- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Is Cogent’s (CCOI) Dividend Hike Amid Wider Losses a Sign of Shifting Capital Priorities?

Reviewed by Simply Wall St

- Cogent Communications Holdings, Inc. recently reported a larger quarterly net loss for the second quarter ended June 30, 2025, while announcing a regular quarterly dividend increase to US$1.015 per share and completion of a tranche in its long-running share repurchase program.

- This combination of increased net losses with modest enhancements to shareholder returns through dividend and buyback activity provides a mixed message about the company's financial priorities.

- Given the wider net loss reported, we'll assess how this new earnings data affects Cogent's investment narrative centered on connectivity growth and margin expansion.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cogent Communications Holdings Investment Narrative Recap

To be a shareholder in Cogent Communications Holdings, you have to believe in the company’s ability to capture sustained demand for global internet connectivity while expanding margins and reducing its heavy reliance on legacy contracts. The recent news of a wider quarterly net loss does not materially alter the main catalyst, growing high-margin wavelength revenue, but it does amplify near-term attention on leverage and ability to protect shareholder returns. The biggest risk remains Cogent’s capacity to support its elevated dividend in the face of ongoing losses.

Of the latest announcements, the small increase in Cogent’s regular quarterly dividend stands out. While the ongoing dividend raises are a mark of continued commitment to shareholder rewards, they are particularly relevant against the backdrop of wider losses, keeping the focus on dividend sustainability as the company pursues margin expansion.

In contrast, investors should be aware of how Cogent’s high leverage and declining T-Mobile transition payments could affect future cash flow and the sustainability of current dividends if profitability does not improve...

Read the full narrative on Cogent Communications Holdings (it's free!)

Cogent Communications Holdings' narrative projects $1.2 billion revenue and $152.8 million earnings by 2028. This requires 9.2% yearly revenue growth and a $369.1 million increase in earnings from the current -$216.3 million.

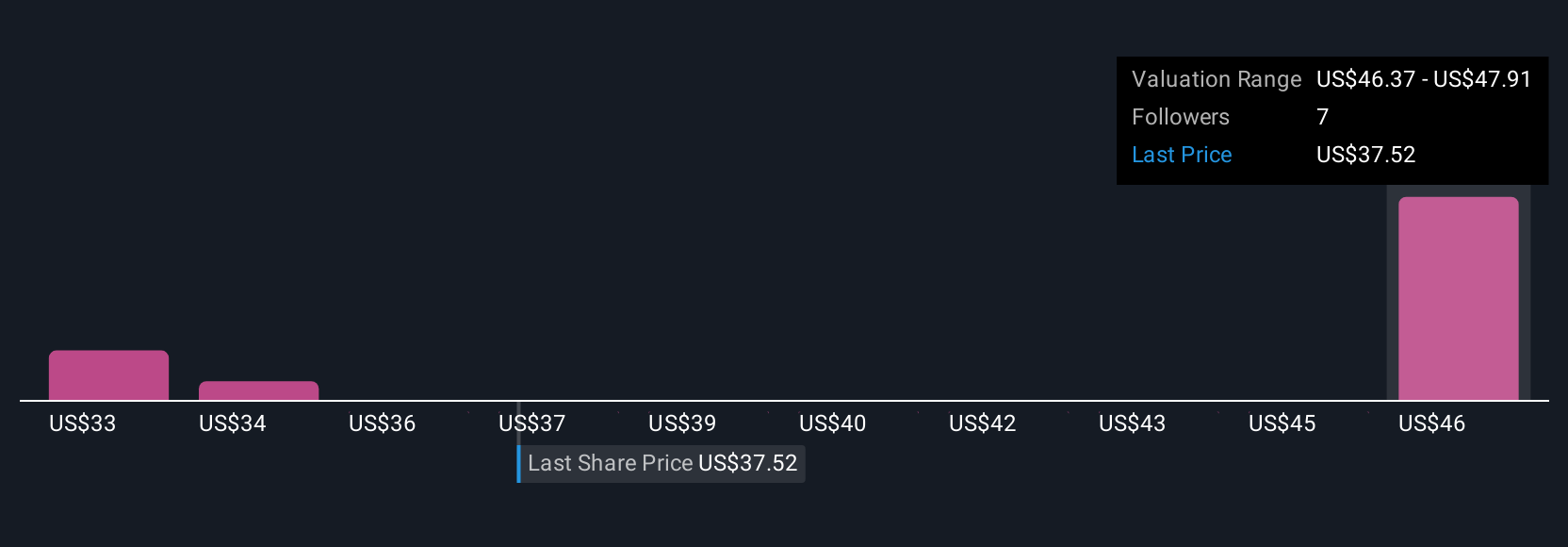

Uncover how Cogent Communications Holdings' forecasts yield a $47.91 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Cogent’s fair value between US$31.30 and US$47.91, across three different analyses. This diversity of views comes as ongoing losses keep the spotlight on the risk that current dividends may not be fully supported by earnings in the near term.

Explore 3 other fair value estimates on Cogent Communications Holdings - why the stock might be worth 15% less than the current price!

Build Your Own Cogent Communications Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Communications Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Cogent Communications Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Communications Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives