- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Reassessing Iridium Communications After a 36% Slide and Recent Share Price Rebound

Reviewed by Bailey Pemberton

- If you have been wondering whether Iridium Communications is starting to look like a bargain or just a value trap, you are not alone, and this is exactly the kind of stock where valuation really matters.

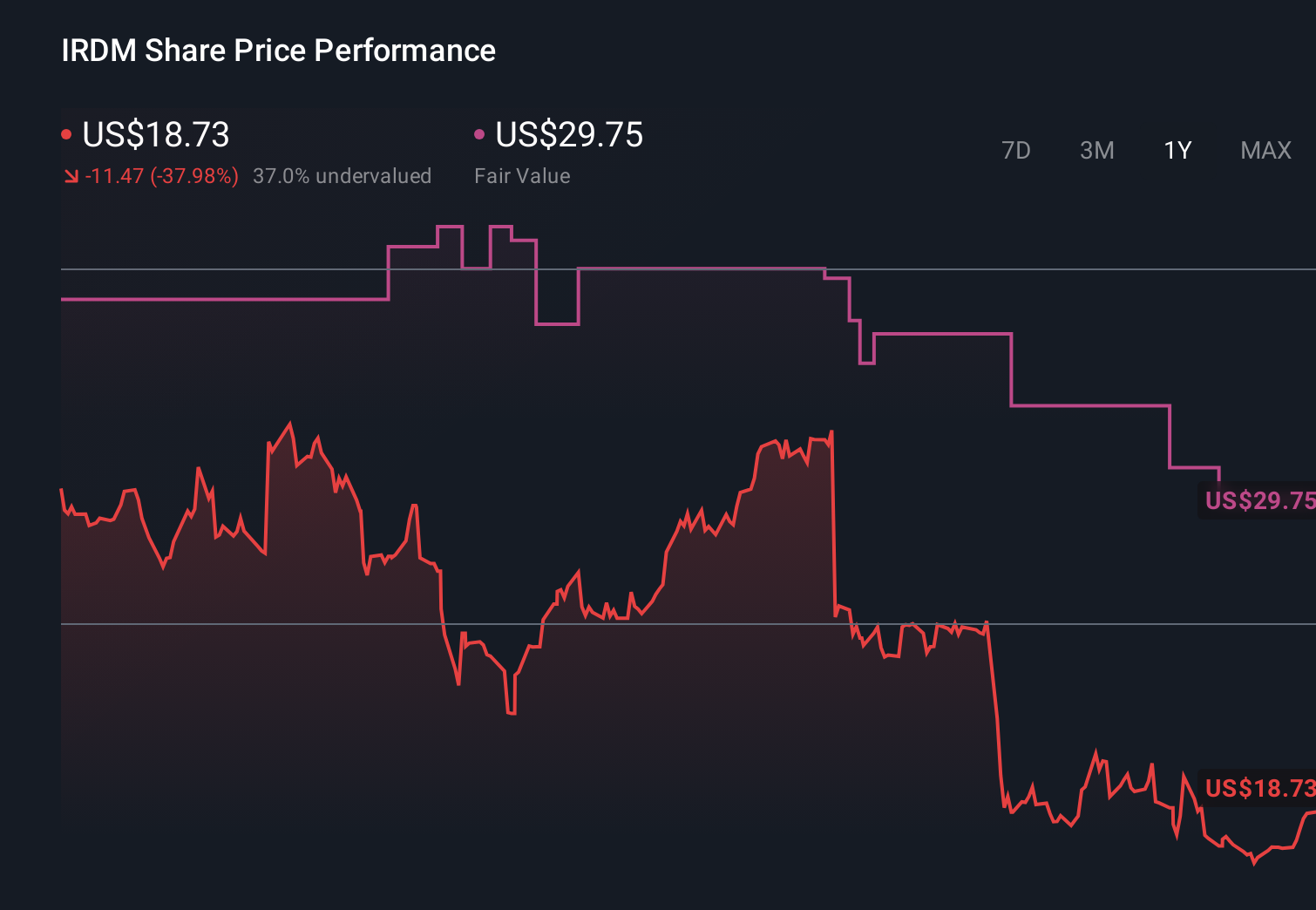

- The share price has bounced 7.5% over the last week and 12.7% over the past month, but it is still down 36.2% year to date and 36.6% over the last year. That suggests sentiment has shifted, but conviction is still fragile.

- Those moves come against a backdrop of ongoing interest in satellite connectivity for remote and critical communications, including government and enterprise contracts that keep Iridium in the conversation when investors think about niche space infrastructure plays. At the same time, increased competition in low Earth orbit services and shifting expectations around long term growth have limited any sustained re rating.

