- United States

- /

- Communications

- /

- NYSE:UI

Ubiquiti (UI) Is Up 6.9% After Russell Index Removal and Strong Q3 Earnings Has The Bull Case Changed?

Reviewed by Simply Wall St

- In late June 2025, Ubiquiti was removed from several major Russell indices, coinciding with the release of strong third-quarter earnings results highlighting revenue and net income growth.

- This combination of index rebalancing and robust financial performance sheds light on how market inclusion and fundamentals can shift investor perspectives.

- We'll explore how Ubiquiti's recent earnings growth shapes the company's investment narrative moving forward.

What Is Ubiquiti's Investment Narrative?

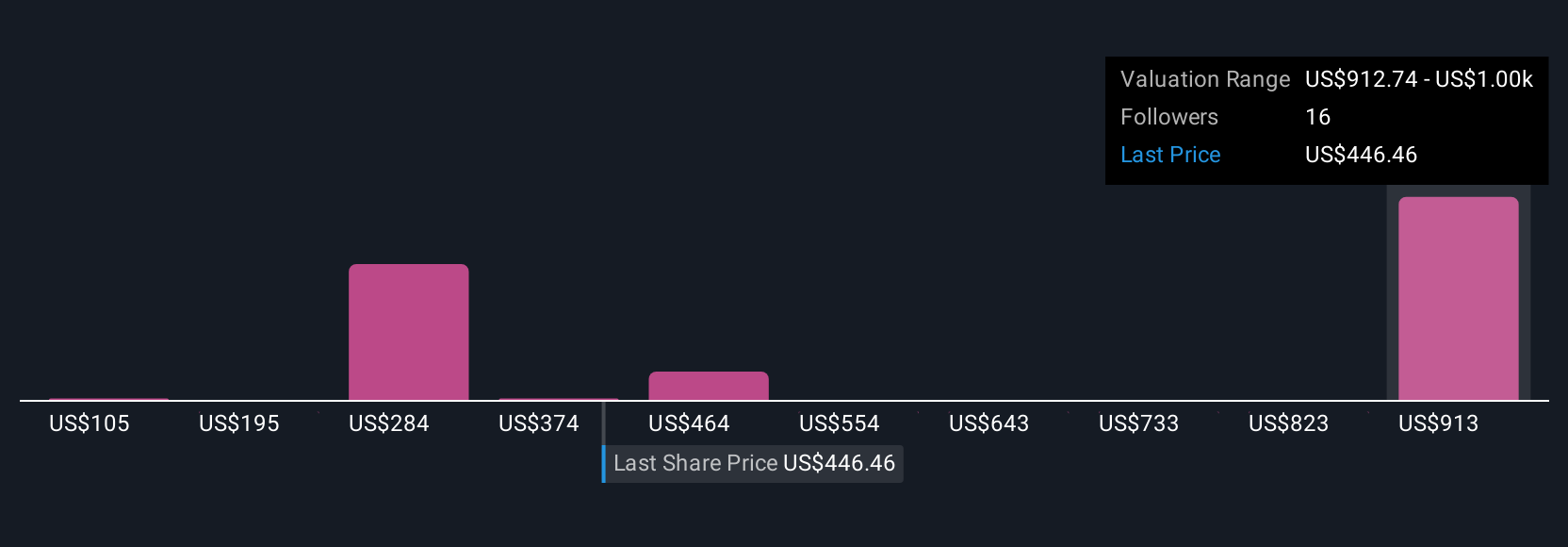

For those looking at Ubiquiti, owning shares today means believing that the company’s fundamental strengths, especially consistent earnings and revenue expansion, will more than offset any shifting tides in market inclusion. The recent removal from the Russell indices hasn’t hurt sentiment, and strong third-quarter earnings provided a clear counterbalance, keeping catalysts like profit growth and sustained dividends at the forefront. So far, the removal appears immaterial for short-term momentum, as shares have moved upward and the business continues to post high margins and robust year-over-year growth. That said, bigger risks remain, such as Ubiquiti’s high valuation versus industry peers and the persistence of high debt on its balance sheet. The current environment calls for an ongoing focus on the company’s fundamentals, as the main narrative is now firmly about execution and risk management.

But amid these strengths, the company’s elevated debt position is one detail to watch.

Exploring Other Perspectives

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives