- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:TROO

TROOPS (TROO) Loss Reduction Highlights Progress, But High Valuation Challenges Bullish Narratives

Reviewed by Simply Wall St

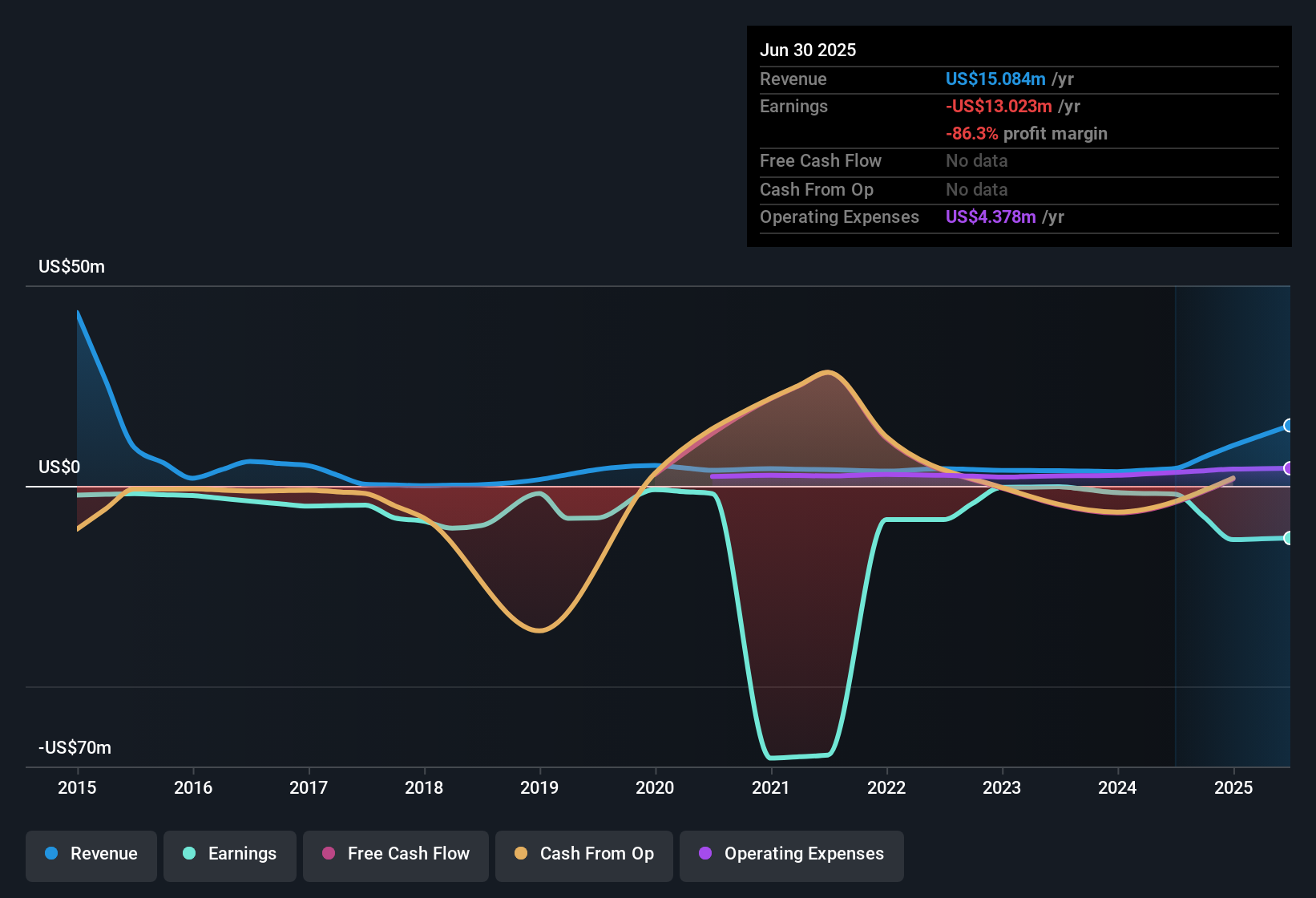

TROOPS (TROO) continues to operate at a loss, with no recent evidence of positive net income or an improving profit margin. Over the past five years, however, the company has managed to reduce its annual losses at a rate of 39%, reflecting some operational progress even as it remains unprofitable. With shares trading at $1.39, well above the estimated fair value of $0.44, the stock's price-to-sales ratio of 16.9x far exceeds both the US Electronic industry average of 2.7x and its peer group average of 4.7x. This puts a spotlight on its elevated valuation metrics.

See our full analysis for TROOPS.The next section puts TROO’s latest numbers side by side with the key narratives shaping market sentiment, highlighting where expectations align and where surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Loss Reduction Outpaces Profit Trend

- TROO has narrowed its annual losses by 39% on average over the past five years, but this progress has not been matched by a turn to profitability. No positive net income or margin recovery has appeared in recent results.

- Even with annual losses shrinking, the lack of bottom-line improvement keeps TROO in unprofitable territory. Continued progress mainly highlights that operations are moving in the right direction, without yet resolving the main bearish concern:

- Rapid loss reduction could signal improving efficiency even as challenges remain.

- The absence of clear profit margin gains adds weight to a cautious stance, reinforcing a wait-and-see approach rather than a full reversal of bearish skepticism.

Share Price Premium Signals Valuation Challenge

- The current share price of $1.39 sits more than triple the DCF fair value estimate of $0.44, and TROO’s price-to-sales ratio of 16.9x is notably higher than both its peer group (4.7x) and the US Electronic industry average (2.7x).

- This striking disconnect between price and fundamentals helps explain why valuation remains a sticking point:

- The comparison to sector and peer averages highlights that TROO’s valuation premium is not mirrored by stronger financial performance or visible growth catalysts.

- Market confidence implied by the share price stands at odds with ongoing losses, and the premium valuation could face downside pressure unless profitability sharply improves.

Losses Narrow, But No Major Risk Flags

- Despite the persistent lack of net profits, no major risk warnings have surfaced in recent disclosures. The company’s reduced losses reflect some operational traction, even if headline figures do not point to a turnaround yet.

- The prevailing market view focuses on the progress in cutting losses but holds back from raising alarm bells:

- Investors may read this as a sign to monitor the trajectory rather than react to imminent threats.

- Until a clear profitability path emerges, valuation and recent price moves will likely continue to drive debate around TROO.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TROOPS's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TROO’s declining losses have not translated into profitability, and the stock’s high valuation stands on shaky ground without improving fundamentals.

If you want more reassuring value, use these 878 undervalued stocks based on cash flows to pinpoint companies trading at more attractive prices with financials to match.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TROOPS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TROO

TROOPS

TROOPS, Inc., along with its subsidiaries, operates in the money lending business in Hong Kong, the Peoples Republic of China, and Australia.

Adequate balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)