- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

Should Investors Rethink HP After 22% Slide and New CFO Appointment in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with HP stock right now? You are not alone. After a few rough months, it is natural to wonder whether this is just another dip on a long-term climb or a sign to head for the exits. HP shares most recently closed at $26.48, and while they have slid by 1.4% over the past week and dropped 8.5% in the last month, these moves come on the back of an overall choppy year. The stock is down 18.4% year to date and 22.6% over the past 12 months, but zoom out a bit more and you will spot an impressive 11.6% three-year gain and a strong 61.2% return over the past five years.

Market sentiment around HP often shifts quickly, sometimes in response to wider trends in tech or shifting views about legacy hardware companies. For now, the market seems cautious, weighing HP's ability to adapt and remain relevant in a world increasingly focused on cloud and mobility. Risk perception seems to have edged upward lately, reflected in those short-term declines, but long-term growth potential still lingers in the shadows for patient investors.

Here is where it gets interesting for value-focused readers: By our calculations, HP racks up a value score of 5 on a six-point scale, meaning it looks undervalued in 5 out of 6 major checks. Numbers like that do not show up every day, and they are worth digging into further. Let us walk through the key valuation approaches next. Stay tuned, because there is an even smarter way to look at HP's valuation coming up later on.

Why HP is lagging behind its peers

Approach 1: HP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts HP’s future cash flows and calculates their value today by discounting them back from the future. This approach is popular because it focuses on the core driver of any business’s value: the cash it actually generates over time.

Currently, HP’s Free Cash Flow stands at approximately $3.01 Billion. Analysts project HP’s annual free cash flow to grow modestly, forecasting it to reach about $3.30 Billion by 2029. Further out, Simply Wall St extrapolates these projections through to 2035, keeping the amounts in the $3.2 to $3.5 Billion range. All values are shown in $.

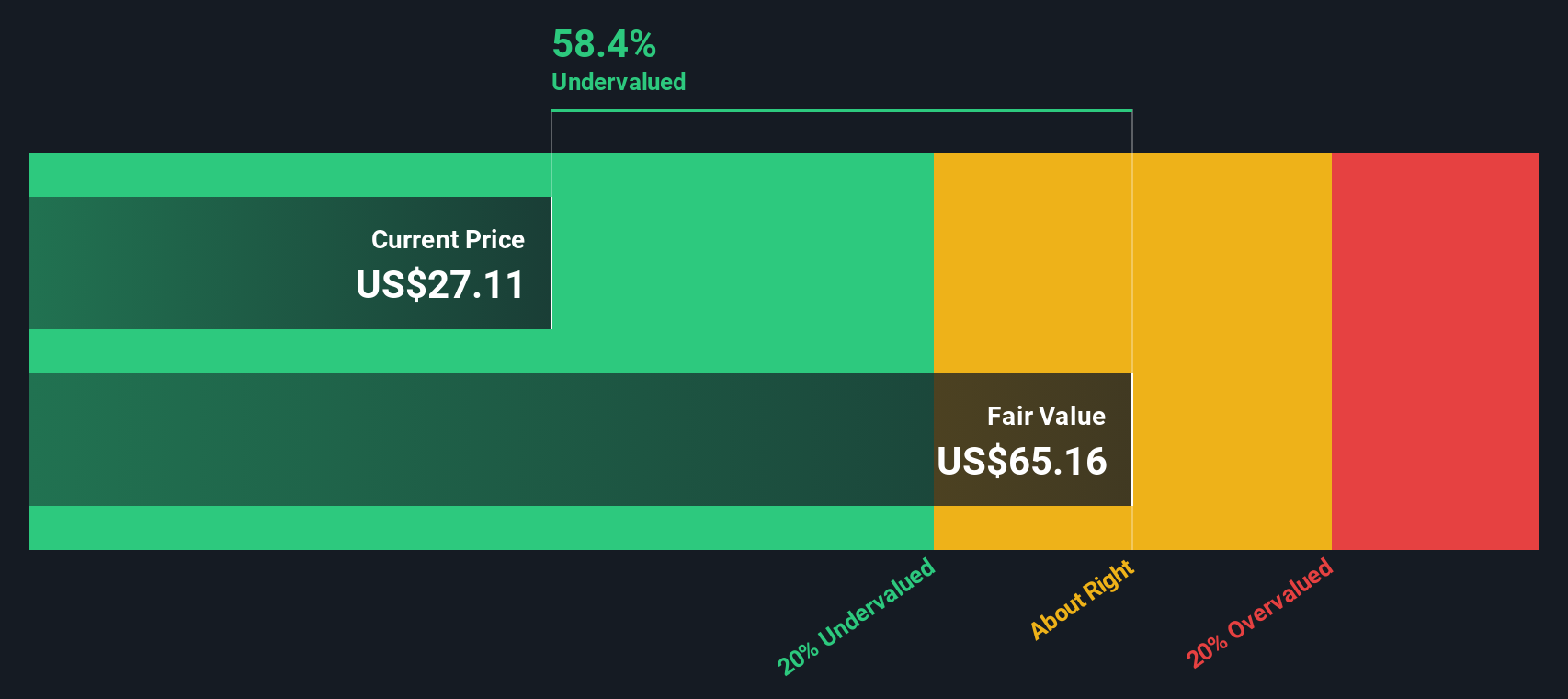

According to this DCF approach, HP’s intrinsic value is calculated at $50.21 per share. With the current market price at $26.48, the stock shows a notable 47.3% discount. This suggests that it is significantly undervalued by this method. This gap indicates that investors might be overlooking HP’s ability to maintain solid cash generation despite industry headwinds.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HP is undervalued by 47.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: HP Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is the primary yardstick for valuing mature, profitable companies like HP, because it directly ties the market price to the company’s actual earnings performance. A company generating steady profits lets investors gauge how much they are paying for every dollar of earnings, making the PE ratio especially relevant for stable businesses in the tech sector.

