Xerox Holdings Corporation (NASDAQ:XRX) will pay a dividend of $0.25 on the 3rd of January. The dividend yield will be 7.3% based on this payment which is still above the industry average.

Our analysis indicates that XRX is potentially undervalued!

Xerox Holdings' Payment Has Solid Earnings Coverage

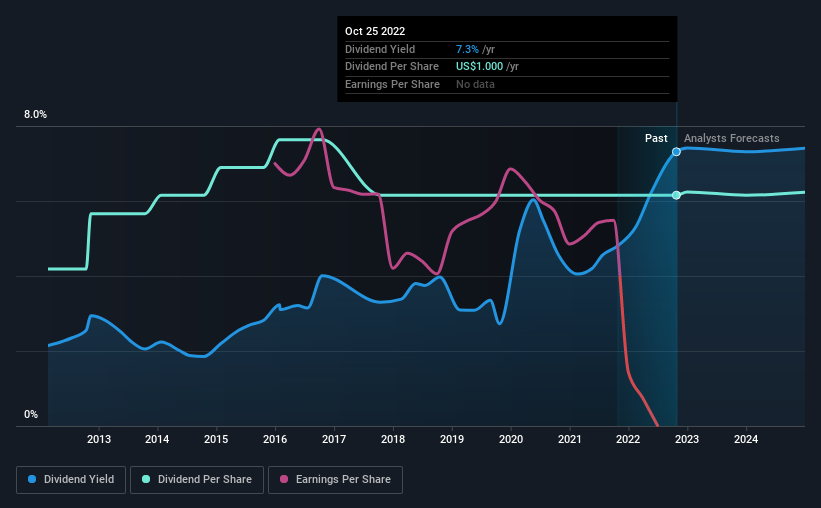

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. While Xerox Holdings is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 7.1%, which we would be comfortable to see continuing.

Xerox Holdings Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.68 in 2012 to the most recent total annual payment of $1.00. This works out to be a compound annual growth rate (CAGR) of approximately 3.9% a year over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Xerox Holdings' EPS has fallen by approximately 36% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Xerox Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Xerox Holdings (of which 1 is significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XRX

Xerox Holdings

Operates as a workplace technology company that integrates hardware, services, and software for enterprises in the Americas, Europe, the Middle East, Africa, India, and internationally.

Undervalued average dividend payer.