- On our framework Iridium scores a 3/6 valuation score, suggesting the market may be underestimating it on some measures but not across the board. Next we will walk through the main valuation approaches and, toward the end of the article, explore a more holistic way to decide what the stock is really worth.

Find out why Iridium Communications's -36.6% return over the last year is lagging behind its peers.

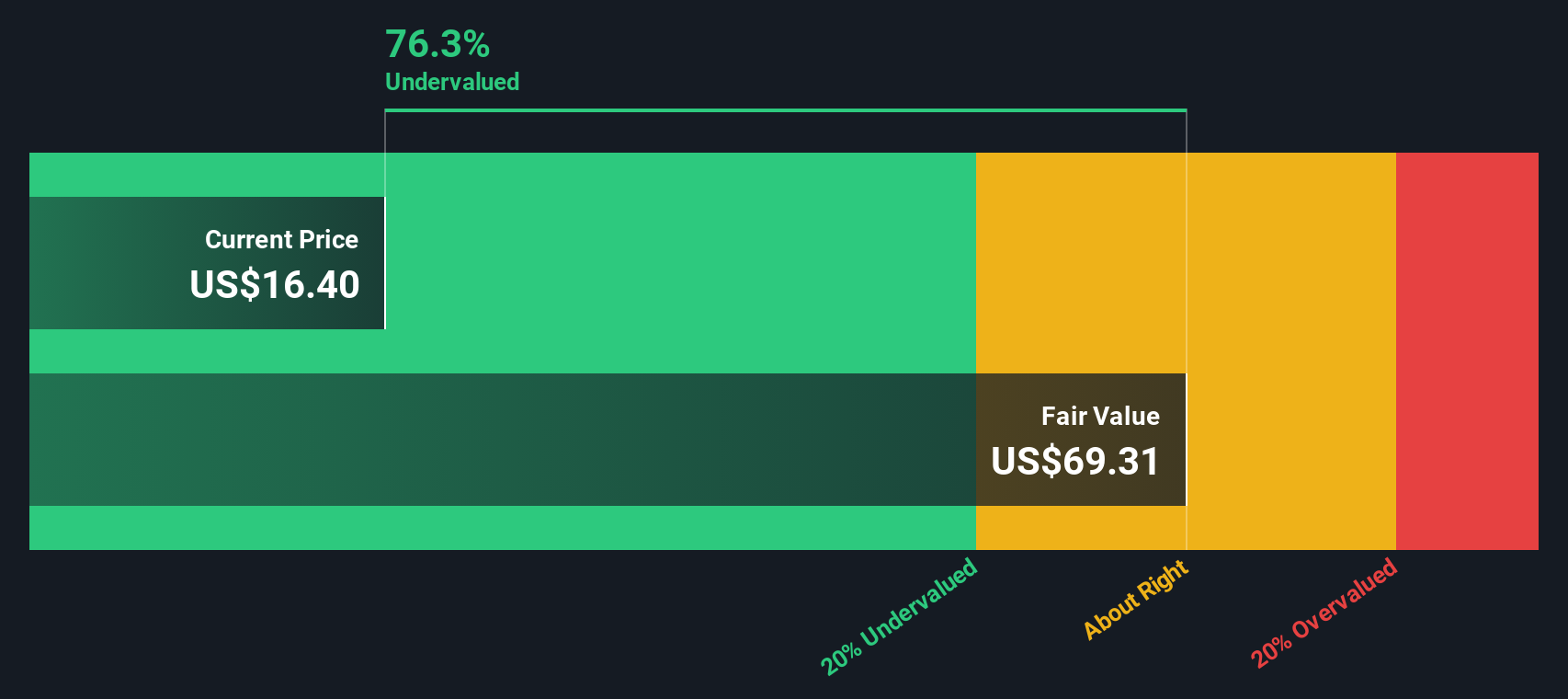

Approach 1: Iridium Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Iridium Communications, this means taking expected future Free Cash Flow, then adjusting for risk and time to arrive at an intrinsic value per share.

Iridium generated about $312.9 Million in Free Cash Flow over the last twelve months, in $. Analysts see this rising steadily, with projections such as roughly $320.2 Million in 2026 and around $377.2 Million by 2029, after which Simply Wall St extrapolates more moderate growth through 2035 using a 2 Stage Free Cash Flow to Equity model.

