Over the last 7 days, the United States market has remained flat, but over the past 12 months, it has risen by 11% with earnings forecast to grow by 14% annually. In this context of steady growth and positive earnings outlooks, identifying high-growth tech stocks that align with these trends can be crucial for investors looking to capitalize on potential opportunities in this dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Halozyme Therapeutics (NasdaqGS:HALO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Halozyme Therapeutics, Inc. is a biopharmaceutical company that focuses on researching, developing, and commercializing proprietary enzymes and devices globally, with a market cap of $6.72 billion.

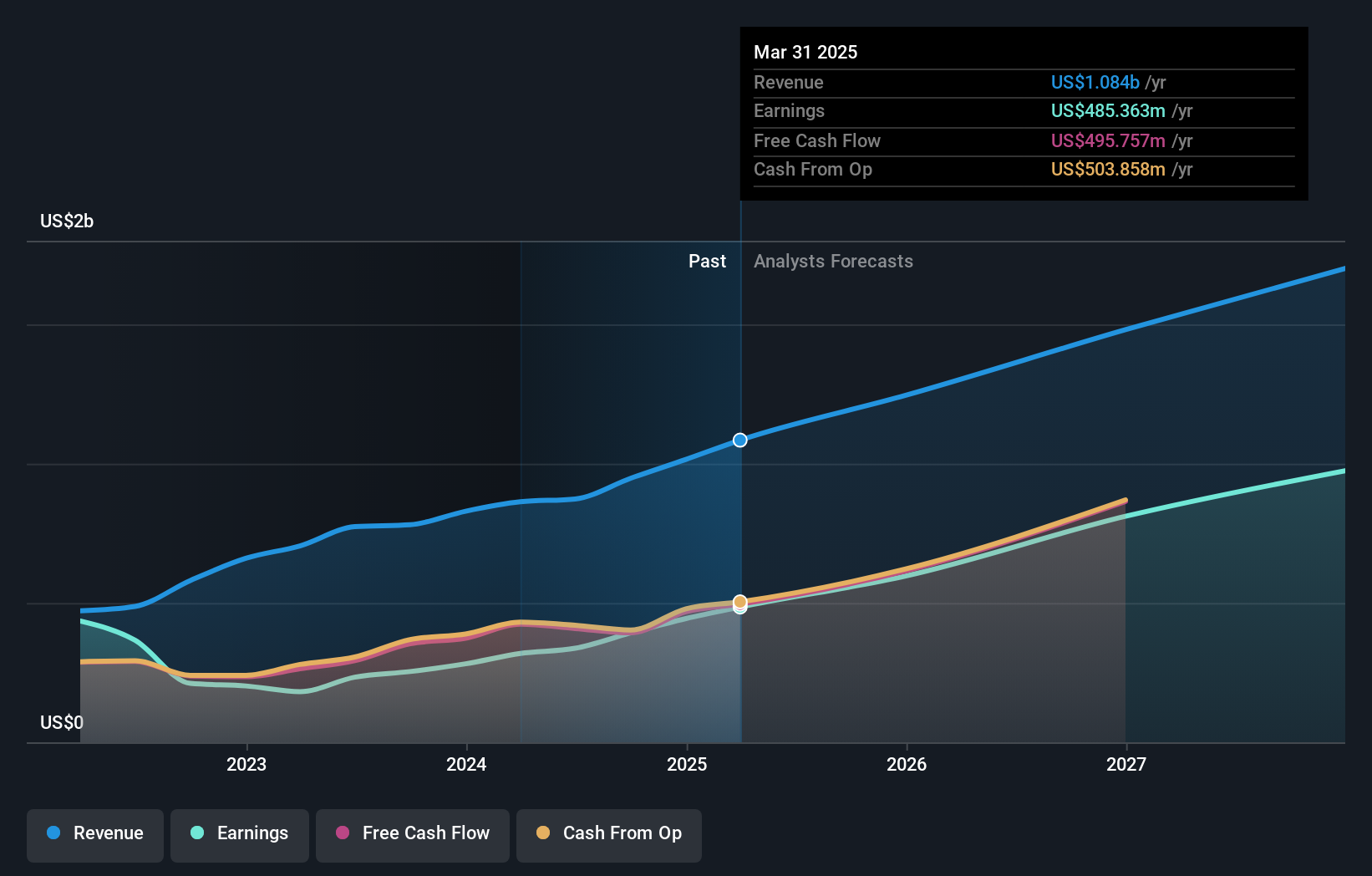

Operations: Halozyme Therapeutics generates revenue primarily through the research, development, and commercialization of proprietary enzymes, with reported revenues of $1.08 billion. The company operates both in the United States and internationally.

