted growth surge and financial levers that analysts believe will lift T-Mobile beyond current expectations. Ready to see the full formula?

Result: Fair Value of $274.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in the broader economy or rising competition could challenge T-Mobile’s ability to deliver the projected growth and profitability targets.

Find out about the key risks to this T-Mobile US narrative.

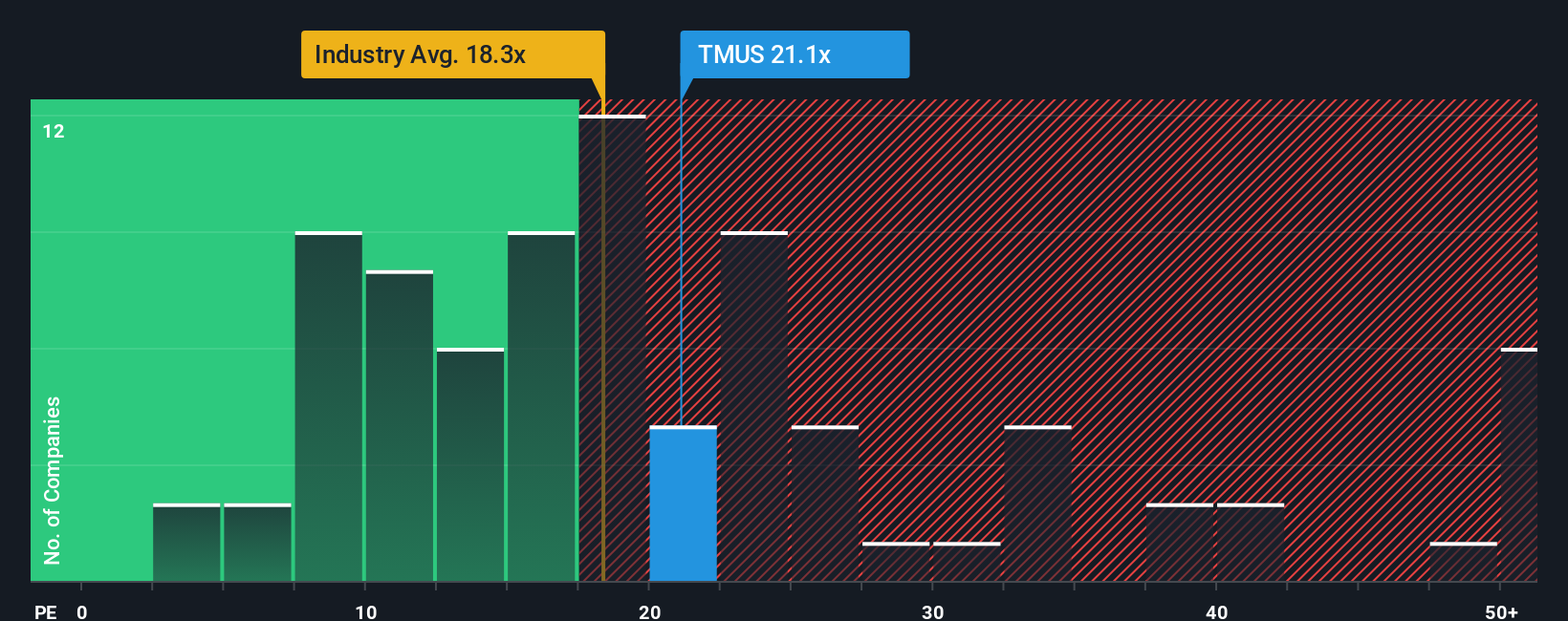

Another Perspective: Market Multiples Paint a Cautionary Picture

While some see clear upside by focusing on T-Mobile’s growth, another lens brings a more cautious view. On a price-to-earnings basis, the company is trading at 21.2x earnings, which is notably higher than its peers at 9.2x and the global wireless telecom average of 18.3x. This also stands well above the fair ratio of 17.6x, which is where valuation could gravitate if market sentiment shifts.

This premium suggests investors have already paid up for future gains. Could the stock hold onto this advantage, or might there be risks if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

If you’re looking to challenge these assumptions or dig into the numbers yourself, it takes just a few minutes to craft a narrative that reflects your own perspective. Do it your way.

A great starting point for your T-Mobile US research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the crowd by acting on fresh opportunities from across the market. Smart investors never limit themselves to just one story. Expand your shortlist with these powerful stock picks:

- Tap into unstoppable innovation by checking out these 24 AI penny stocks where artificial intelligence is reshaping entire industries and opening new growth frontiers.

- Capture hidden value by scanning these 873 undervalued stocks based on cash flows that are primed for a market re-rate based on strong fundamentals and overlooked upside potential.

- Lock in steady returns with these 17 dividend stocks with yields > 3%, highlighting companies offering reliable income streams and attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)