- United States

- /

- Software

- /

- NYSE:PAR

PAR Technology (PAR) Unveils AI-Powered Assistant Enhancing Restaurant Operations and Customer Engagement

Reviewed by Simply Wall St

PAR Technology (PAR), recently announced the launch of PAR® AI, featuring intelligence layers integrated into its product suite, aimed at enhancing restaurant operations through tools such as Coach AI™. This development aligns with the broader market trends, where AI is experiencing significant demand, as evidenced by Oracle's 40% share surge linked to AI demand. Despite this, PAR's share price remained relatively flat over the past month. In a market that saw record highs, such as the Nasdaq's all-time peak and S&P 500's strong performance, PAR's AI advancements likely lent moderate support amid prevailing positive market movements.

PAR Technology has 1 weakness we think you should know about.

The launch of PAR® AI within its suite of offerings could bolster PAR Technology's long-term growth strategy centred on cloud-native solutions. By catering to ongoing market demand for AI and operational efficiency, this development has the potential to enhance PAR's recurring revenue growth and profitability outlook. Despite this progress, PAR's share price has largely remained stable in the short term. Over the longer three-year period, however, the company's total shareholder return was 36.42%, underscoring its sustained potential amid slower short-term movements. This performance contrasts with PAR's underperformance relative to the 20.5% rise in the US market over the past year.

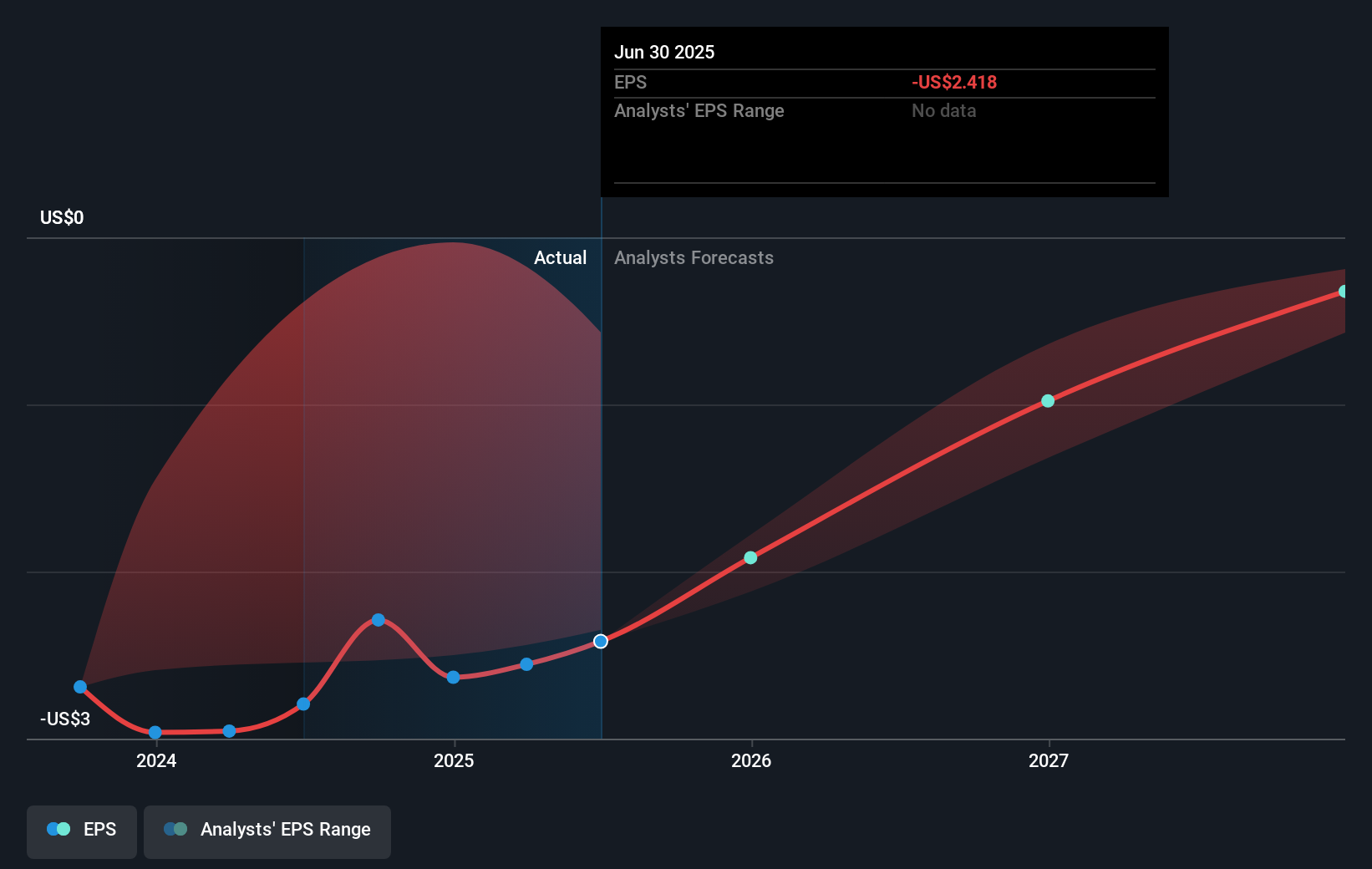

The recent AI initiative may influence future revenue and earnings forecasts by increasing cross-sell opportunities and average revenue per user, especially with bundled cloud services. Analysts anticipate a 12.67% annual revenue growth, though profitability remains a challenge. As of today, PAR's share price of US$46.86 is significantly below the consensus analyst price target of US$76.0. This gap suggests expectations for improved financial metrics and market positioning, providing room for potential appreciation if PAR succeeds in executing its global expansion and SaaS strategies.

Evaluate PAR Technology's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026