Halozyme Therapeutics has demonstrated robust financial performance with a 35% increase in Q1 revenue year-over-year, reaching $264.86 million, and a significant rise in net income to $118.1 million from $76.82 million previously. This growth is complemented by strategic advancements such as the FDA approval of VYVGART® Hytrulo for self-injection, leveraging their ENHANZE® technology to enhance drug delivery—a first for patients with certain autoimmune conditions. Additionally, Halozyme's commitment to shareholder returns is evident from their recent completion of a $250 million share buyback program, underscoring confidence in their financial health and future prospects. These factors collectively highlight Halozyme's potential within the biotech sector amid an evolving treatment landscape and increasing demand for innovative therapeutic solutions.

- Click here and access our complete health analysis report to understand the dynamics of Halozyme Therapeutics.

Assess Halozyme Therapeutics' past performance with our detailed historical performance reports.

Lumentum Holdings (NasdaqGS:LITE)

Simply Wall St Growth Rating: ★★★★★★

Overview: Lumentum Holdings Inc. manufactures and sells optical and photonic products across various regions, including the Americas, Asia-Pacific, Europe, the Middle East, and Africa, with a market cap of $5.44 billion.

Operations: Lumentum Holdings generates revenue primarily from its Industrial Tech and Cloud & Networking segments, with the latter contributing $1.24 billion. The company's operations span multiple regions, focusing on optical and photonic products.

Lumentum Holdings, amidst a challenging financial backdrop marked by a net loss reduction from $127 million to $44.1 million in Q3 2025, continues to innovate in high-speed optical technologies crucial for AI and machine learning applications. The company's recent guidance anticipates Q4 revenues between $440 million and $470 million, reflecting its strategic pivot towards high-demand sectors. Notably, Lumentum's collaboration on the 448 Gbps data transmission demonstration underscores its commitment to advancing communication technology standards critical for future data centers' efficiency and scalability. This focus on developing next-generation photonic solutions is poised to play a pivotal role in the tech industry's evolution, especially as digital infrastructures become increasingly AI-driven.

- Get an in-depth perspective on Lumentum Holdings' performance by reading our health report here.

Examine Lumentum Holdings' past performance report to understand how it has performed in the past.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coherent Corp. is a company that specializes in the development, manufacturing, and marketing of engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation markets globally; it has a market capitalization of approximately $12.20 billion.

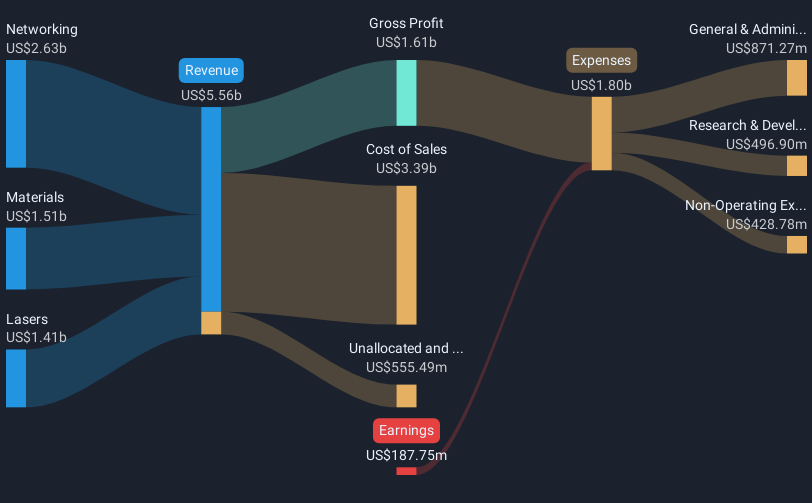

Operations: Coherent generates revenue primarily from three segments: Networking ($3.21 billion), Materials ($1.52 billion), and Lasers ($1.45 billion). The company's operations span the industrial, communications, electronics, and instrumentation markets worldwide.

Coherent Corp. has demonstrated a robust turnaround in its financial performance, with recent earnings showing a significant shift from a net loss of $13.19 million to a net income of $15.71 million in Q3 2025. This recovery is underscored by an impressive annual revenue growth rate of 8.6% and an extraordinary forecasted annual earnings growth of 96%. Innovatively, Coherent is enhancing its market position through the launch of the Axon FL, which expands the utility of femtosecond lasers for intricate neuroscience applications—a move that not only broadens their product application but also taps into the growing demand for advanced research tools in live brain imaging. These strategic advancements are pivotal as Coherent steers towards profitability and greater market penetration in high-tech sectors reliant on sophisticated optical solutions.

- Navigate through the intricacies of Coherent with our comprehensive health report here.

Gain insights into Coherent's historical performance by reviewing our past performance report.

Make It Happen

- Investigate our full lineup of 231 US High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives