Those following along with Mach Natural Resources LP (NYSE:MNR) will no doubt be intrigued by the recent purchase of shares by William McMullen, Chairman of the Board of Mach Natural Resources GP LLC of the company, who spent a stonking US$8.7m on stock at an average price of US$15.48. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 0.8%.

View our latest analysis for Mach Natural Resources

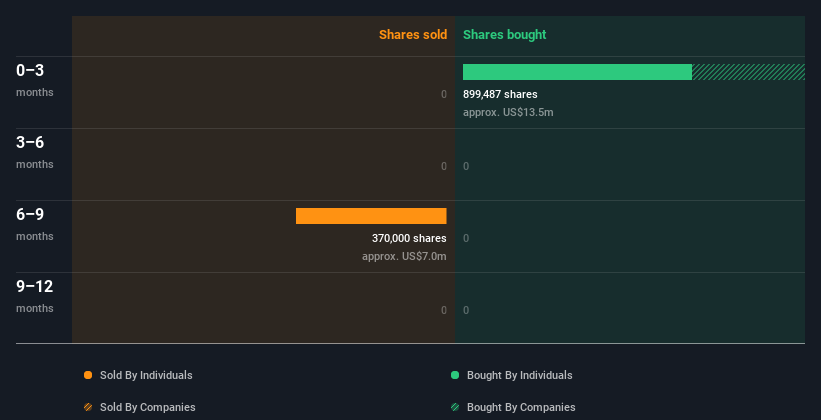

Mach Natural Resources Insider Transactions Over The Last Year

Notably, that recent purchase by William McMullen is the biggest insider purchase of Mach Natural Resources shares that we've seen in the last year. That implies that an insider found the current price of US$15.67 per share to be enticing. Of course they may have changed their mind. But this suggests they are optimistic. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. The good news for Mach Natural Resources share holders is that an insider was buying at near the current price. The only individual insider to buy over the last year was William McMullen.

The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Mach Natural Resources insiders own 13% of the company, currently worth about US$213m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Mach Natural Resources Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. When combined with notable insider ownership, these factors suggest Mach Natural Resources insiders are well aligned, and quite possibly think the share price is too low. Nice! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To that end, you should learn about the 3 warning signs we've spotted with Mach Natural Resources (including 1 which can't be ignored).

Of course Mach Natural Resources may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MNR

Mach Natural Resources

An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Very undervalued with acceptable track record.

Market Insights

Community Narratives