- United States

- /

- Software

- /

- NasdaqGS:ZS

3 US Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. markets experience a notable surge, with the S&P 500 and Nasdaq climbing higher thanks to gains in large-cap technology stocks, investors are keeping a close eye on potential opportunities amidst fluctuating oil prices and economic indicators. In this context, identifying stocks that might be trading below their estimated value could offer appealing prospects for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Peoples Financial Services (NasdaqGS:PFIS) | $44.73 | $87.06 | 48.6% |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $27.02 | $53.66 | 49.7% |

| Molina Healthcare (NYSE:MOH) | $324.93 | $641.75 | 49.4% |

| Cadence Bank (NYSE:CADE) | $30.81 | $61.48 | 49.9% |

| Heartland Financial USA (NasdaqGS:HTLF) | $56.02 | $110.32 | 49.2% |

| Phibro Animal Health (NasdaqGM:PAHC) | $22.01 | $42.63 | 48.4% |

| California Resources (NYSE:CRC) | $52.58 | $104.03 | 49.5% |

| EVERTEC (NYSE:EVTC) | $33.37 | $66.20 | 49.6% |

| Enphase Energy (NasdaqGM:ENPH) | $104.17 | $204.32 | 49% |

| Bowhead Specialty Holdings (NYSE:BOW) | $28.40 | $56.60 | 49.8% |

Let's uncover some gems from our specialized screener.

Intuit (NasdaqGS:INTU)

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States with a market cap of approximately $168.86 billion.

Operations: The company's revenue segments include Small Business and Self-Employed at $9.53 billion, Consumer at $4.45 billion, Credit Karma at $1.71 billion, and Pro-Tax at $599 million.

Estimated Discount To Fair Value: 37%

Intuit is trading significantly below its estimated fair value, indicating potential undervaluation based on discounted cash flow analysis. Recent initiatives like the Intuit Enterprise Suite and enhancements to its AI capabilities aim to enhance profitability and streamline operations for mid-market businesses. Despite recent insider selling, Intuit's earnings are expected to grow faster than the US market average, supported by a robust revenue forecast exceeding general market growth rates.

- The growth report we've compiled suggests that Intuit's future prospects could be on the up.

- Dive into the specifics of Intuit here with our thorough financial health report.

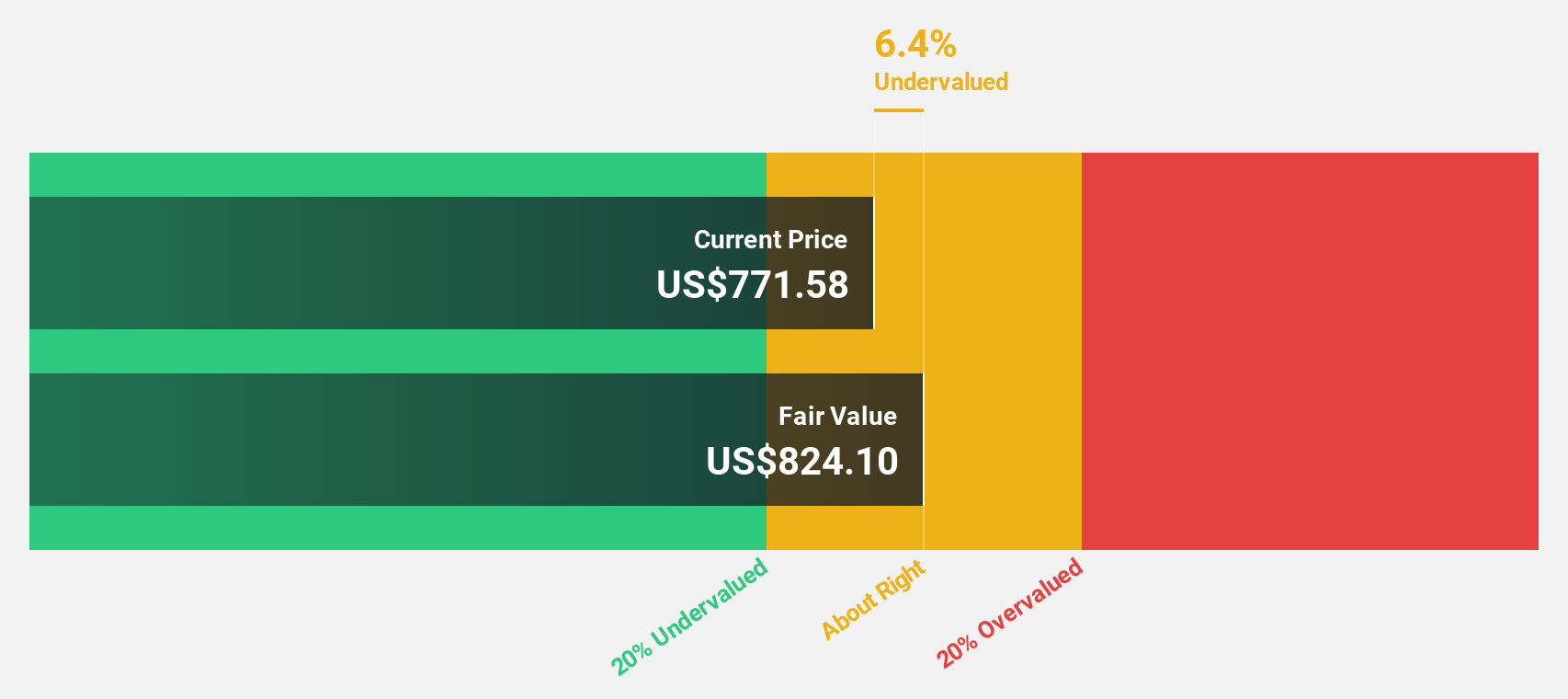

Zscaler (NasdaqGS:ZS)

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $26.25 billion.