Expectations about future growth and risk shape what makes a PE ratio “fair.” Rapidly growing companies tend to command higher PE ratios, reflecting investor optimism and willingness to pay up for future earnings. Conversely, if the outlook is uncertain, risk increases, and the multiple typically contracts.

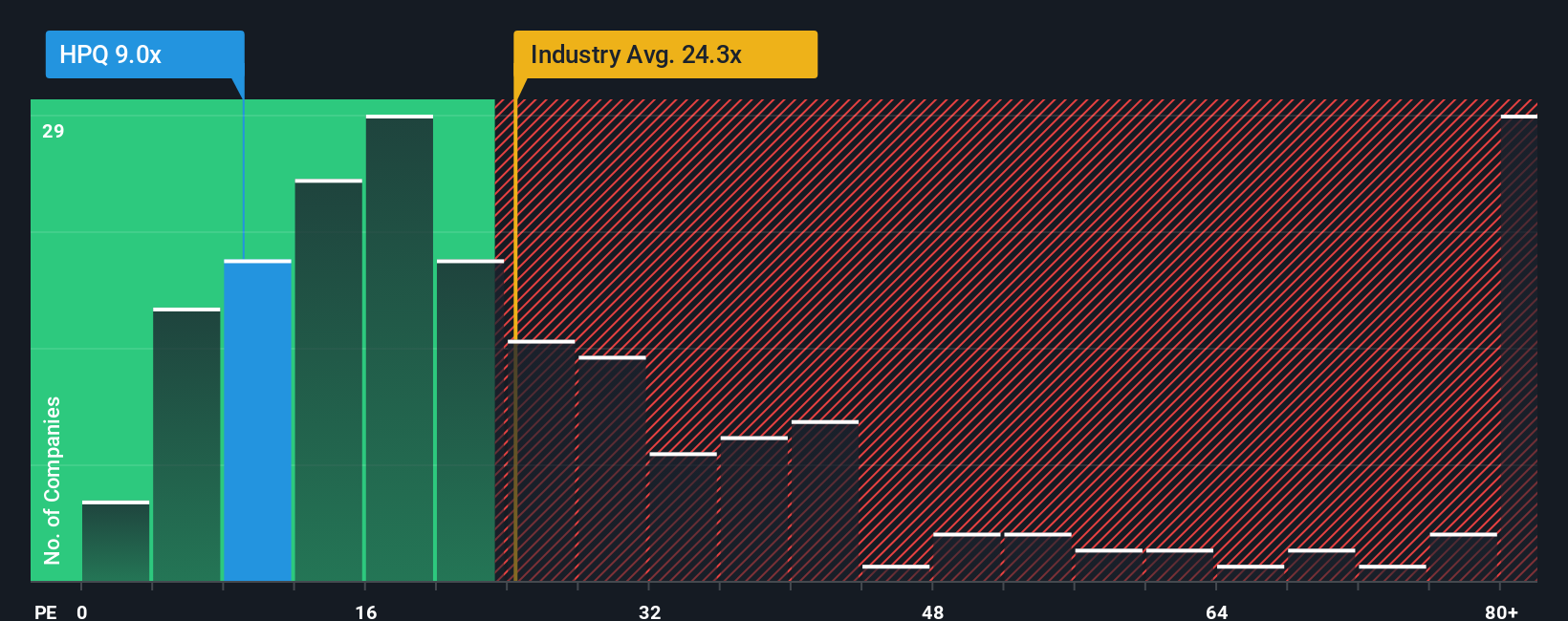

At the moment, HP trades at a PE multiple of 9.4x, which is noticeably lower than both the tech industry average of 23.9x and the average for HP’s direct peers at a lofty 71.4x. However, such comparisons do not always capture the nuances of HP’s unique business profile or risk factors. That is where Simply Wall St’s “Fair Ratio” sets itself apart. For HP, the Fair PE Ratio is 26.6x. This metric reflects not just industry conventions but also company-specific factors such as its earnings growth, margins, business risks, and market size.

Unlike a simple peer or industry average, the Fair Ratio cuts through noise by blending broader market trends with HP’s own fundamentals. If HP’s current PE is well below this Fair Ratio, it signals that the stock might be undervalued even after factoring in its risks and expected growth.

Comparing HP’s actual PE of 9.4x with its Fair Ratio of 26.6x, the stock screens as undervalued based on this core valuation metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are an intuitive tool for investors to give context and meaning to the numbers, allowing you to outline your own story about HP: what you think the company will achieve and why, linking assumptions about future revenue, earnings, and profit margins to a fair value you believe is justified.

On Simply Wall St’s platform, Narratives are easily created and updated on the Community page, making it simple for anyone to blend their perspective on HP’s business outlook directly with dynamic financial forecasts. Narratives make decision making actionable; comparing your fair value (based on your story and expectations) with the current market price can quickly tell you if it is time to buy, sell, or hold. Plus, as new earnings results or breaking news emerge, Narratives are refreshed automatically to reflect the latest information and keep your outlook relevant.

For example, some investors may craft an optimistic narrative focused on HP’s growth in AI-enabled devices and recurring services, resulting in a bullish fair value close to $30 per share. Meanwhile, the most conservative interpreters, seeing persistent industry risks and market headwinds, set fair value as low as $25 per share. Narratives help you see both sides and give you the tools to act confidently on your own conclusions.

Do you think there's more to the story for HP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives