- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Iridium Communications (IRDM) Sees 19% Dip in Share Price Over Last Month

Reviewed by Simply Wall St

Iridium Communications (IRDM) saw its shares decline by 19% over the last month, potentially influenced by various market dynamics. This drop contrasts with broad market trends where major indices like the S&P 500 and Nasdaq hit all-time highs, buoyed by a lower-than-expected Producer Prices Index. Such favorable economic indicators generally encouraged market optimism, yet Iridium's significant share price decline suggests company-specific challenges may have played a role, potentially beyond the scope of general market trends. Factors unrelated to broader market performance could include operational issues or sector-specific pressures that affected investor sentiment about the company.

We've identified 1 risk for Iridium Communications that you should be aware of.

The 19% decline in Iridium Communications' share price over the past month may reflect deeper issues than those affecting general market trends, potentially impacting the company's long-term narrative. While favorable economic conditions have bolstered major indices, Iridium's distinct challenges, such as operational setbacks or industry pressures, might be influencing investor sentiment. This underperformance is further highlighted when considering Iridium's total shareholder return of 26.30% decline over the past year, which contrasts markedly with its prior five-year trajectory of becoming profitable with an 83.5% annual earnings growth. However, in the past year alone, the company underperformed the US Telecom industry, which saw a 15.6% return.

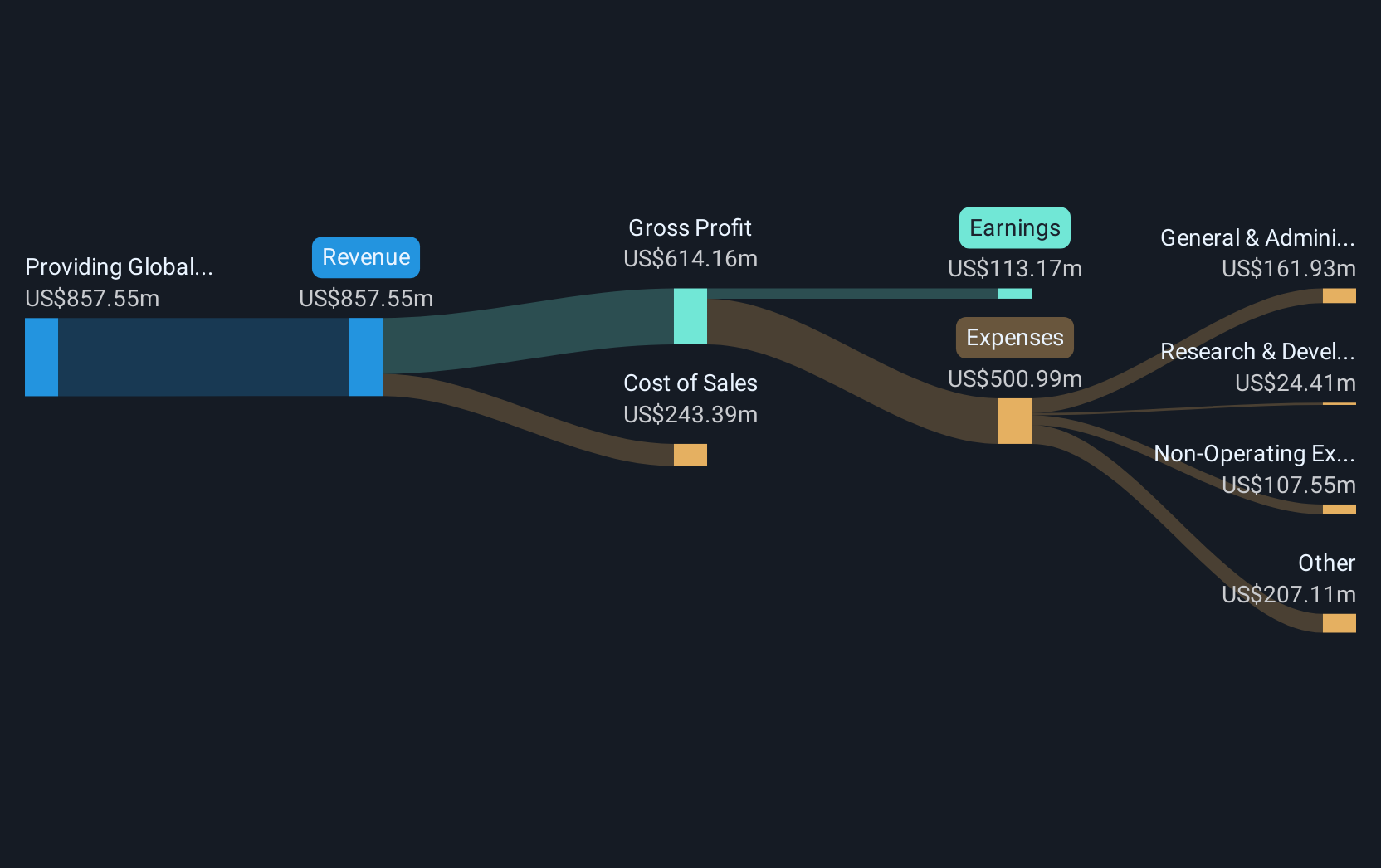

Critically, the recent share price moves may affect revenue and earnings forecasts. With revenue projected to grow annually at 4.8%—slower than the US market average of 9.5%—and increasing competition threatening margins, the potential for operational disruption remains high. The discrepancy between the current share price of US$19.19 and the consensus analyst price target of US$36.12—a 31.7% disparity—suggests room for significant appreciation if future earnings and growth assumptions hold true. Aligning the market view with this target will depend on how well the company addresses the highlighted risks and navigates sector-specific hurdles to reinforce its revenue and earnings narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>