- United States

- /

- Semiconductors

- /

- NYSE:ONTO

3 US Stocks Estimated To Be Trading Up To 36% Below Intrinsic Value

Reviewed by Simply Wall St

As the United States market experiences a tech-driven rally, with the S&P 500 and Nasdaq Composite seeing gains led by chip stocks, investors are increasingly looking for opportunities that may be trading below their intrinsic value. In this environment, identifying undervalued stocks can be crucial for those seeking to capitalize on potential growth, especially when market conditions highlight sectors like technology that are currently in focus.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.95 | $53.03 | 49.2% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.14 | $61.62 | 49.5% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $59.82 | $117.93 | 49.3% |

| Afya (NasdaqGS:AFYA) | $14.88 | $29.32 | 49.3% |

| Lamb Weston Holdings (NYSE:LW) | $63.05 | $125.18 | 49.6% |

| Ally Financial (NYSE:ALLY) | $36.21 | $71.66 | 49.5% |

| HealthEquity (NasdaqGS:HQY) | $97.10 | $189.22 | 48.7% |

| Mr. Cooper Group (NasdaqCM:COOP) | $94.43 | $187.71 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | $65.01 | $128.87 | 49.6% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.69 | $30.76 | 49% |

Let's uncover some gems from our specialized screener.

Coherent (NYSE:COHR)

Overview: Coherent Corp. is a global company that develops, manufactures, and markets engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation markets with a market cap of $16.43 billion.

Operations: The company's revenue segments consist of Lasers at $1.41 billion, Materials at $1.51 billion, and Networking at $2.63 billion.

Estimated Discount To Fair Value: 36%

Coherent Corp. is trading at US$100.96, significantly below its estimated fair value of US$157.81, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution, the company shows promising growth potential with earnings forecasted to rise substantially over the next three years and revenue expected to grow faster than the U.S. market average. Recent product innovations and strategic expansions indicate a focus on long-term profitability and market leadership in advanced technologies.

- Our growth report here indicates Coherent may be poised for an improving outlook.

- Dive into the specifics of Coherent here with our thorough financial health report.

Corning (NYSE:GLW)

Overview: Corning Incorporated operates in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences sectors globally, with a market cap of approximately $40.67 billion.

Operations: The company's revenue segments are composed of $3.77 billion from Display Technologies, $4.19 billion from Optical Communications, $1.70 billion from Environmental Technologies, $1.98 billion from Specialty Materials, and $971 million from Life Sciences.

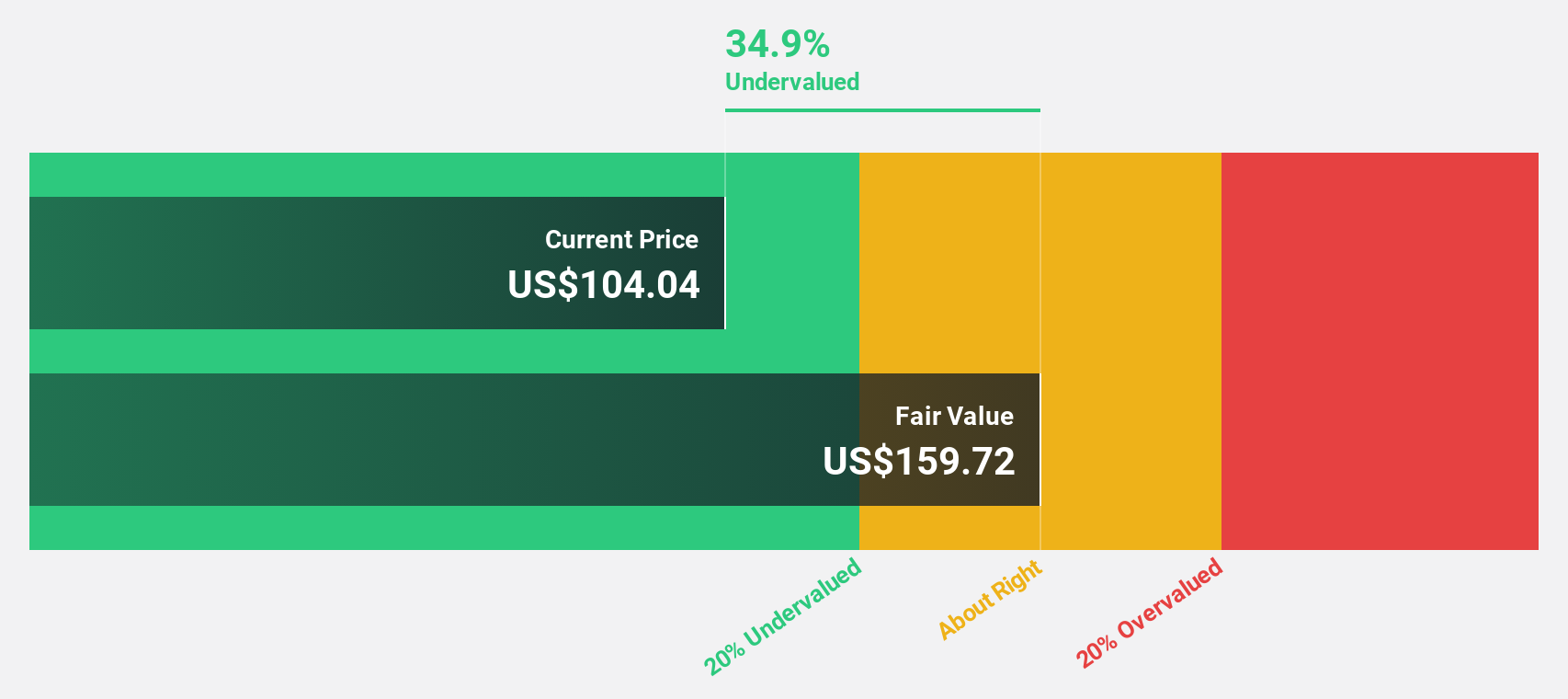

Estimated Discount To Fair Value: 27.5%

Corning is trading at US$48.34, well below its estimated fair value of US$66.64, indicating potential undervaluation based on cash flows. Despite a recent net loss and lower profit margins, earnings are forecasted to grow significantly over the next three years. The company completed a substantial share buyback program and secured a major agreement with AT&T for fiber solutions, which may enhance future revenue streams amidst high debt levels and insider selling concerns.

- Upon reviewing our latest growth report, Corning's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Corning's balance sheet health report.

Onto Innovation (NYSE:ONTO)

Overview: Onto Innovation Inc. designs, develops, manufactures, and supports process control tools for optical metrology and has a market cap of approximately $8.89 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, which generated $942.24 million.

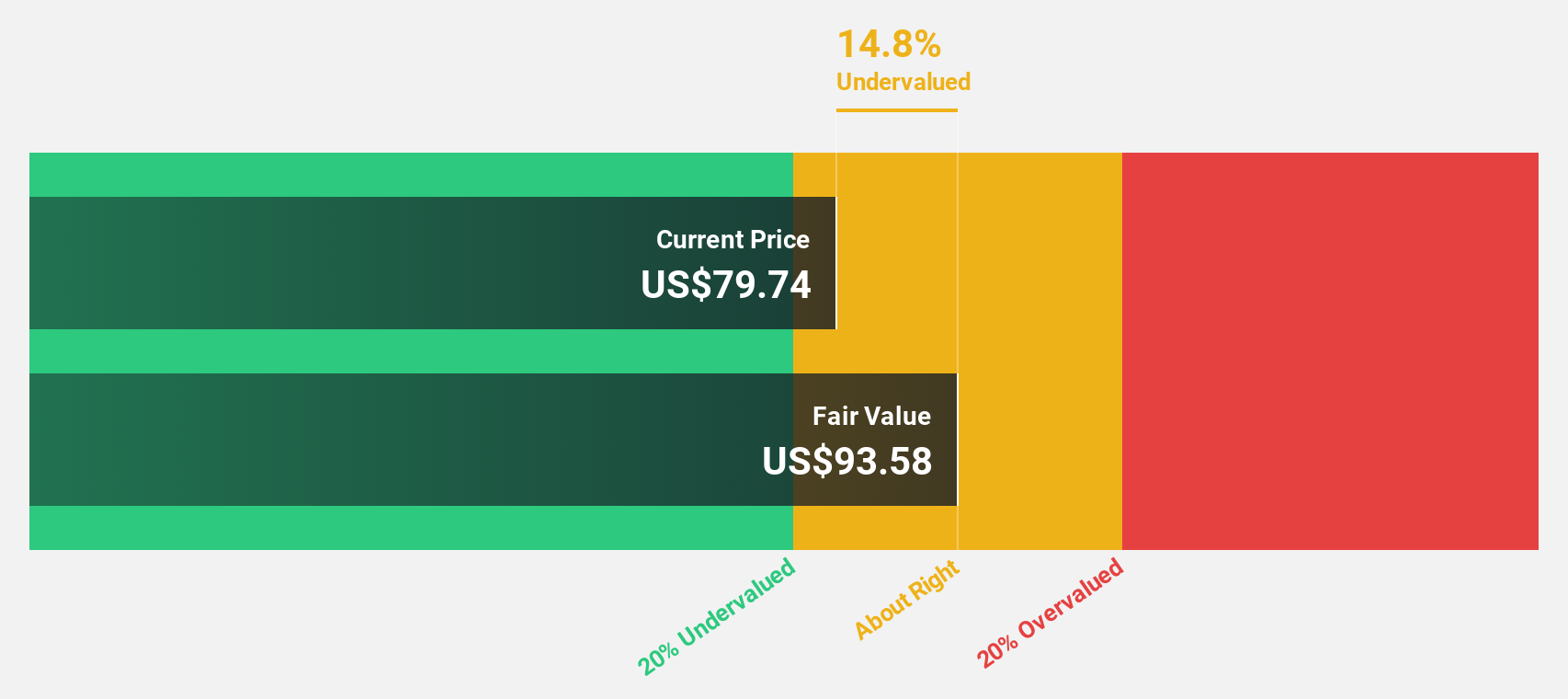

Estimated Discount To Fair Value: 24.9%

Onto Innovation is trading at US$192.39, below its estimated fair value of US$256.02, highlighting potential undervaluation based on cash flows. Recent earnings show strong growth with Q3 sales reaching US$252.21 million and net income at US$53.05 million, up from the previous year. Future earnings are expected to grow significantly at 30% annually, although revenue growth is projected to be slower than 20% per year but faster than the overall market rate.

- Insights from our recent growth report point to a promising forecast for Onto Innovation's business outlook.

- Unlock comprehensive insights into our analysis of Onto Innovation stock in this financial health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 170 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology.

Flawless balance sheet and good value.