- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (NasdaqGS:SMCI) Partners With Ericsson To Advance Edge AI Deployment

Reviewed by Simply Wall St

Super Micro Computer (NasdaqGS:SMCI) recently experienced a price move of 35% in the last month. This significant increase can be linked to the company's collaboration with Ericsson, aimed at advancing Edge AI deployment by integrating 5G connectivity with its AI platforms, which supports essential sectors like retail and healthcare requiring low-latency processing. Amidst a general market rise of 1.5% in the past week, this strategic development likely added weight to Supermicro's gains. Other partnerships and product innovations, such as AI infrastructure expansions and collaborations with Cologix and Digi Power X, further underline the company's robust growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

Super Micro Computer's recent collaboration with Ericsson could have substantial implications for the company's long-term growth narrative. By integrating 5G with AI platforms, Supermicro positions itself to capture significant demand from sectors requiring low-latency solutions. As these sectors expand, the company's revenue forecasts could potentially benefit. This move aligns with Supermicro's planned introduction of new AI platforms such as Blackwell GPUs, expected to bolster revenue growth and optimize operations via global manufacturing. Meanwhile, earnings forecasts anticipate substantial growth, potentially influenced by advancements in cooling technologies and increased market share.

Over the past five years, Supermicro's total shareholder return, including dividends, reached a very large 1,278.08%, indicating significant long-term shareholder gain. In the more immediate one-year timeframe, however, the company's performance underperformed the US Tech industry, which posted a return of 3.2%. Despite the short-term underperformance, these new partnerships and product initiatives could catalyze future returns.

With the company's current share price at US$32.94, the recent price movement must be viewed in the context of the consensus analyst price target of US$48.76, suggesting a 32.4% potential upside. This discrepancy highlights the potential market optimism or caution surrounding the company's anticipated growth trajectory. Investors and analysts will be closely watching how effectively Supermicro capitalizes on these partnerships and innovations to drive up its revenue and earnings projections, reinforcing or challenging the current price targets.

Review our historical performance report to gain insights into Super Micro Computer's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

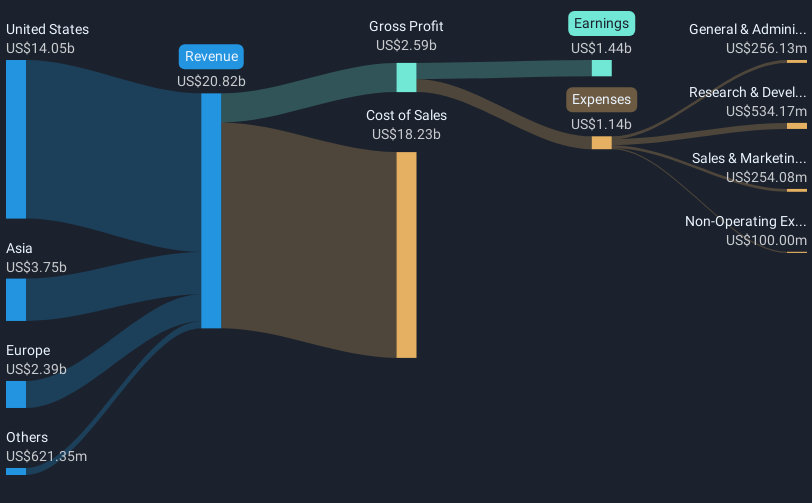

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)