When those cash flows are discounted back, the model produces an estimated fair value of about $66.23 per share, implying the stock is trading at a 71.5% discount to intrinsic value. On this basis, Iridium appears significantly undervalued relative to its long term cash generation potential according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Iridium Communications is undervalued by 71.5%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

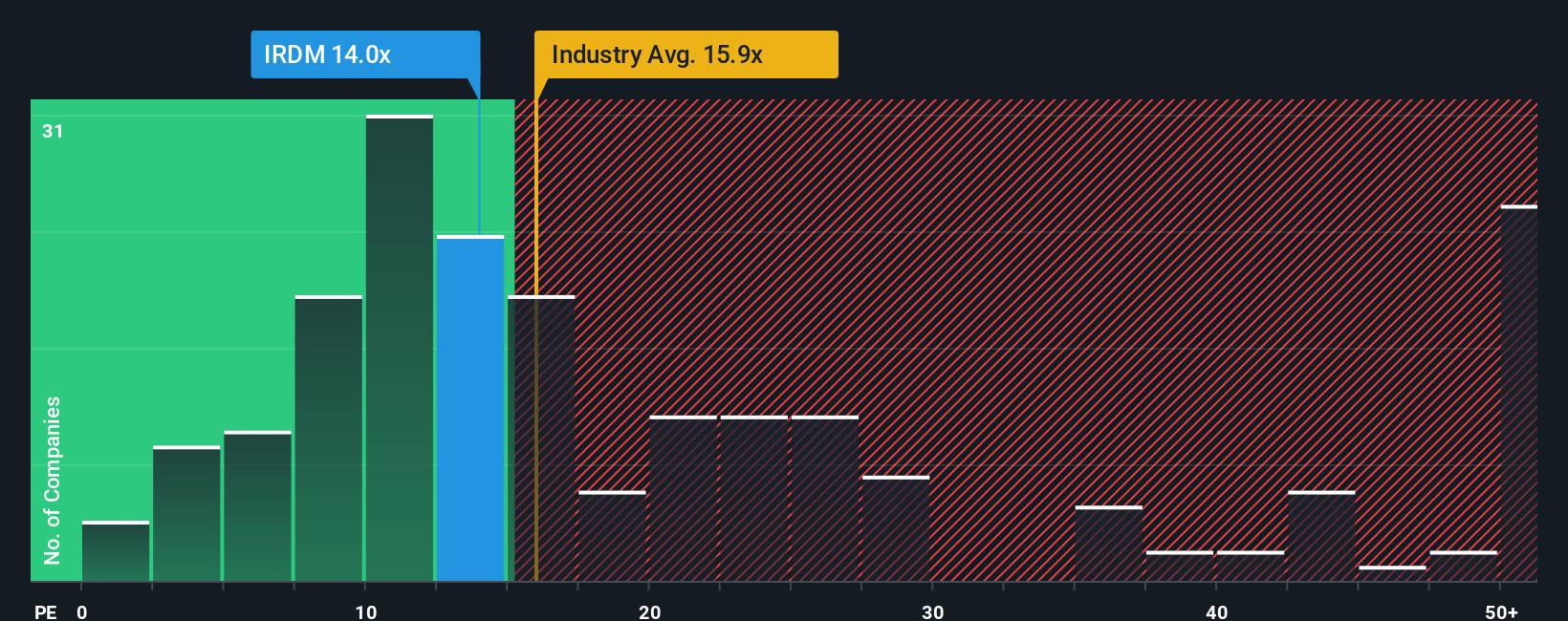

Approach 2: Iridium Communications Price vs Earnings

For a profitable business like Iridium Communications, the Price to Earnings (PE) ratio is a useful way to gauge what investors are willing to pay for each dollar of current earnings. In general, companies with faster, more reliable growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty usually means a lower, more conservative multiple.

Iridium currently trades on a PE of about 15.7x, which is slightly below the broader Telecom industry average of around 16.3x, but well above the peer average of roughly 6.6x. To go beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE multiple a stock should trade on after accounting for its earnings growth prospects, profit margins, risk profile, industry context and market capitalization. For Iridium, this Fair Ratio is 14.5x.

Because the Fair Ratio is tailored to Iridium’s specific fundamentals, it offers a more nuanced anchor point than raw peer or industry averages. With the current PE of 15.7x sitting modestly above the Fair Ratio of 14.5x, the shares look slightly expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Iridium Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Iridium Communications with the numbers by telling a story about its future, translating that story into forecasts for revenue, earnings and margins, and then into a Fair Value that you can easily compare to today’s share price.

A Narrative on Simply Wall St’s Community page is your own, easy to update investment thesis. Here you can spell out what you think will happen to Iridium’s satellite deals, competition and cash flows. The platform automatically links that story to a quantified forecast and real time Fair Value estimate so you can see how your Narrative aligns with different potential investment stances as new news or earnings are released.

For Iridium, one investor might build a bullish Narrative around expanding spectrum partnerships, high margin services and a Fair Value near the top end of analyst targets around 45 dollars. A more cautious investor could create a bearish Narrative that assumes slower IoT growth and tougher competition, supporting a Fair Value closer to the low end near 16 dollars.

Do you think there's more to the story for Iridium Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion