Coherent (NYSE:COHR) Showcases High-Speed Solutions For AI And Data Center Networking

Reviewed by Simply Wall St

Coherent (NYSE:COHR) recently announced the launch of the 800G ZR/ZR+ transceiver, underlining its commitment to next-generation optical networking, alongside showcasing innovations at the OFC 2025 event. Despite these advancements, Coherent's share price moved flat over the last week. Broader market conditions may have played a role, with major tech stocks experiencing a selloff influenced by inflation concerns and weak consumer sentiment affecting the overall tech sector. While Coherent's technical advancements are promising, they were presented during a week of market pressures, thus not reflecting a significant price change.

Buy, Hold or Sell Coherent? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Coherent's shareholders have seen a total return of 168.70%, exemplifying a robust growth trajectory despite the current period's market volatility. Several fundamental factors may have contributed to this performance. The company has experienced significant advancements, such as the launch of the high-performance eOTDR for fiber health monitoring and new pluggable transceivers aimed at AI applications, supporting their technical leadership position in optical networking.

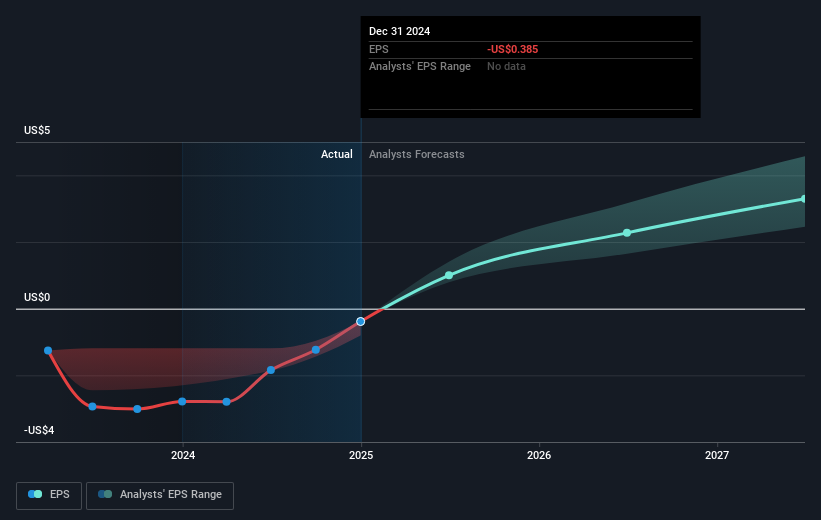

Additionally, recent financial results have indicated improved profitability, with Q2 2025 sales reaching US$1.43 billion and net income of US$103.39 million, reflecting a stark improvement from prior losses. This reflects a broader trend of recovery and growth that could bolster long-term investor confidence. Furthermore, in the past year, Coherent exceeded the US Electronic industry, which saw a modest 3% return, highlighting the company's relative resilience and rewarding shareholders even in challenging conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)