- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

Market Cool On Liberty Latin America Ltd.'s (NASDAQ:LILA) Revenues

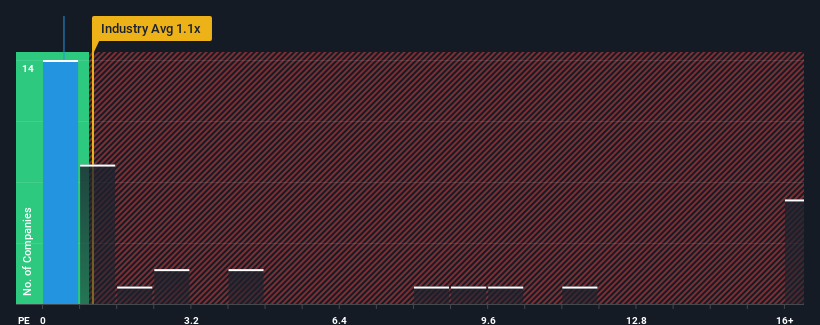

You may think that with a price-to-sales (or "P/S") ratio of 0.4x Liberty Latin America Ltd. (NASDAQ:LILA) is a stock worth checking out, seeing as almost half of all the Telecom companies in the United States have P/S ratios greater than 1.1x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Liberty Latin America

How Liberty Latin America Has Been Performing

While the industry has experienced revenue growth lately, Liberty Latin America's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Liberty Latin America.Is There Any Revenue Growth Forecasted For Liberty Latin America?

Liberty Latin America's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.1%. Regardless, revenue has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 2.4% during the coming year according to the six analysts following the company. With the industry predicted to deliver 1.7% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Liberty Latin America is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Liberty Latin America currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Liberty Latin America has 2 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of Liberty Latin America's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services in Puerto Rico, Panama, Costa Rica, Jamaica, Latin America and the Caribbean, the Bahamas, Trinidad and Tobago, Barbados, Curacao, Chile, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives