CTS (CTS) Earnings Slowdown Challenges Long-Term Growth Narrative Despite Favorable Valuation

Reviewed by Simply Wall St

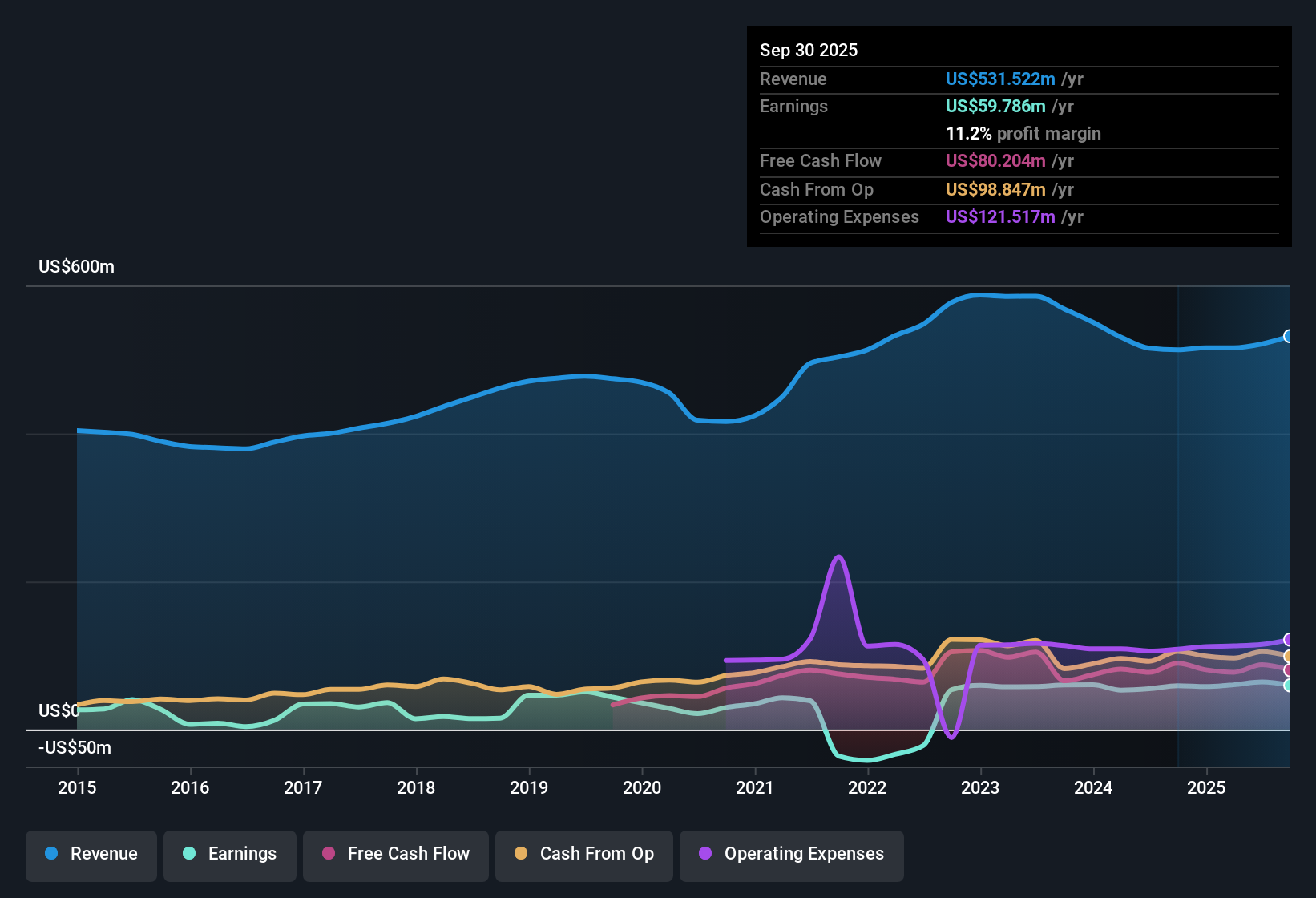

CTS (CTS) reported earnings growth averaging 26.3% per year over the past five years, but the most recent year showed just 0.9% growth. This suggests a notable slowdown from historical trends. Net profit margins dipped slightly to 11.2% from 11.5% last year. Looking forward, analysts expect annual earnings growth of 10.2% and revenue to rise 4.5% per year, both of which trail the broader US market's forecasts. The price-to-earnings ratio of 20.3x is below both the peer average of 43.9x and the electronic industry average of 25.1x. The current share price of $41.13 is a bit under the independently estimated fair value of $42.39, reflecting a positive valuation sentiment for the stock despite moderating growth and margins.

See our full analysis for CTS.Now, let’s see how these numbers measure up against the current narratives shaping investor sentiment. Some storylines will get confirmation, while others may be put to the test.

See what the community is saying about CTS

Margin Expansion Backed by Premium Offerings

- Analysts project CTS's profit margins will increase from 12.3% today to 12.9% within three years, supported by strategic moves up the value chain and investment in next-generation sensor and actuator technology.

- The analysts' consensus view notes that CTS is seeking higher-margin growth through diversification into segments like medical (ultrasound) and industrial applications (EV charging, automation), and by selling more premium, integrated solutions rather than just components.

- New customer wins in automation and connected devices are expected to drive both near- and long-term demand. This reinforces the consensus that margin expansion is sustainable even while facing transportation market softness.

- Ongoing operational improvements and efficiency gains, especially in North America and Europe, have already contributed to a healthier margin mix and provide a buffer if current segment challenges persist.

- Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Growth Trails Broader Market

- CTS is expected to grow revenue at 4.5% per year and earnings at 10.2% per year, according to analyst forecasts. Both rates are below the US market’s averages of 10.2% for revenue and 15.6% for earnings growth.

- Consensus narrative highlights that although CTS holds a strong backlog and has a healthy pipeline in core and diversified segments, company-level growth remains vulnerable to ongoing softness in transportation and cyclical pressure in certain medical product lines.

- Forecasts build in potential headwinds from weak transportation sales linked to global trade disputes and demand dips in diagnostic ultrasound product bookings.

- Despite these risks, the consensus notes that operational execution and continued acquisitions in high-margin segments could partially offset market headwinds over the medium term.

Attractive Valuation Versus Industry Averages

- CTS trades at a P/E of 20.3x, lower than both the US electronic industry average of 25.1x and the peer average of 43.9x, with a share price ($41.13) sitting just below a DCF fair value of $42.39.

- The analysts' consensus view emphasizes that with a current price close to DCF fair value and a consensus analyst target of $47.00, there is modest conviction about upside potential. However, pricing already reflects the company's premium mix and historical growth.

- Investors are advised to sense-check the $47.00 price target, as it implies belief in sustained margin improvements and forecasted earnings of $78.8 million by 2028. These numbers are ambitious given anticipated sector challenges and a required P/E contraction to 18.8x.

- The valuation discussion remains nuanced. Bulls may see a bargain relative to sector medians, while others may be cautious about the gap between recent and historic earnings growth rates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CTS on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotting a different story in the data? Put your insights to work and craft a personal take in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding CTS.

See What Else Is Out There

CTS's revenue and earnings growth lag behind broader market averages. Margins and forecast expansion are at risk due to reliance on cyclical sectors.

If you want more consistent results, filter for companies with steadier earnings and sales by checking out stable growth stocks screener (2122 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)