- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Expands Quantum Innovation Through Collaboration With Emergence Quantum

Reviewed by Simply Wall St

IonQ (IONQ) recently announced a strategic collaboration with Emergence Quantum, focusing on advanced quantum innovation. Over the past quarter, the company's stock price surged 56%, potentially buoyed by this news, alongside other developments such as the partnership with Einride for quantum fleet optimization and a collaboration with EPB for an innovation center. These events suggest a strengthening of IonQ's position in the quantum sector. While the S&P 500 also hit record highs, IonQ's individual gains surpassed broader market trends, indicating that these strategic partnerships may have added significant weight to its recent performance.

IonQ has 5 weaknesses (and 2 which can't be ignored) we think you should know about.

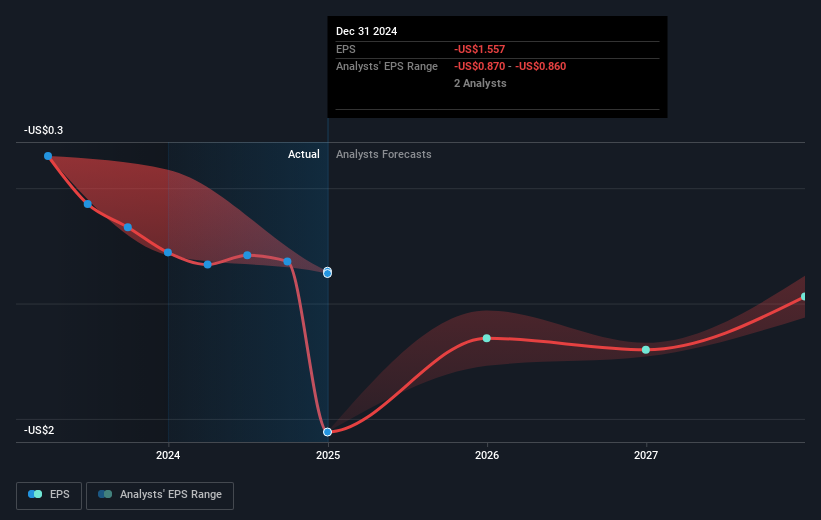

Over the past three years, IonQ delivered a very large total shareholder return of 788.56%. This substantial performance contrasts with the broader US Tech industry, which declined 4.9% in the past year. The company's recent growth initiatives and partnerships have potentially strengthened its trajectory, contributing to a share price increase of 56% in the last quarter alone. IonQ's collaborations, such as those with Emergence Quantum and Einride, may support future revenue and provide a foundation for operational improvements, though the company remains unprofitable with earnings forecasted to decline by 2.1% annually for the next three years.

Currently trading at US$41.94, IonQ's share price is close to the consensus analyst price target of US$44.17, indicating limited upside potential based on these projections. Despite this, IonQ's revenue is expected to grow 40.3% per year, outpacing the US market's 9% growth forecast. While the company faces challenges such as volatility and substantial insider selling, its efforts in advancing quantum technology may influence its future market position and financial performance.

Our expertly prepared valuation report IonQ implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives