- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate Technology Holdings (NasdaqGS:STX) Stock Jumps 11% Over Past Week

Reviewed by Simply Wall St

Seagate Technology Holdings (NasdaqGS:STX) experienced an 11% increase in its stock price over the past week. This rise comes despite a challenging week for the broader tech sector, including declines led by Nvidia, Tesla, and others. While major indexes such as the S&P 500 and Nasdaq Composite were down, Seagate's stock showed resilience. Although no specific company-related events were noted during the period, the notable movement in Seagate’s share price may relate to sector dynamics or shifts in investor sentiment. Overall, Seagate's performance stood out compared to broader market trends, which were generally negative for tech stocks.

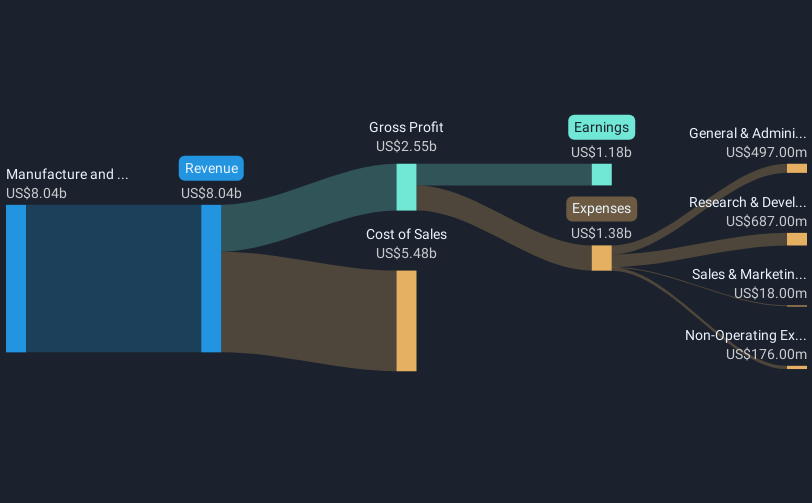

The recent uptick in Seagate Technology Holdings' stock price, despite a challenging environment for the tech sector, indicates a potential shift in investor sentiment or sector dynamics that may align with the company's longer-term growth narrative. Over the past five years, Seagate's total shareholder return was 115.09%, a significant achievement that demonstrates the company's resilience and potential for continued performance. This comes in contrast to its performance against the US Tech industry, where Seagate underperformed over the past year. The company’s strategic focus on evolving demands for mass storage, driven by developments in Gen AI and advancements in HAMR technology, could further bolster its revenue and earnings forecasts.

Seagate's current share price of US$75.36 stands at a 30.9% discount to the consensus analyst price target of US$108.99. This suggests room for growth should the eventual earnings and revenue align with analyst projections of US$10.1 billion revenue and US$1.5 billion earnings by 2028. While the company's Price-To-Earnings Ratio appears favorable compared to the industry average, it is key for investors to evaluate these metrics within the context of potential risks such as supply constraints and debt levels. The recent price movement might encourage a reassessment of Seagate's position as compared to analyst expectations, balancing optimism with an awareness of potential challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives