- United States

- /

- Life Sciences

- /

- NasdaqGM:OABI

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, the U.S. stock market faces a challenging period with significant declines in major indices like the Dow Jones and S&P 500, marking their worst month since April. Amid these fluctuations, investors often turn their attention to penny stocks—companies with lower share prices that can offer intriguing opportunities for growth despite their vintage terminology. By focusing on those penny stocks with strong financials and potential for stability, investors may find promising prospects even in turbulent times.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.89 | $229.35M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $9.2M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.57 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Wrap Technologies (NasdaqCM:WRAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wrap Technologies, Inc. is a public safety technology and services company that develops policing solutions for law enforcement and security personnel globally, with a market cap of $83.05 million.

Operations: The company's revenue is derived entirely from its Aerospace & Defense segment, totaling $4.23 million.

Market Cap: $83.05M

Wrap Technologies, with a market cap of US$83.05 million, has faced challenges typical of penny stocks. The company reported a revenue decline to US$0.593 million in Q3 2024 from US$3.63 million the previous year, yet achieved a net income of US$1.99 million compared to a net loss previously. Despite shareholder dilution and high volatility, Wrap's strategic relocation to Virginia aims to bolster its manufacturing capabilities and expand its public safety solutions—a move supported by local government initiatives that could enhance future prospects amidst current financial instability and limited cash runway under one year without debt obligations.

- Dive into the specifics of Wrap Technologies here with our thorough balance sheet health report.

- Gain insights into Wrap Technologies' historical outcomes by reviewing our past performance report.

908 Devices (NasdaqGM:MASS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 908 Devices Inc. is a commercial-stage technology company that offers handheld and desktop mass spectrometry devices for analyzing unknown materials across industries such as life sciences, bioprocessing, pharma/biopharma, and forensics, with a market cap of $78.70 million.

Operations: The company's revenue is derived from the Scientific & Technical Instruments segment, totaling $55.16 million.

Market Cap: $78.7M

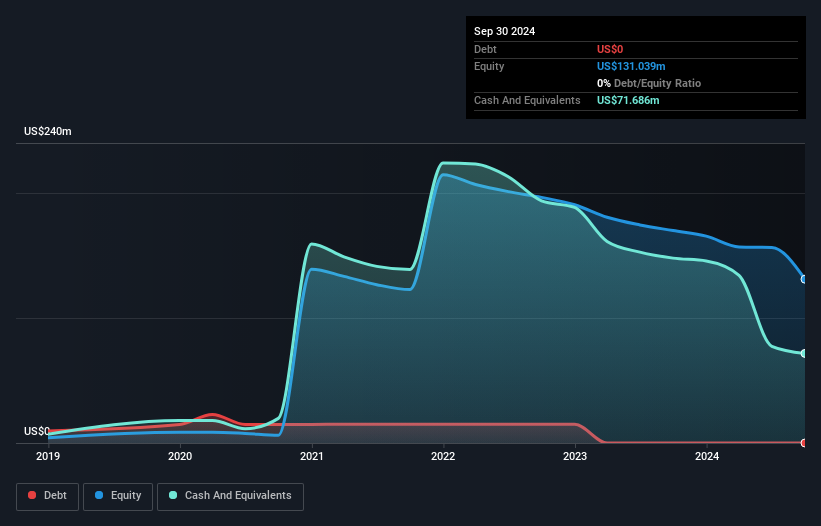

908 Devices Inc., with a market cap of US$78.70 million, is navigating the challenges of being unprofitable while implementing strategic changes to improve financial health. Recent restructuring and relocation plans are projected to save US$6.6 million annually from 2025, despite incurring one-time costs for severance and relocations. The company's revenue increased to US$16.77 million in Q3 2024 from US$14.3 million the previous year, yet it reported a significant net loss due to high operational costs and goodwill impairment charges of over US$30 million, highlighting its volatile financial position amidst industry uncertainties.

- Jump into the full analysis health report here for a deeper understanding of 908 Devices.

- Explore 908 Devices' analyst forecasts in our growth report.

OmniAb (NasdaqGM:OABI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OmniAb, Inc. is a biotechnology company involved in the discovery and provision of therapeutic antibody discovery technologies in the United States, with a market cap of approximately $434.44 million.

Operations: The company's revenue segment consists of Research Services, generating $20.41 million.

