- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Can Iridium (IRDM) Turn Hyundai’s IoT Deal and New Board Hire Into Durable Service-Margin Strength?

Reviewed by Sasha Jovanovic

- In early December 2025, Iridium Communications declared a US$0.15 per share cash dividend payable on December 31 and added experienced telecom and cloud executive Louis Alterman to its expanded 12-member board, while HD Hyundai Construction Equipment selected Iridium to power global satellite connectivity for its Hi MATE remote fleet management system.

- Together, the Hyundai partnership and governance changes highlight Iridium’s push deeper into industrial IoT and enterprise mobility, potentially reinforcing its recurring, high-margin service focus while broadening its customer base beyond traditional satellite communications users.

- Next, we’ll examine how the HD Hyundai Hi MATE IoT connectivity deal could reshape Iridium’s investment narrative and long-term growth assumptions.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Iridium Communications Investment Narrative Recap

To own Iridium, you need to believe that its global L-band network can keep converting niche satellite demand into sticky, recurring IoT and mission critical service revenue. The HD Hyundai Hi MATE win supports that IoT pillar, while the new dividend and board additions do not meaningfully change the key near term swing factor, which remains whether IoT growth can reaccelerate amid rising direct to device competition.

Among the latest announcements, HD Hyundai Construction Equipment’s decision to embed Iridium into its Hi MATE remote fleet management platform looks most relevant, because it speaks directly to the IoT growth story that underpins many bullish theses. If more industrial OEMs adopt Iridium for remote monitoring and telematics, that could help offset softer trends in legacy maritime ARPU and uneven PNT service uptake.

Yet, even as Iridium deepens its IoT reach, investors should be aware that intensifying direct to device and satellite competitors could...

Read the full narrative on Iridium Communications (it's free!)

Iridium Communications' narrative projects $982.9 million revenue and $174.8 million earnings by 2028. This requires 4.7% yearly revenue growth and about a $61.6 million earnings increase from $113.2 million today.

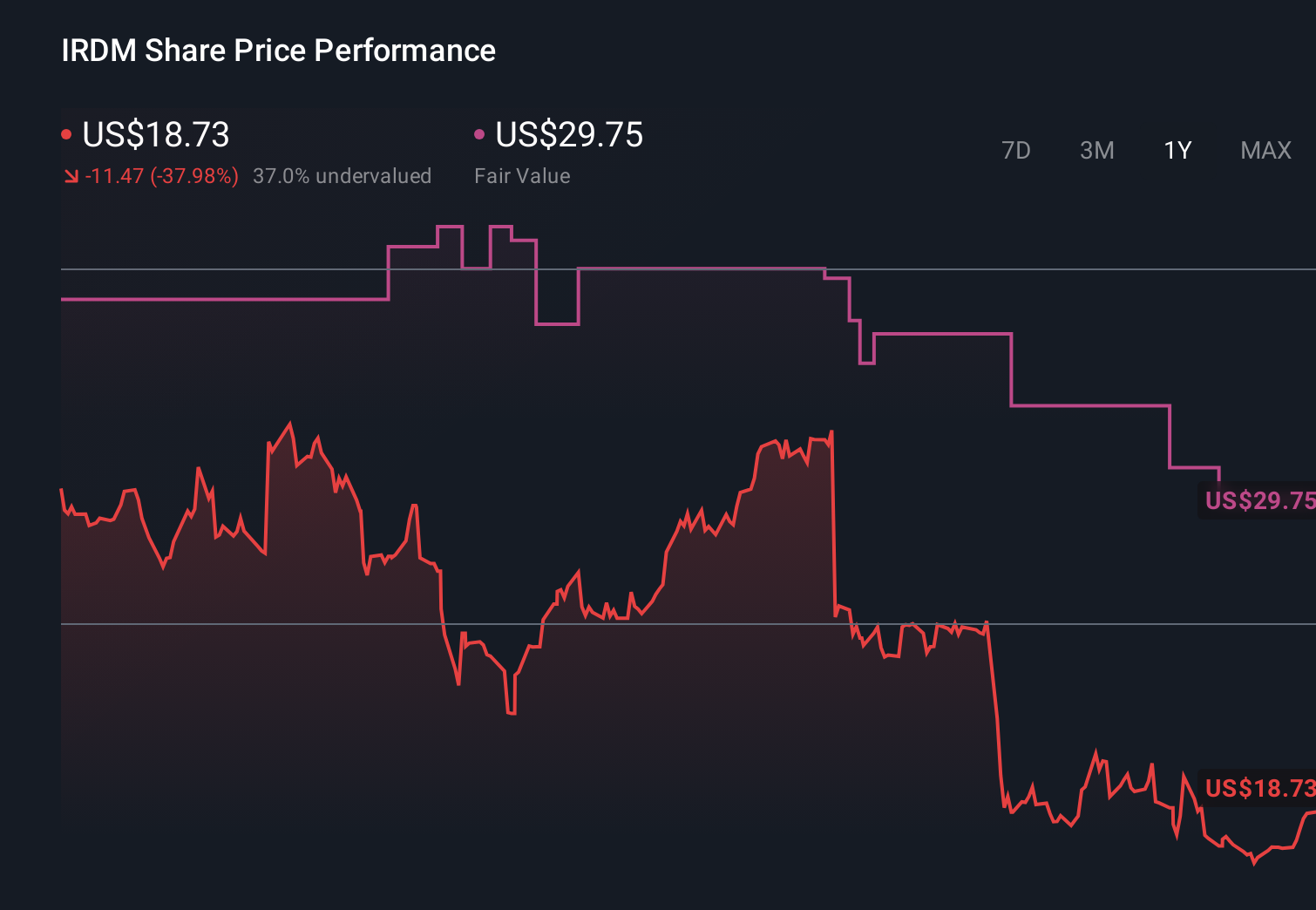

Uncover how Iridium Communications' forecasts yield a $29.75 fair value, a 59% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently value Iridium in a wide US$25 to about US$65 per share range, underscoring just how far opinions can differ. Against that backdrop, the HD Hyundai IoT win speaks directly to the growth pillar many are banking on, but it also heightens the importance of tracking whether IoT revenue momentum actually improves from here.

Explore 7 other fair value estimates on Iridium Communications - why the stock might be worth just $25.00!

Build Your Own Iridium Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Iridium Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iridium Communications' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)