- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

HP (HPQ): Assessing Valuation Following Q3 Earnings Estimates Cut and $39m Printing Settlement

Reviewed by Simply Wall St

If you are tracking HP (HPQ) these days, you are not alone. Just ahead of its upcoming Q3 earnings announcement, the company’s shares have caught the eye of investors. Downward revisions to consensus estimates and a projected drop in earnings per share have set the stage. In addition, news of a $39 million settlement over allegations related to the company's printing supplies business is adding to the conversation. The focus for now is whether these near-term headwinds signal deeper issues or are simply bumps on an otherwise steady road.

HP’s stock has slipped roughly 19% over the past year, underperforming the broader tech sector, and recent momentum has not reversed this trend. The past month brought a modest recovery with an 8% gain, yet shares remain well below where they started the year. Meanwhile, HP continues to introduce product innovations, such as its new AI-powered OMEN and HyperX gaming ecosystem, and has managed steady revenue growth despite mixed signals on profit. For some investors, this combination of news and numbers makes it unclear whether risk or reward is shaping the stock’s current level.

With the next earnings report just around the corner, the question is whether this recent dip is a buying opportunity for HP, or if the market has already accounted for the company’s prospects for growth.

Most Popular Narrative: 2.7% Overvalued

According to community narrative, analysts believe HP is currently trading above its fair value. This suggests the stock may be slightly overvalued after recent movements.

HP's acquisition of strategic assets from Humane and investment in AI and software capabilities are expected to accelerate the company's move toward building an intelligent ecosystem across all HP devices. This could drive future revenue growth by enhancing their product offerings in AI PCs, smart printers, and connected conference rooms.

Want to uncover what’s really powering HP’s valuation beyond the headlines? The narrative points to ambitious growth plans and profit targets that could surprise many. Big tech bets, strategic shifts, and pivotal margin goals are influencing the outlook. Curious what bold forecasts are driving this price target? The real story is hidden in the numbers. Explore further to see how analysts arrived at their fair value.

Result: Fair Value of $27.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, HP’s continued reliance on China and intensifying competition in print could challenge its margins and weaken confidence in future growth projections.

Find out about the key risks to this HP narrative.Another Perspective: Discounted Cash Flow Tells a Different Story

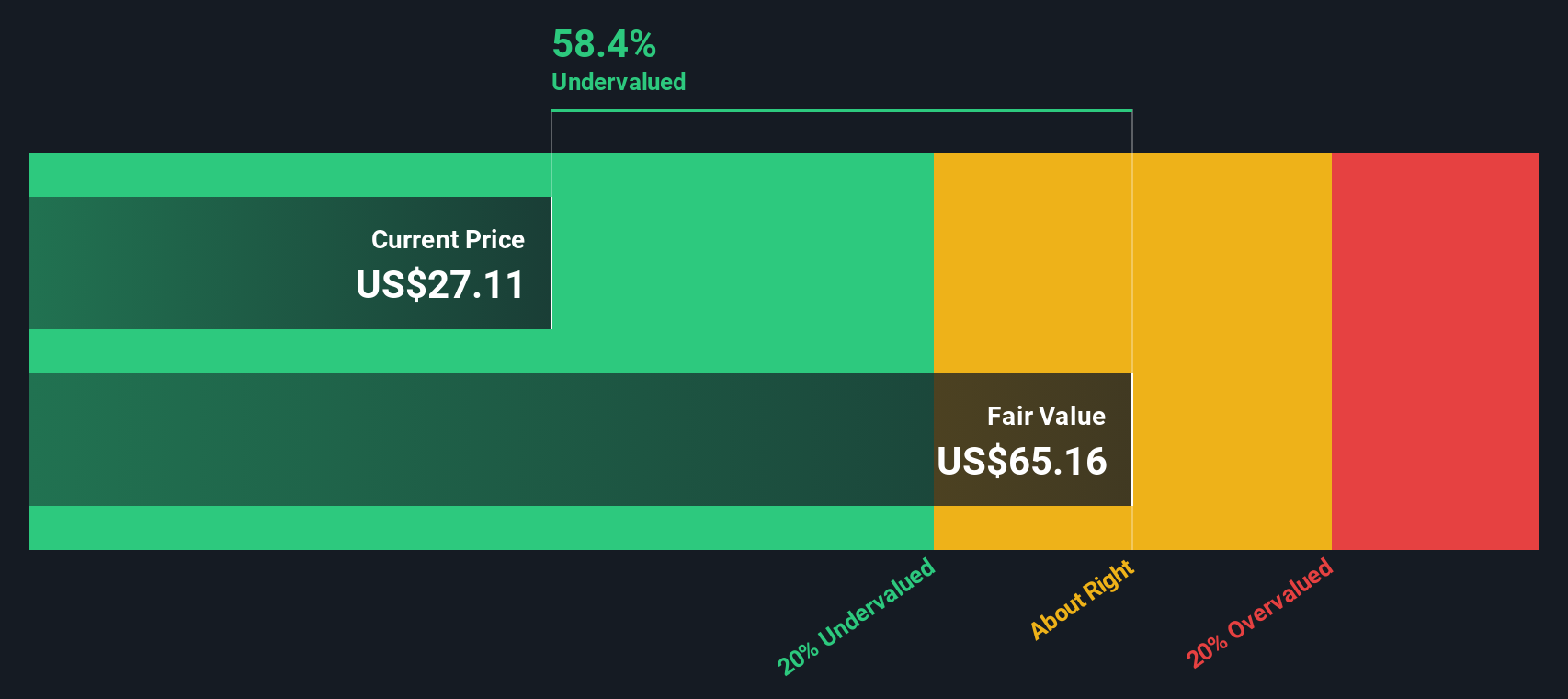

While the market consensus points to HPZ as slightly overvalued, our DCF model takes a much longer-term view and suggests the shares may actually be undervalued. Which outlook truly reflects the company’s potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HP Narrative

If you see things differently or want to look deeper into HP’s story, you can build your own narrative using the data in just a few minutes. do it your way.

A great starting point for your HP research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sticking to just one stock can limit your potential. Enhance your portfolio by exploring options beyond the obvious. The Simply Wall Street Screener helps you discover unique investment opportunities you might not find on your own. If you do not explore further, you might miss out on some of the best opportunities.

- Unlock the power of steady income by checking out dividend stocks with yields > 3% for shares that offer generous yields above 3% and have a history of rewarding loyal investors.

- Pursue high potential with AI penny stocks and consider companies at the forefront of AI as they shape, automate, and transform industries around the world.

- Get ahead by exploring cryptocurrency and blockchain stocks, where digital assets and blockchain innovators are creating new possibilities for future finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives