- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

HP (HPQ) Valuation in Focus After Strong Q3 Results and Upbeat Analyst Commentary

Reviewed by Simply Wall St

HP (HPQ) just reported its third-quarter results, and investors are double-checking their portfolios in light of the numbers. Revenue and net income both came in higher than last year, which has given analysts reason to sound upbeat about HP’s place in the evolving PC market. The new earnings guidance and recent share buybacks provide additional context, making this quarter’s announcement a catalyst for fresh discussions on what the company is really worth.

All of this is happening after a year in which momentum for HP has been mixed. The stock has climbed 17% over the past month and gained 13% in the past 3 months, in contrast to its 16% slide over the year. With PC demand trends improving and the company making moves to return value to shareholders, HP is trying to shift the narrative after several quarters of lagging performance.

So, after a bounce in recent months, is HP suddenly an undervalued stock with room to run, or has the optimism already been built into the price?

Most Popular Narrative: 2.9% Overvalued

The prevailing narrative suggests HP is currently trading slightly above its estimated fair value, given its projected growth path and multiple industry dynamics.

HP's acquisition of strategic assets from Humane and investment in AI and software capabilities are expected to accelerate the company's move toward building an intelligent ecosystem across all HP devices. This has the potential to drive future revenue growth by enhancing their product offerings in AI PCs, smart printers, and connected conference rooms.

Curious what is fueling this bold fair value calculation? The narrative hinges on transformational growth bets and ambitious profit margin targets. A valuation model shaped by select financial assumptions plays a critical role. Even a single shift in these numbers could narrow or widen the gap between current price and target. Find out exactly what projections are at the heart of these high-stakes expectations.

Result: Fair Value of $27.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing geopolitical tensions with China and continued weakness in the consumer PC market could quickly disrupt the analyst expectations that are currently influencing today's consensus valuation.

Find out about the key risks to this HP narrative.Another View: The SWS DCF Model Flips the Script

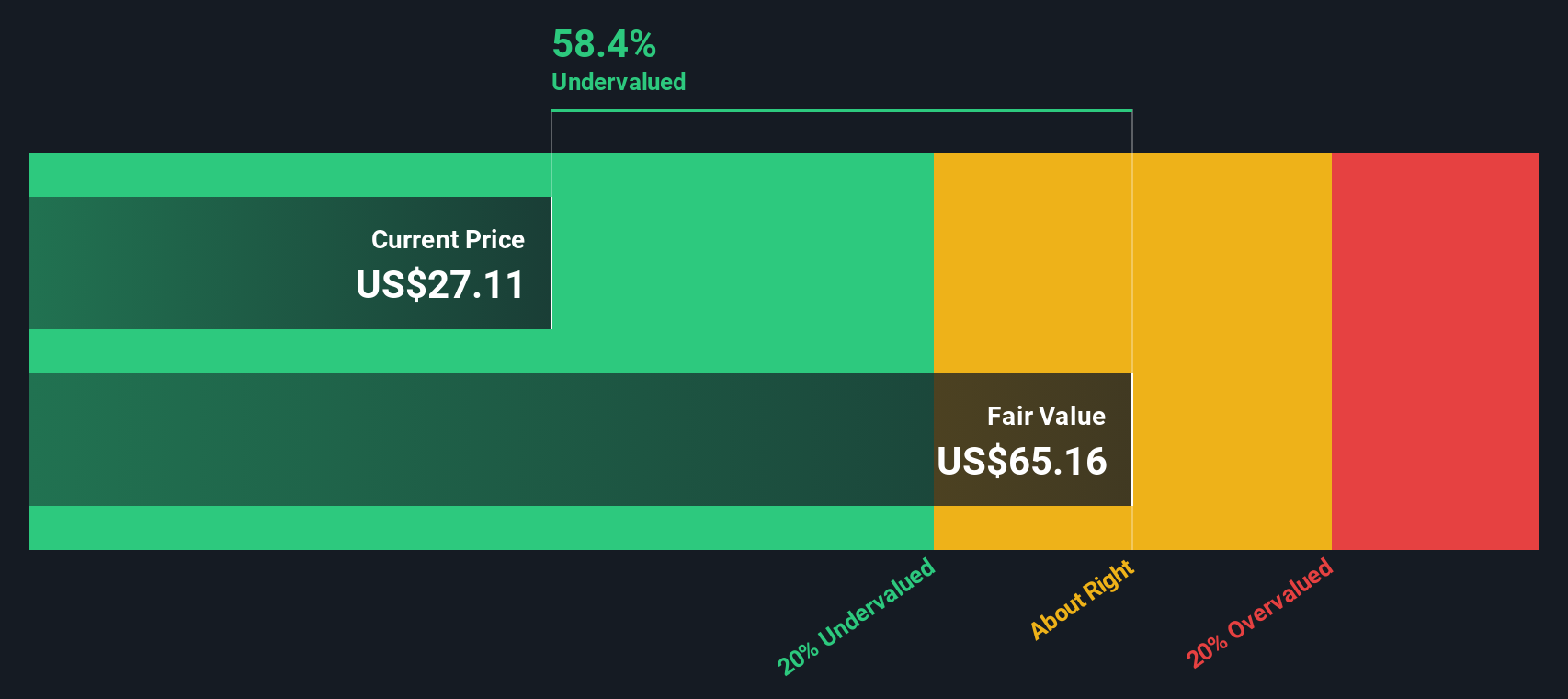

While analyst targets imply HP is overvalued, our DCF model comes to a very different conclusion and suggests the stock trades well below its estimated fair value. Can two smart methods really diverge so much?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HP Narrative

Keep in mind that if these conclusions do not match your own outlook, or if you want to dive into the numbers yourself, you can easily develop your own version of the HP story in under three minutes. Do it your way.

A great starting point for your HP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next smart move with stock picks that match your style. The market doesn't wait, so take action and shape a stronger portfolio right now.

- Capture big yield opportunities by targeting companies offering consistently high returns. Use our shortcut to spot dividend stocks with yields > 3% delivering 3%+ yields and financial resilience.

- Tap into technology’s hottest trend by selecting leaders in artificial intelligence breakthroughs. Start with these AI penny stocks fueling innovation across industries.

- Accelerate your search for growth by zeroing in on stocks trading below their true worth. Let our tool highlight undervalued stocks based on cash flows you can act on before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)