- United States

- /

- Communications

- /

- NasdaqGS:RBBN

Why Ribbon Communications (RBBN) Is Down 7.0% After Raising Full-Year Revenue and Earnings Guidance

Reviewed by Sasha Jovanovic

- Ribbon Communications reported its third quarter 2025 results earlier this week, posting revenues of US$215.37 million and a narrower net loss compared to the prior year, alongside issuing earnings guidance of US$230 million to US$250 million in revenue for the fourth quarter and a full-year revenue midpoint of US$857 million.

- This combination of quarterly results and updated guidance reflects ongoing revenue growth and improving net loss metrics as the company executes its longer-term business transformation strategy.

- With the company projecting further revenue gains and narrowing losses, we’ll explore how this updated guidance impacts Ribbon Communications’ investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ribbon Communications Investment Narrative Recap

To be a shareholder in Ribbon Communications, you need to believe that ongoing global telecom modernization and increased demand for cloud-native and secure communications will drive the company’s recovery and market relevance, despite its current losses and reliance on large clients. The recent Q3 results and improved guidance suggest positive momentum, but they do not materially lessen the most pressing short-term risk: revenue concentration with major customers like Verizon and the potential volatility this brings.

The most relevant recent announcement is the company's Q4 and full-year 2025 earnings guidance, which projects continued growth and a narrower operating loss. This is important for assessing whether Ribbon can maintain visibility on revenue despite persisting risks such as pricing pressure or contract attrition with key clients, which remain central to its narrative and can influence future investor sentiment.

By contrast, investors should also be aware of just how quickly Ribbon’s fortunes could shift if the company were to lose a major contract with a top-tier customer…

Read the full narrative on Ribbon Communications (it's free!)

Ribbon Communications' outlook anticipates $988.4 million in revenue and $78.5 million in earnings by 2028. This is based on a 4.6% annual revenue growth rate and reflects a $122.9 million increase in earnings from the current level of -$44.4 million.

Uncover how Ribbon Communications' forecasts yield a $6.08 fair value, a 72% upside to its current price.

Exploring Other Perspectives

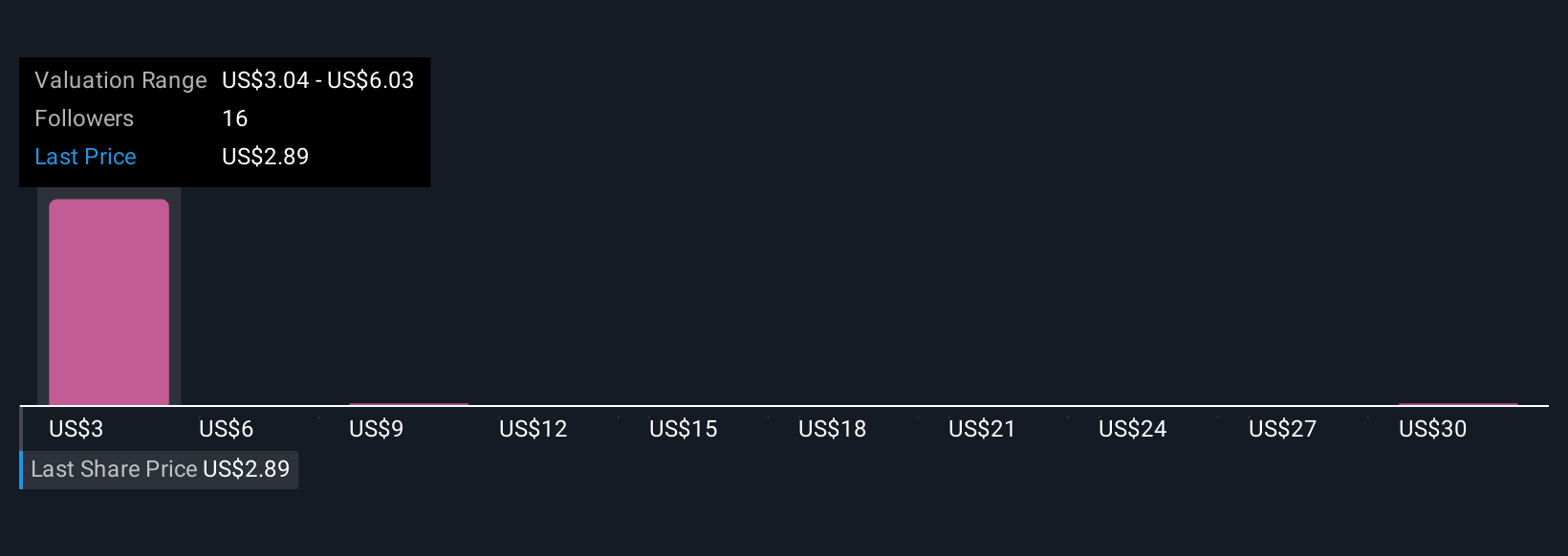

Fair value estimates from five Simply Wall St Community members span US$3.76 to over US$32.90 per share, with most clustered at the lower end. With ongoing reliance on a few large customers remaining a principal risk, these diverse perspectives highlight how widely opinions differ on Ribbon’s outlook and whether market challenges have been fully priced in.

Explore 5 other fair value estimates on Ribbon Communications - why the stock might be worth just $3.76!

Build Your Own Ribbon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ribbon Communications research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ribbon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ribbon Communications' overall financial health at a glance.

No Opportunity In Ribbon Communications?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBBN

Ribbon Communications

Provides communications technology in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)