- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

Shareholders in Liberty Latin America (NASDAQ:LILA) have lost 68%, as stock drops 7.5% this past week

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Liberty Latin America Ltd. (NASDAQ:LILA) share price managed to fall 68% over five long years. That's an unpleasant experience for long term holders. Furthermore, it's down 35% in about a quarter. That's not much fun for holders.

If the past week is anything to go by, investor sentiment for Liberty Latin America isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Liberty Latin America

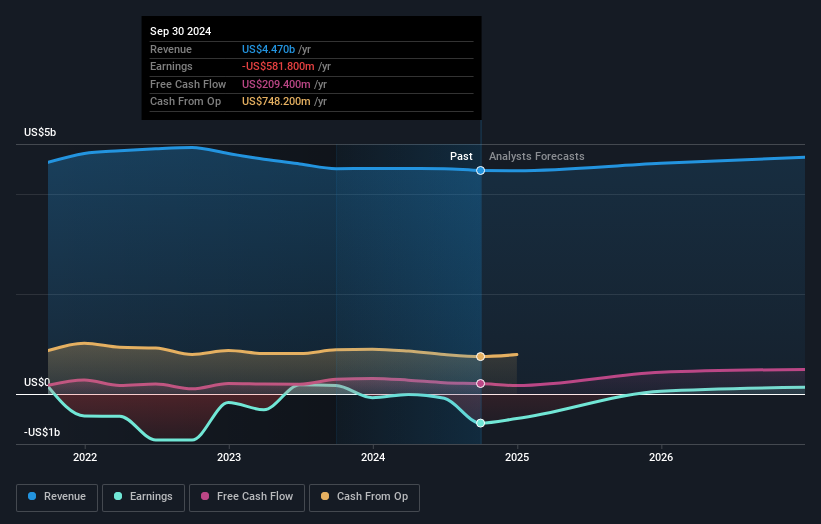

Because Liberty Latin America made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Liberty Latin America saw its revenue increase by 4.4% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 11% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Liberty Latin America. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Liberty Latin America will earn in the future (free profit forecasts).

A Different Perspective

Investors in Liberty Latin America had a tough year, with a total loss of 12%, against a market gain of about 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Liberty Latin America is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services.

Undervalued with moderate growth potential.