Operations: Zscaler generates revenue primarily through the sale of subscription services to its cloud platform and related support services, amounting to $2.17 billion.

Estimated Discount To Fair Value: 35.8%

Zscaler is trading well below its estimated fair value, suggesting potential undervaluation based on cash flows. The company's revenue growth forecast of 16.3% annually outpaces the broader US market, and it is expected to become profitable within three years. Recent strategic moves include AI and Zero Trust integrations with CrowdStrike, enhancing security operations capabilities. However, significant insider selling and shareholder dilution in the past year present concerns for investors evaluating its value proposition.

- The analysis detailed in our Zscaler growth report hints at robust future financial performance.

- Click here to discover the nuances of Zscaler with our detailed financial health report.

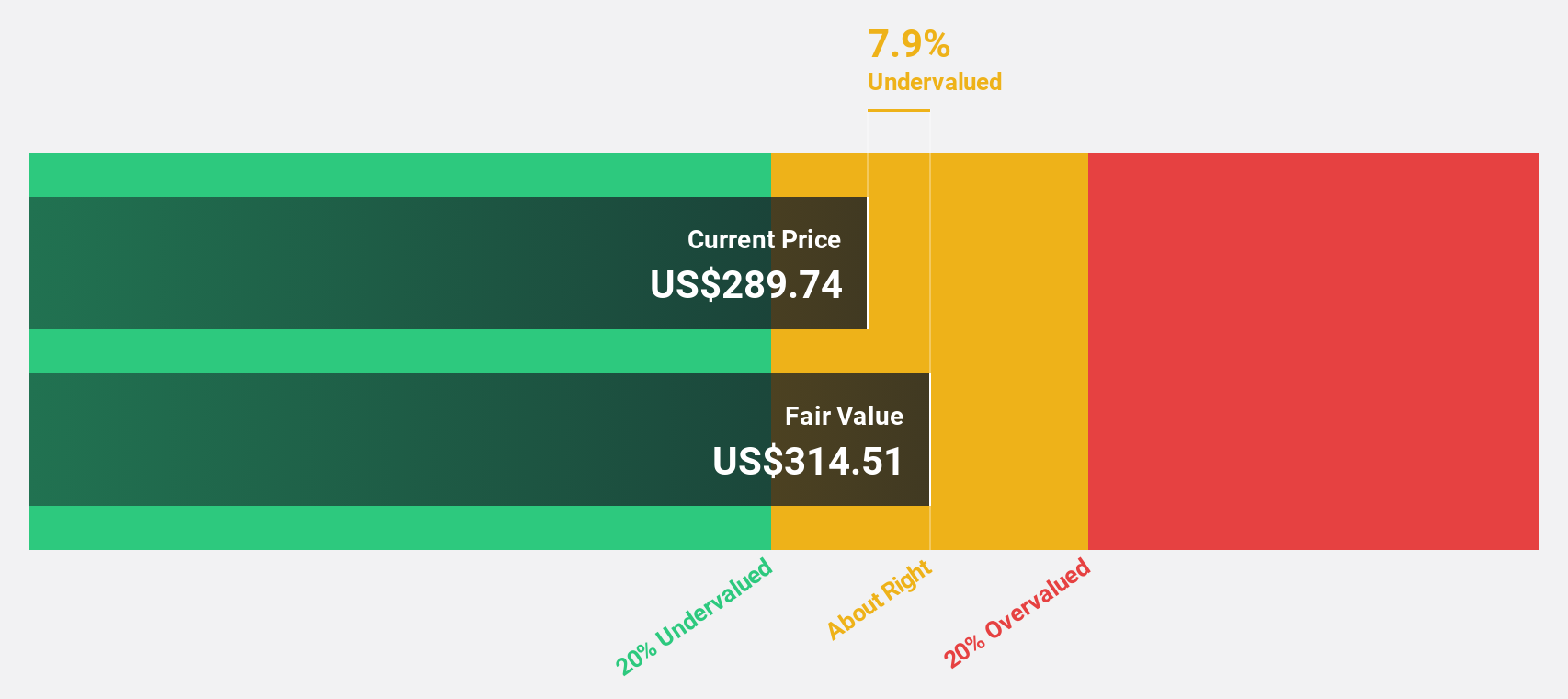

Pure Storage (NYSE:PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of $16.82 billion.

Operations: The company's revenue segment consists of computer storage devices, generating $3.01 billion.

Estimated Discount To Fair Value: 41.3%

Pure Storage is trading at US$52.51, significantly below its estimated fair value of US$89.48, highlighting potential undervaluation based on cash flows. The company's earnings are expected to grow substantially at 37.3% annually, surpassing market averages. Recent strategic alliances with Commvault enhance its cybersecurity offerings, aligning with regulatory demands like the EU's DORA. Despite shareholder dilution and insider selling concerns, Pure Storage's inclusion in the FTSE All-World Index underscores its growing market presence.

- According our earnings growth report, there's an indication that Pure Storage might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Pure Storage.

Key Takeaways

- Click here to access our complete index of 186 Undervalued US Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

High growth potential with excellent balance sheet.