- United States

- /

- Communications

- /

- NYSE:UI

Ubiquiti's (NYSE:UI) Upcoming Dividend Will Be Larger Than Last Year's

Ubiquiti Inc. (NYSE:UI) has announced that it will be increasing its dividend on the 22nd of November to US$0.60. Despite this raise, the dividend yield of 0.6% is only a modest boost to shareholder returns.

Check out our latest analysis for Ubiquiti

Ubiquiti's Payment Has Solid Earnings Coverage

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, prior to this announcement, Ubiquiti's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 27.7% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 20% by next year, which we think can be pretty sustainable going forward.

Ubiquiti's Dividend Has Lacked Consistency

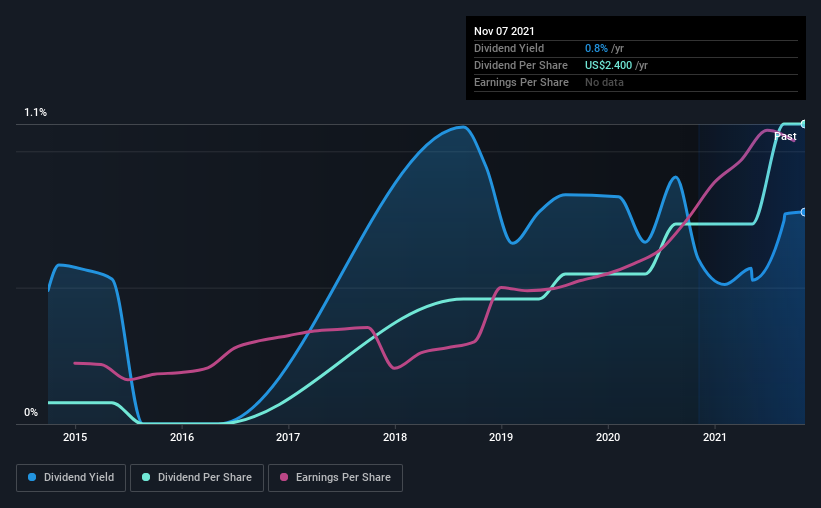

It's comforting to see that Ubiquiti has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. The first annual payment during the last 7 years was US$0.17 in 2014, and the most recent fiscal year payment was US$2.40. This means that it has been growing its distributions at 46% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Ubiquiti has grown earnings per share at 28% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Ubiquiti's Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Ubiquiti that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)