Market Cap: $434.44M

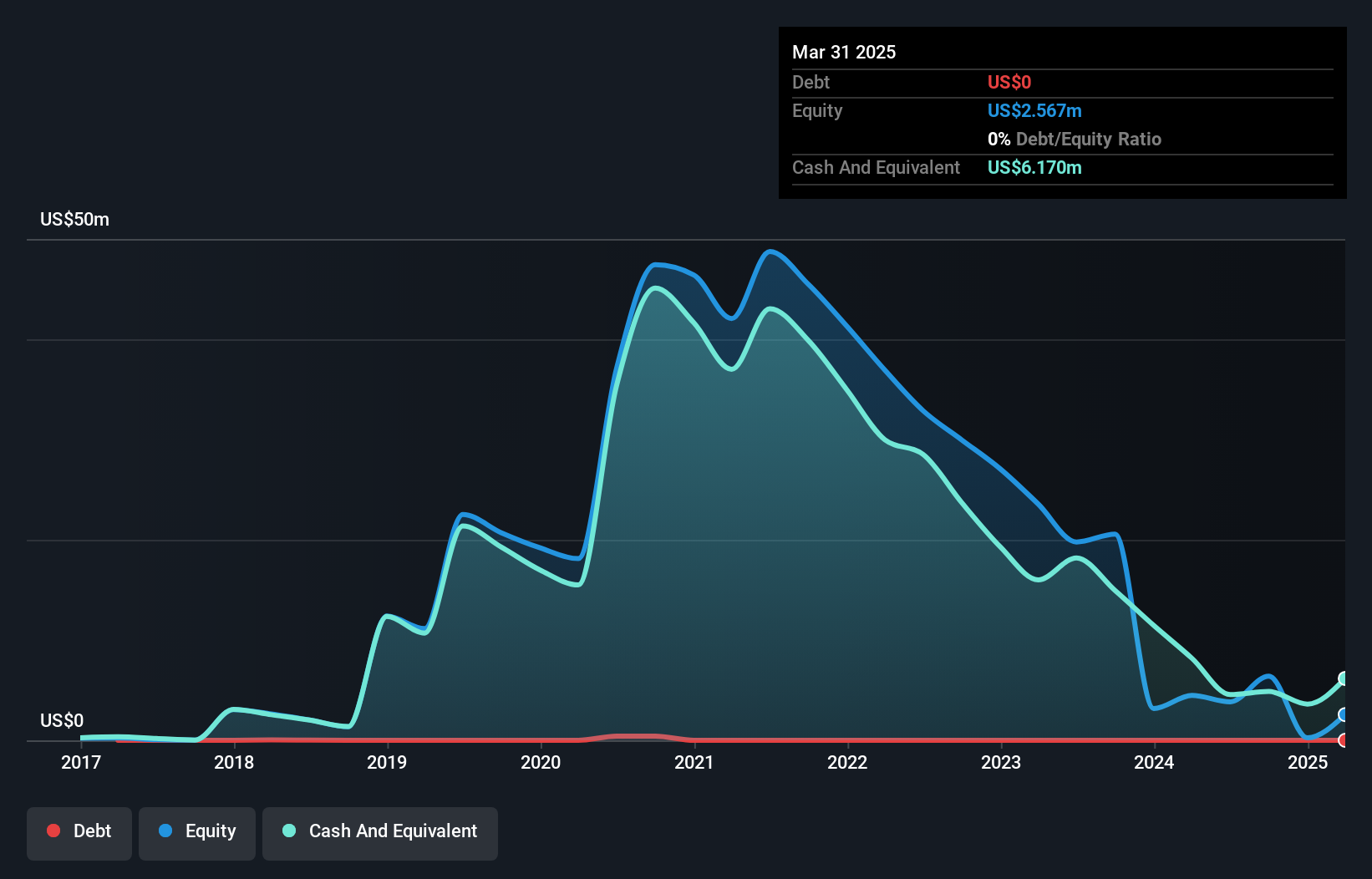

OmniAb, Inc., a biotechnology firm with a market cap of US$434.44 million, is currently navigating the challenges of being unprofitable while operating in the therapeutic antibody discovery space. Despite generating US$20.41 million in revenue from research services, its financials reveal increasing losses, with a net loss of US$48.97 million for the first nine months of 2024 compared to US$36.57 million in 2023. The company has no debt and maintains sufficient short-term assets to cover liabilities but faces shareholder dilution and negative return on equity (-21.6%). Revenue growth is forecast at 29.44% annually amidst ongoing industry engagement through multiple conference presentations.

- Click to explore a detailed breakdown of our findings in OmniAb's financial health report.

- Gain insights into OmniAb's future direction by reviewing our growth report.

Summing It All Up

- Gain an insight into the universe of 731 US Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OABI

OmniAb

A biotechnology company, licenses discovery research technology to pharmaceutical and biotech companies, and academic institutions to enable the discovery of therapeutics in the United States, Europe, Japan, China, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives