- United States

- /

- Biotech

- /

- NasdaqGS:SLRN

Promising US Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a temporary setback with technology shares sliding, investors' attention is turning towards alternative investment opportunities such as penny stocks. Despite their name suggesting an outdated concept, penny stocks remain a significant area of interest due to their potential for growth and affordability. These smaller or newer companies, particularly those with robust financials, can offer unique opportunities for investors looking to uncover hidden value in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.802475 | $5.67M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $167.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.72 | $143.18M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.22 | $8.3M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.90 | $702.04M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $51.81M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.952 | $85.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $424.98M | ★★★★☆☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Wrap Technologies (NasdaqCM:WRAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wrap Technologies, Inc. is a public safety technology and services company that develops policing solutions for law enforcement and security personnel globally, with a market cap of $71.58 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling $4.23 million.

Market Cap: $71.58M

Wrap Technologies, Inc. is navigating the challenges of being a penny stock with a market cap of US$71.58 million and limited revenue growth, reporting US$4.23 million primarily from its Aerospace & Defense segment. Despite being unprofitable with increasing losses over five years, recent strategic moves like relocating its facility to Virginia aim to bolster innovation and manufacturing capabilities for public safety solutions such as BolaWrap® and Wrap Reality™. The company has faced shareholder dilution and significant insider selling but remains debt-free, with short-term assets covering liabilities while grappling with high volatility in share price stability.

- Click here to discover the nuances of Wrap Technologies with our detailed analytical financial health report.

- Learn about Wrap Technologies' historical performance here.

GoPro (NasdaqGS:GPRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GoPro, Inc. develops and sells cameras, mountable and wearable accessories, as well as subscription services and software globally, with a market cap of $184.17 million.

Operations: The company generates revenue primarily from its Photographic Equipment & Supplies segment, amounting to $896.01 million.

