- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

High Growth Tech Stocks in the US to Watch This April 2025

Reviewed by Simply Wall St

The United States market has shown resilience with a 2.3% climb over the past week and a 5.9% increase over the last year, while earnings are forecast to grow by 14% annually. In this context of steady growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to evolving market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.05% | 37.69% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.88% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.84% | 59.74% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. is a company that develops and sells high performance server and storage solutions with a modular and open architecture, serving markets in the United States, Europe, Asia, and internationally; it has a market cap of approximately $19.53 billion.

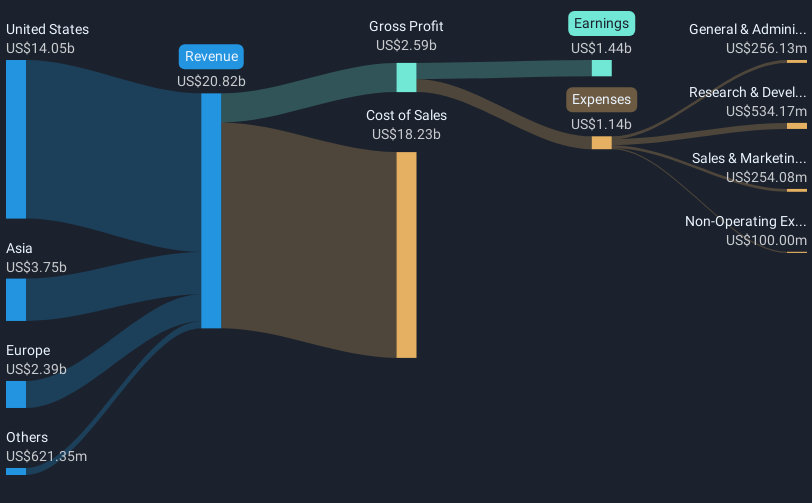

Operations: The company's primary revenue stream comes from developing and providing high-performance server solutions, generating approximately $20.82 billion.

Super Micro Computer's recent strategic alliances and product innovations underscore its adaptability and growth trajectory in the high-tech sector. The collaboration with SteelDome to deliver cutting-edge solutions for AI and hyperconverged workloads, announced on April 15, 2025, leverages Supermicro's robust hardware capabilities. This partnership is poised to enhance data resilience and operational efficiency, marking a significant step in addressing the evolving needs of enterprise data centers. Additionally, the introduction of new single-socket servers on March 27 highlights Supermicro's commitment to cost-effective and energy-efficient technology solutions, catering effectively to a diverse range of data center demands. These developments not only reflect Supermicro’s proactive approach in a competitive market but also align with industry shifts towards more sustainable and scalable IT infrastructure solutions.

- Delve into the full analysis health report here for a deeper understanding of Super Micro Computer.

Understand Super Micro Computer's track record by examining our Past report.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

