- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Trimble (TRMB) Expands Sales Footprint With New Technology Outlet at Martin Equipment

Reviewed by Simply Wall St

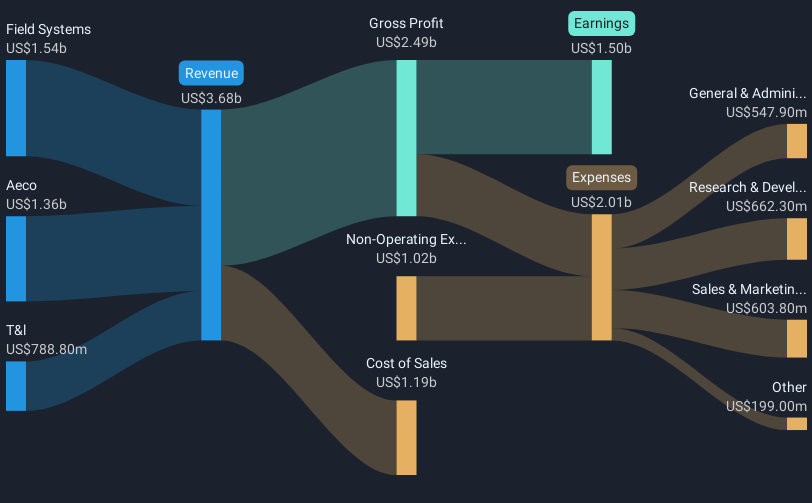

Trimble (TRMB) has recently expanded its business by partnering with Martin Equipment in Goodfield, Illinois, to establish a new Trimble Technology Outlet. This move, part of Trimble's civil construction distribution strategy, likely supports the company's share price increase of 10% over the last quarter. Alongside this partnership, Trimble's recent launch of the Trimble Freight Marketplace and strategic collaborations, such as with Hyundai for Trimble Ready 3D options, have bolstered its market position. The company's share performance aligns with broader market strength, with the S&P 500 and Nasdaq reaching all-time highs, further buoying investor sentiment.

You should learn about the 1 warning sign we've spotted with Trimble.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent partnership with Martin Equipment to establish a Trimble Technology Outlet reinforces Trimble's efforts in expanding its civil construction distribution strategy. This development, along with collaborations like Trimble Ready 3D with Hyundai, may contribute positively to revenue growth and enhance customer value through integrated technology solutions. Over a five-year period, Trimble’s total shareholder return was 53.73%, indicating solid long-term performance. Over the past year, Trimble outpaced the US Electronic industry, which returned 42.1%. This consistent outperformance underscores Trimble’s robust market position and its potential to generate sustained returns.

The ongoing transition to cloud-based, AI-driven software and subscription models suggests an increase in recurring revenues and improved margin performance. However, challenges such as technological disruptions and heightened competition could dampen earnings growth. As analysts anticipate revenue expansion to 4.1 billion and earnings reaching 776.4 million by 2028, Trimble is positioned for growth, albeit with risks like government spending fluctuations and competitive pressures. The current share price of US$80.06 remains below the analyst consensus price target of US$94.75. This price movement, in light of the projected earnings growth, indicates potential room for appreciation if Trimble successfully executes its strategic initiatives to enhance profitability and market penetration.

Evaluate Trimble's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)