Market Cap: $184.17M

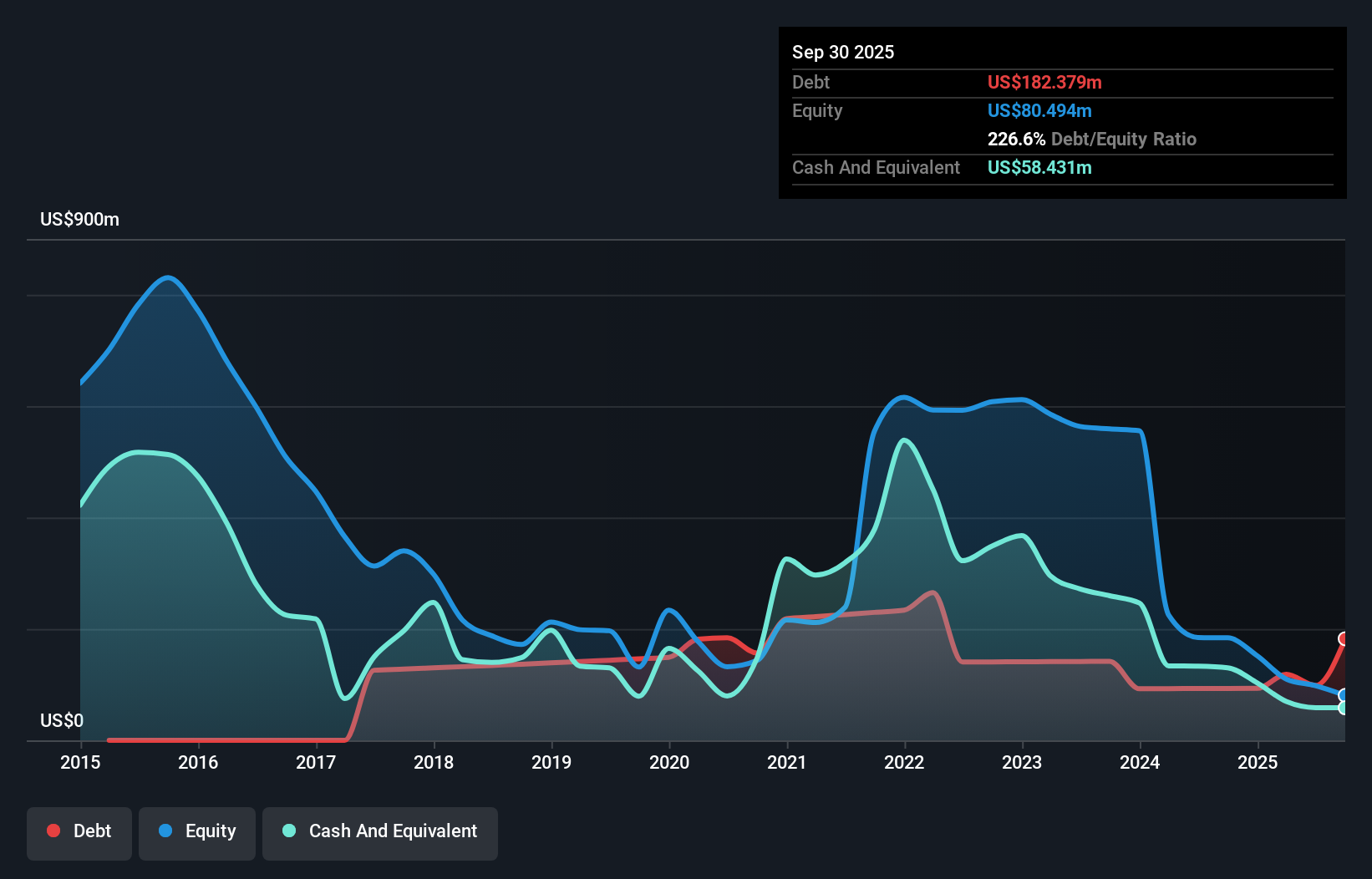

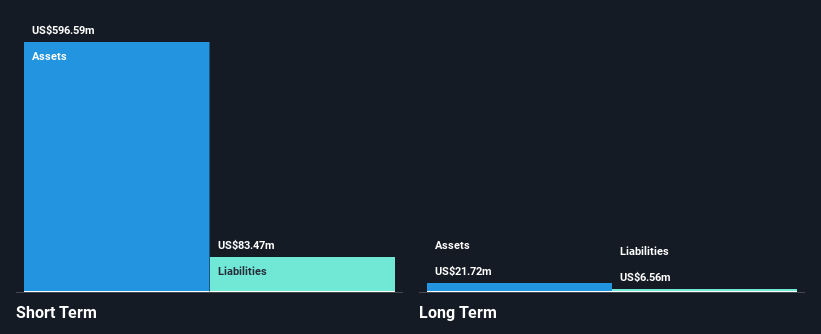

GoPro, Inc., with a market cap of US$184.17 million, faces the challenges typical of penny stocks, such as ongoing unprofitability and increasing losses over the past five years. Despite these hurdles, GoPro maintains more cash than its total debt and has a sufficient cash runway for over a year based on current free cash flow. The company's board and management are seasoned, aiding strategic direction amidst financial struggles. Recent product launches like the HERO13 Black aim to rejuvenate sales but have yet to reverse declining revenues or profitability issues highlighted in recent earnings reports.

- Dive into the specifics of GoPro here with our thorough balance sheet health report.

- Evaluate GoPro's prospects by accessing our earnings growth report.

Acelyrin (NasdaqGS:SLRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acelyrin, Inc. is a clinical biopharma company dedicated to identifying, acquiring, and accelerating the development and commercialization of transformative medicines, with a market cap of $465.51 million.

Operations: Acelyrin, Inc. has not reported any revenue segments as it is focused on the development and commercialization of transformative medicines.

Market Cap: $465.51M

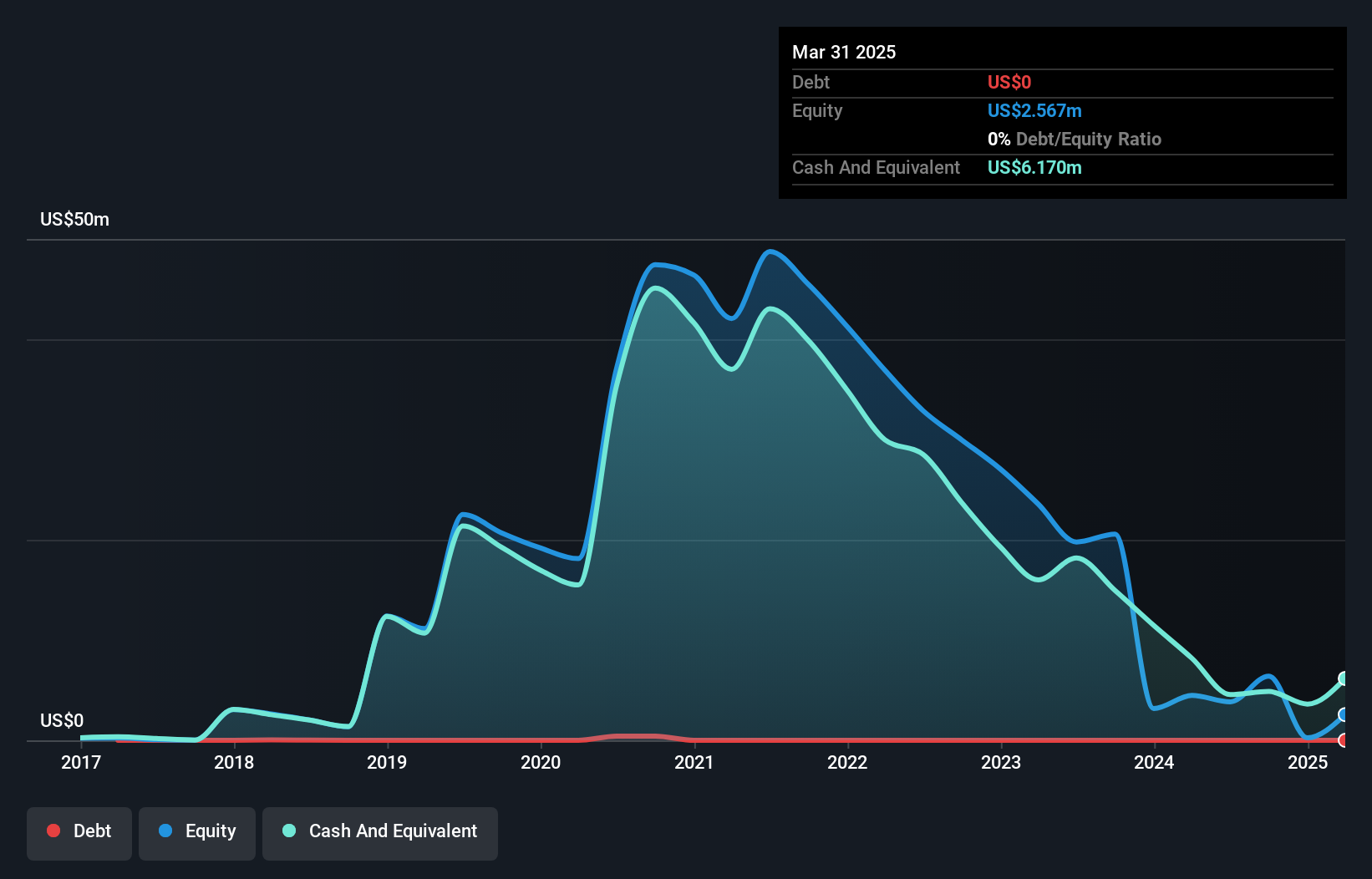

Acelyrin, Inc., with a market cap of US$465.51 million, is pre-revenue and faces typical challenges for penny stocks, including unprofitability and shareholder dilution over the past year. The company has no debt and a substantial cash runway exceeding one year based on current free cash flow trends. Recent financial reports show reduced losses compared to previous periods, with a net loss of US$48.55 million in Q3 2024 versus US$83.94 million a year prior. Acelyrin's recent follow-on equity offering of US$150 million aims to bolster its financial position as it continues its focus on transformative medicines development.

- Get an in-depth perspective on Acelyrin's performance by reading our balance sheet health report here.

- Understand Acelyrin's earnings outlook by examining our growth report.

Key Takeaways

- Investigate our full lineup of 713 US Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLRN

Acelyrin

A clinical biopharma company, focuses on identifying, acquiring, and accelerating the development and commercialization of transformative medicines.

Flawless balance sheet slight.