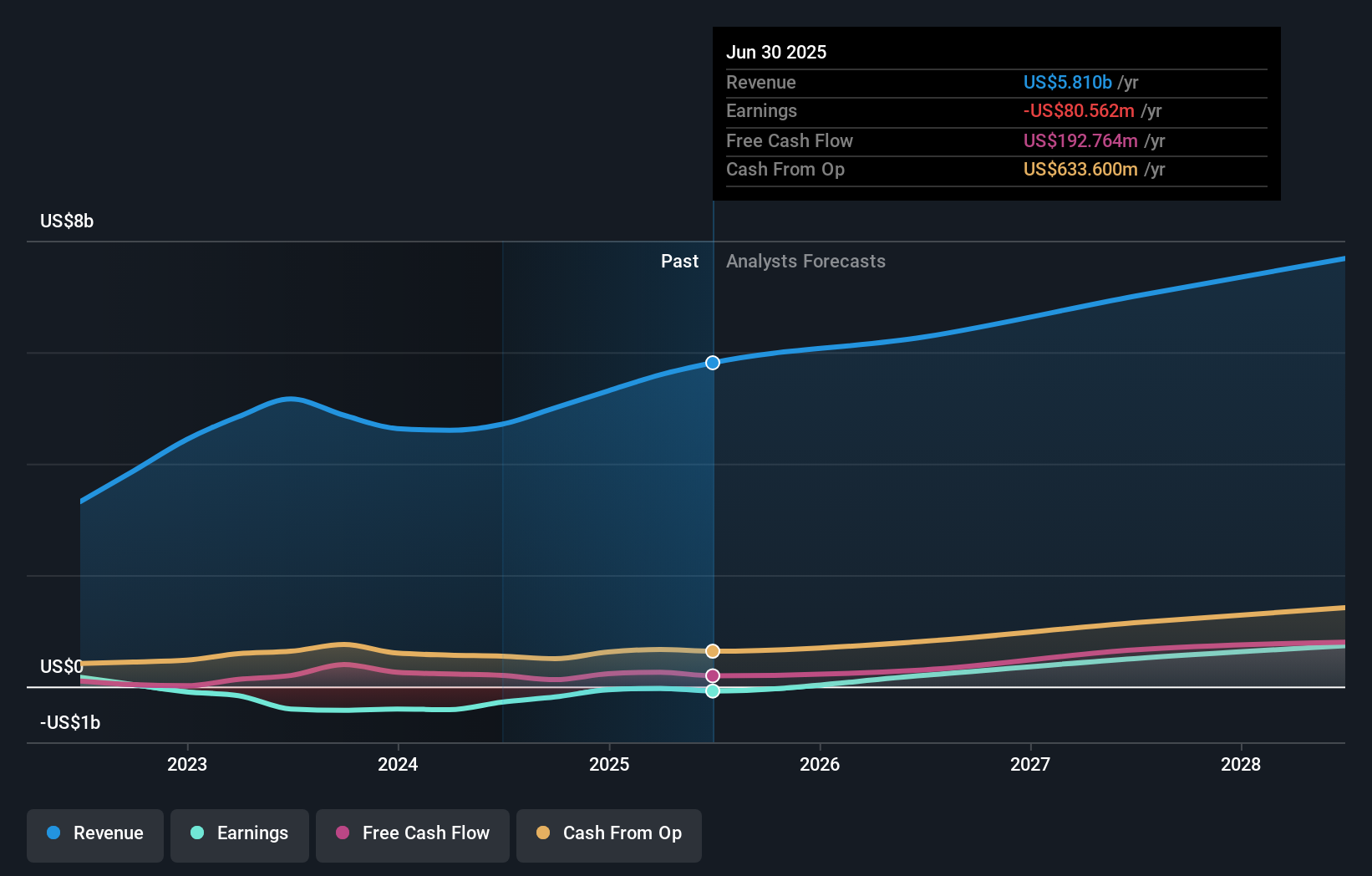

Overview: Coherent Corp. is a company that specializes in the development, manufacturing, and marketing of engineered materials, optoelectronic components, and optical and laser systems for various global markets including industrial and communications, with a market cap of approximately $8.54 billion.

Operations: Coherent Corp. generates revenue primarily through its Networking, Materials, and Lasers segments, with the Networking segment contributing $2.93 billion and Materials $1.52 billion in revenue. The company operates globally across industrial, communications, electronics, and instrumentation markets.

Coherent's recent advancements underscore its potential in high-growth tech sectors, particularly with its innovative optical solutions like the Axon FL and 1.6T-DR8 transceiver module. The Axon FL enhances Mini2P microscopy applications by enabling versatile laser use across various research setups, marking a significant step in neuroscience tool development. Meanwhile, the 1.6T-DR8 transceiver, featuring a cutting-edge 3nm DSP from Marvell®, exemplifies Coherent's push towards energy-efficient data communication technologies that align with modern AI infrastructure needs. These developments not only highlight Coherent's commitment to innovation but also position it well within the competitive landscape of high-tech industries focusing on precision and sustainability.

- Click here and access our complete health analysis report to understand the dynamics of Coherent.

Examine Coherent's past performance report to understand how it has performed in the past.

Oracle (NYSE:ORCL)

Simply Wall St Growth Rating: ★★★★☆☆

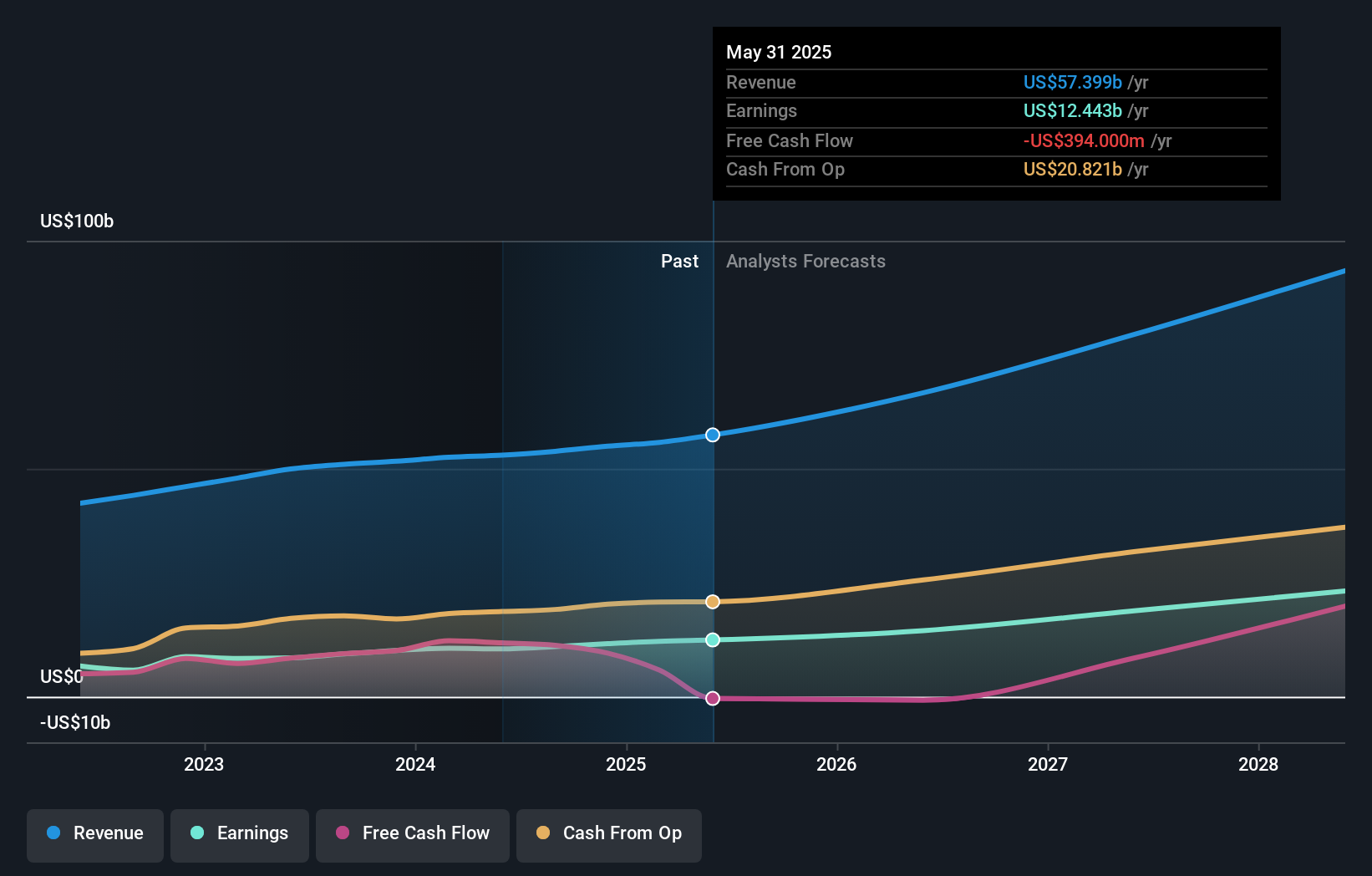

Overview: Oracle Corporation provides a wide range of products and services designed for enterprise information technology environments globally, with a market capitalization of $356.81 billion.

Operations: Oracle generates revenue primarily through its Cloud and License segment, contributing $47.60 billion, followed by Services at $5.26 billion, and Hardware at $2.93 billion.

Oracle's strategic focus on cloud services and AI-driven solutions is evident in its recent contract to provide cloud compute and storage services to the U.S. Army's Enterprise Cloud Management Agency, leveraging Oracle U.S. Defense Cloud. This move not only underscores Oracle's commitment to enhancing digital transformation strategies for defense but also highlights its robust R&D efforts, which are critical in maintaining a competitive edge in the tech industry. With a 13.7% annual revenue growth rate and an impressive 16.6% projected earnings growth per year, Oracle is actively expanding its influence beyond traditional databases into more dynamic sectors like government cloud solutions, demonstrating both innovation and adaptability in high-tech environments.

Summing It All Up

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 231 more companies for you to explore.Click here to unveil our expertly curated list of 234 US High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives