- United States

- /

- Communications

- /

- NYSE:CIEN

High Growth Tech Stocks In The US Market To Watch

Reviewed by Simply Wall St

As the U.S. market experiences a slight dip following a strong rally in the S&P 500, investors are closely monitoring economic indicators and broader market sentiment that impact small-cap companies. In this environment, identifying high-growth tech stocks involves looking for companies with robust earnings potential and resilience to economic fluctuations, making them noteworthy candidates in today's dynamic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Legend Biotech | 26.73% | 58.77% | ★★★★★★ |

| Travere Therapeutics | 25.82% | 65.45% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Vertex (NasdaqGM:VERX)

Simply Wall St Growth Rating: ★★★★★☆

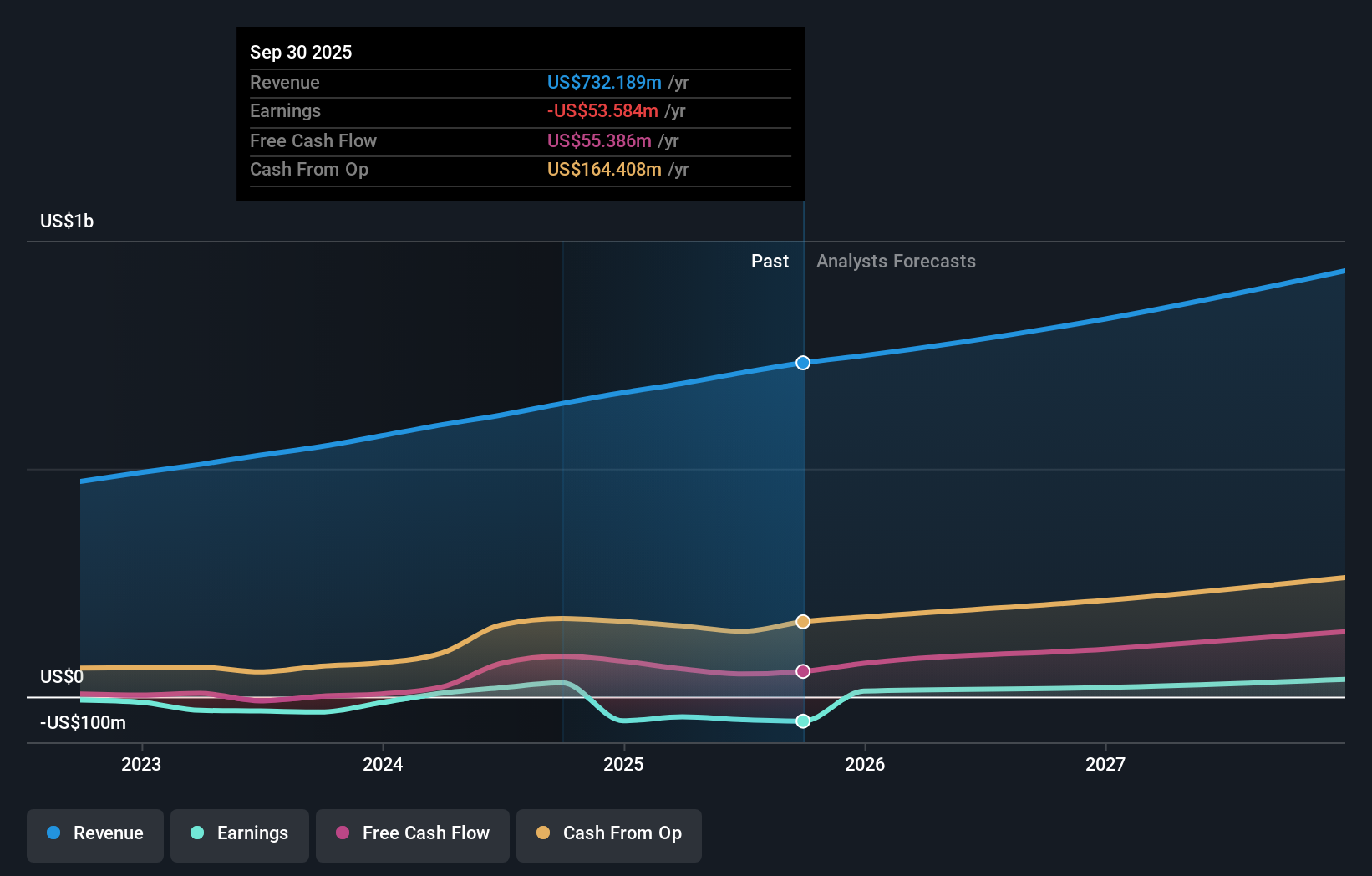

Overview: Vertex, Inc. offers enterprise tax technology solutions for retail, wholesale, and manufacturing sectors globally and has a market capitalization of approximately $6.05 billion.

Operations: Vertex, Inc. generates revenue primarily from its software and programming segment, which accounts for $687.06 million.

Vertex's recent strategic partnership with Majesco, integrating its tax solutions into the ClaimVantage platform, underscores its commitment to enhancing operational efficiency and accuracy in tax calculations for disability claims. This move not only boosts Vertex's service offerings but also expands its market reach in Canada with plans to extend to U.S. customers later this year. Financially, Vertex reported a significant increase in Q1 2025 revenue, rising to $177.06 million from $156.78 million the previous year, alongside a substantial growth in net income from $2.68 million to $11.13 million. These figures reflect Vertex's robust financial health and innovative edge in developing solutions that address complex regulatory challenges, positioning it well for future expansion and profitability as indicated by their optimistic revenue forecasts of up to $768 million for 2025.

- Navigate through the intricacies of Vertex with our comprehensive health report here.

Assess Vertex's past performance with our detailed historical performance reports.

Sarepta Therapeutics (NasdaqGS:SRPT)

Simply Wall St Growth Rating: ★★★★☆☆

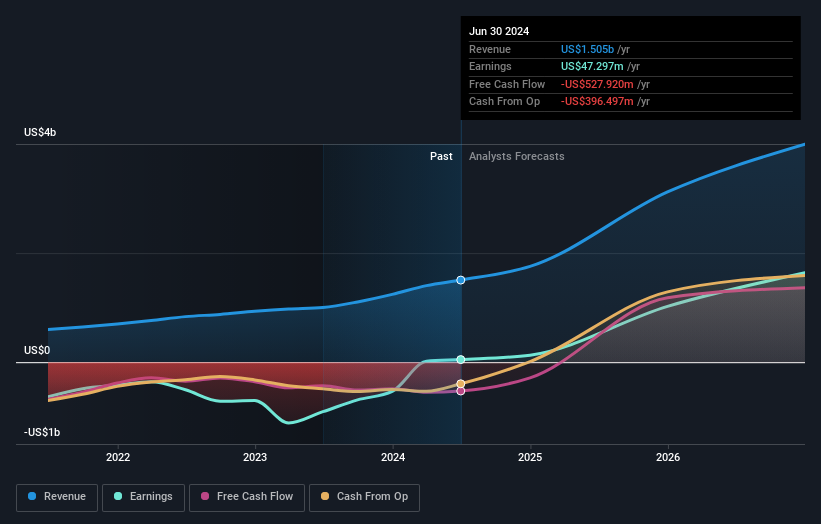

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of $3.58 billion.

Operations: Sarepta Therapeutics focuses on discovering, developing, manufacturing, and delivering RNA-targeted therapeutics and gene therapies for rare diseases, generating $2.23 billion in revenue.

Sarepta Therapeutics, a trailblazer in gene therapies for Duchenne muscular dystrophy, recently showcased promising results from its ENDEAVOR study. Treatment with ELEVIDYS demonstrated significant dystrophin protein expression, a crucial factor for disease management. Despite facing challenges such as elevated liver enzymes in some patients, Sarepta's rigorous monitoring and adaptive treatment strategies underscore its commitment to safety and efficacy. The company's strategic focus on innovative gene therapies not only enhances its portfolio but also positions it well within the high-growth biotech sector, despite a recent downward adjustment in revenue projections to $2.3 billion for 2025.

- Unlock comprehensive insights into our analysis of Sarepta Therapeutics stock in this health report.

Ciena (NYSE:CIEN)

Simply Wall St Growth Rating: ★★★★☆☆

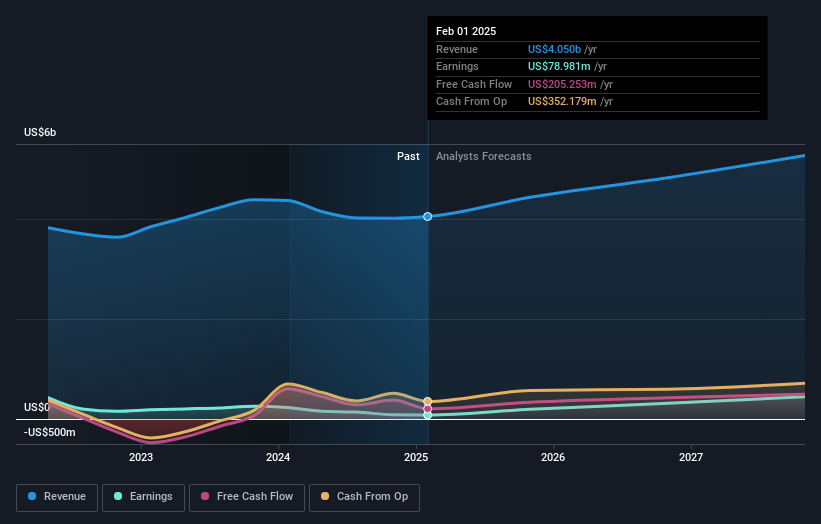

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators across multiple regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India with a market capitalization of approximately $11.55 billion.

Operations: Ciena generates revenue primarily from its Networking Platforms segment, which accounts for $3.06 billion, followed by Global Services at $540.45 million. The Platform Software and Services and Blue Planet Automation Software and Services segments contribute $363.38 million and $89.71 million, respectively.

Despite a challenging year with earnings growth down by 64.7%, Ciena's commitment to innovation remains robust, as evidenced by its significant R&D investment and recent technological advancements. The company has successfully trialed its WaveLogic 6 Extreme technology over an impressive distance of 1,590 kilometers, showcasing potential for future high-bandwidth applications. This aligns with a revenue growth forecast of 9.4% annually, outpacing the US market average of 8.5%. With earnings expected to surge by 51% annually, Ciena is strategically positioned to capitalize on increasing demand for advanced network solutions, despite current profit margins standing at a modest 2%.

- Click here to discover the nuances of Ciena with our detailed analytical health report.

Review our historical performance report to gain insights into Ciena's's past performance.

Key Takeaways

- Reveal the 234 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives