- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

Stable and Undervalued - Here are the Fundamentals of HP Inc. (NYSE:HPQ)

Investors following Berkshire will be excited to find out that the management team has added HP (NYSE:HPQ) shares to their portfolio. Considering that the company has a long investment approach and targets undervalued companies, we wanted to re-evaluate the fundamental qualities of HPQ and revisit the company's intrinsic value with our Discounted Cash Flow model.

Before going ahead, here is what we found in our analysis:

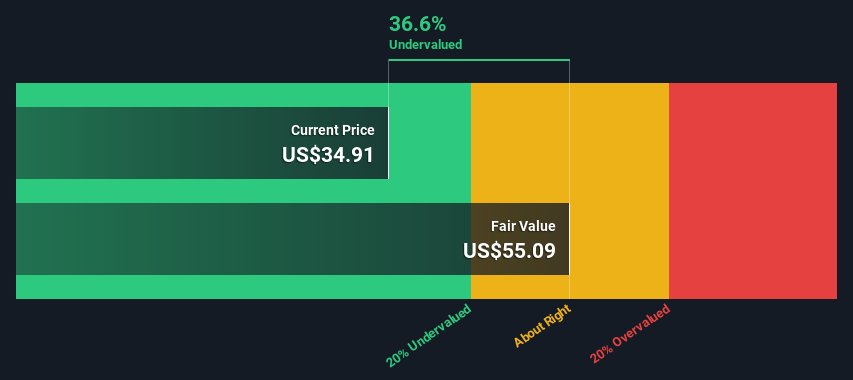

- HP seems to be 37% undervalued before today's open (Apr. 7).

- The company has improving margins, regular earnings and cash flows.

- Stable balance sheet with an adequate debt to equity balance.

- Affordable dividend with a 2.8% yield.

Key Fundamentals

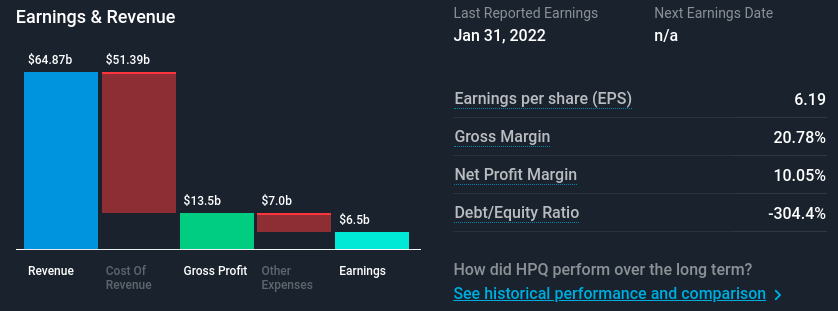

We will go over some key fundamentals and try to understand what makes HPQ a quality company. In our income snapshot we can see that HP, has revenues of US$64b and US$6.5b Earnings. This justifies the large cap categorization, and the stock even looks cheap on a 5.6x P/E basis.

Growth

In the last 5 years, HP has increased its revenue by 33.3%, going from US$48.7b in 2017 to US$64.9b in 2022. This results in a CAGR of 5.9% over the last 5 years. In the last 12 months, the company's revenues increased by 12.5%, which is more than the 3-year average growth rate of 3.2%.

This may indicate an acceleration or possibly a boost from the change in consumer spending during 2021 and 2020.

Analysts are also projecting a 0.6% annual revenue growth, indicating that the company had an unusual year and is in a stable growth phase.

Margins

We notice that HP has a healthy net margin of 10%, which should give investors a sufficient buffer and protect the company in bad times. We may want to consider that this as peak performance, because in the past, the margin was mid single digit.

Balance Sheet

For HP you will come across some strange numbers, such as a negative debt to equity value and a high return on capital and equity. These numbers do not reflect the real standing of the company because HP has a negative book value of equity - making the calculations off.

Solving for the debt to equity is quite easy, we just take the total value of debt and divide it by the market value of equity, this gets us a 19.2% debt to equity value. This is actually a good result for a mature company with consistent earnings, because it allows them to minimize taxes and fund new projects.

Returns

Unfortunately, solving for the return metrics is a bit more difficult, as we cannot't use market values in this case. We use book values because we want to see how well the company reinvests with their retained earnings and debt. Return on assets is 17.3% which is great, but this metric is used more for companies that rely on assets rather than operations to deliver returns. Perhaps the best alternative is to consider the industry return on equity of 17.8% and assume that HPQ will converge to that value.

Dividends

HPQ is also a good dividend payer, with a 2.8% yield. The company has a rocky dividend history, but the latest decision has increased the dividend per share to US$1. Considering that the company has consistent earnings, and a payout ratio of 15%, it seems that their dividends are affordable and stable.

Valuation

Now we need to bring all of this together and estimate an intrinsic value for HPQ.

For this, we will use a 2 Stage Free Cash Flow to Equity DCF. We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios.

Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of projected future cash flows to their estimated value in today's dollars:

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF | US$4.93b | US$5.11b | US$4.52b | US$3.30b | US$3.20b | US$3.16b | US$3.15b | US$3.16b | US$3.19b | US$3.22b |

| Growth Rate Estimate Source | Analyst x5 | Analyst x4 | Analyst x2 | Analyst x1 | Analyst x1 | Est @ -1.31% | Est @ -0.34% | Est @ 0.34% | Est @ 0.81% | Est @ 1.15% |

| Present Value Discounted @ 7.2% | US$4.6b | US$4.5b | US$3.7b | US$2.5b | US$2.3b | US$2.1b | US$1.9b | US$1.8b | US$1.7b | US$1.6b |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$27b

As you can see, analysts estimate the company to be in a relatively steady growth state, which simplifies the calculation of our present value.

For the terminal value, we discount future cash flows to today's value, using a cost of equity of 7.2%.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r – g) = US$3.2b× (1 + 1.9%) ÷ (7.2%– 1.9%) = US$63b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$63b÷ ( 1 + 7.2%)10= US$31b

We add up the present values and get the intrinsic value of the company: US$58b!

Compared to the current share price of US$34.9, the company appears quite good value at a 37% discount to where the stock price trades currently.

It seems that Warren's team has indeed found an undervalued company.

Conclusion

HP Inc., shows qualities of an undervalued stock, with regular profits and adequate capitalization. Our valuation model shows that the company's cash flows are mispriced even in a scenario with limited growth.

Investors that believe that the Tech Hardware industry has a stable or positive outlook might be interested in this company.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives