- United States

- /

- Banks

- /

- NYSE:EQBK

Insider Buying Highlights 3 Top Undervalued Small Caps On US

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a significant 25% rise over the past 12 months with earnings forecast to grow by 15% annually. In this environment, identifying stocks that are potentially undervalued can be crucial for investors seeking opportunities, especially when insider buying suggests confidence in these small-cap companies' future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.0x | 49.33% | ★★★★★☆ |

| German American Bancorp | 14.3x | 4.7x | 49.44% | ★★★★☆☆ |

| Quanex Building Products | 33.9x | 0.9x | 37.57% | ★★★★☆☆ |

| First United | 13.2x | 3.0x | 46.49% | ★★★★☆☆ |

| Franklin Financial Services | 10.4x | 2.1x | 32.98% | ★★★★☆☆ |

| Innovex International | 9.3x | 2.2x | 46.71% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.8x | 10.40% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.3x | -159.43% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -91.22% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -58.05% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

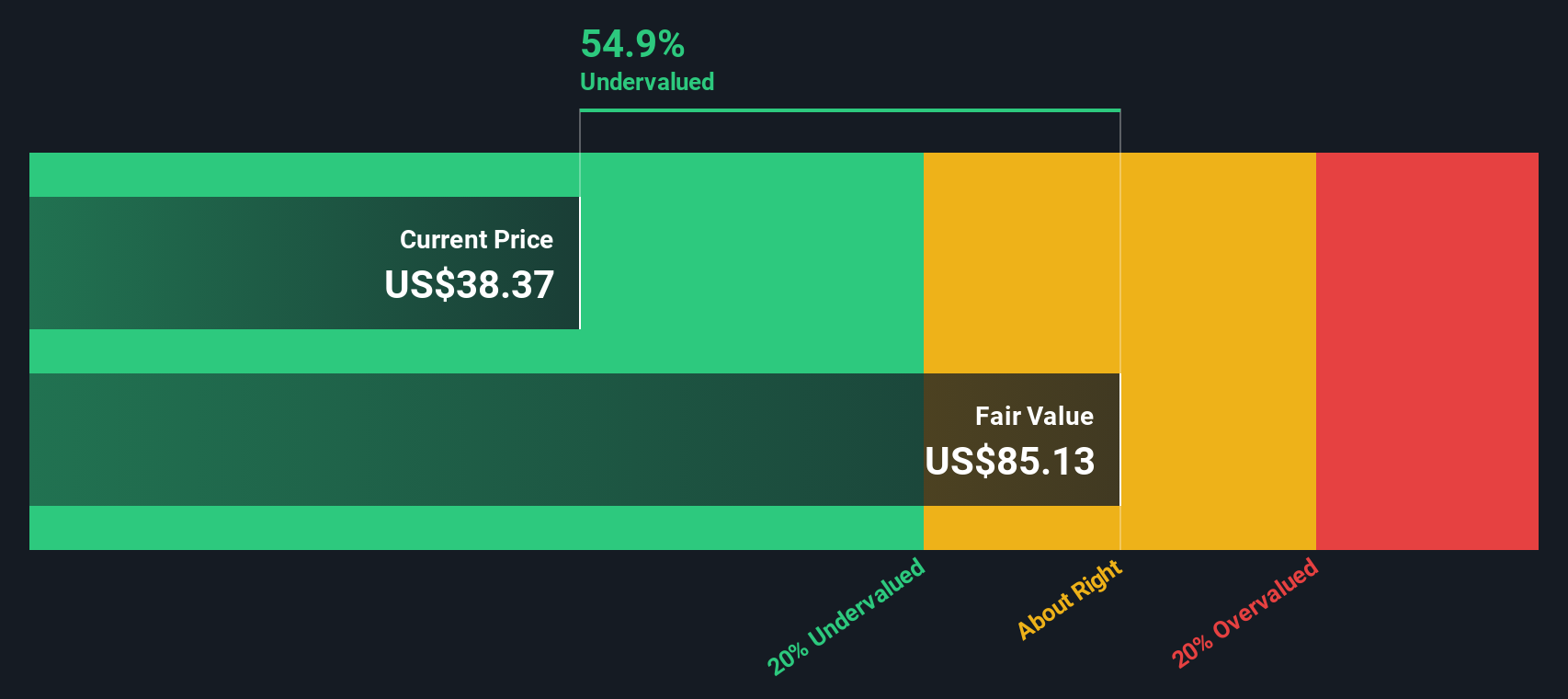

OneWater Marine (NasdaqGM:ONEW)

Simply Wall St Value Rating: ★★★★★★

Overview: OneWater Marine operates as a premier marine retailer specializing in the sale of new and pre-owned recreational boats, related marine products, and services, with a market cap of approximately $0.46 billion.

Operations: The company's revenue is primarily derived from its dealerships and distribution segments, with a notable contribution of $1.62 billion and $156.06 million respectively. Over recent periods, the gross profit margin has shown a declining trend, moving from 31.75% to 24.71%. Operating expenses include significant allocations towards general and administrative costs, which have consistently been the largest portion of expenses over time.

PE: -42.0x

OneWater Marine, a small-cap player in the marine industry, has shown insider confidence with share purchases over recent periods. Despite a decrease in revenue to US$1.77 billion for the year ending September 2024, net losses narrowed significantly to US$5.71 million from US$38.59 million previously. The company adjusted its credit agreements and financing terms, indicating proactive financial management amid challenging conditions. Looking ahead, it forecasts revenue between US$1.7 billion and US$1.85 billion for fiscal 2025 despite some anticipated headwinds from recent hurricanes.

- Get an in-depth perspective on OneWater Marine's performance by reading our valuation report here.

Examine OneWater Marine's past performance report to understand how it has performed in the past.

CPI Card Group (NasdaqGM:PMTS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CPI Card Group is a company that specializes in providing payment card solutions, including prepaid debit and debit and credit cards, with a market capitalization of approximately $0.55 billion.

Operations: The company generates revenue primarily from its Debit and Credit segment, followed by the Prepaid Debit segment. Over recent periods, the gross profit margin has shown fluctuations, with a notable figure of 41.33% in mid-2021. Operating expenses have varied but remain a significant component of overall costs, impacting net income margins across different quarters.

PE: 21.8x

CPI Card Group, a smaller U.S. company, has caught attention with its recent insider confidence as they purchased shares over the past year. Despite facing challenges like negative shareholder equity and reliance on external borrowing, the company is actively pursuing acquisitions and strategic investments to strengthen its position. Recent earnings showed $124.75 million in Q3 revenue but a dip in net income to $1.29 million from last year's $3.86 million, prompting revised guidance for modest sales growth this year.

- Take a closer look at CPI Card Group's potential here in our valuation report.

Evaluate CPI Card Group's historical performance by accessing our past performance report.

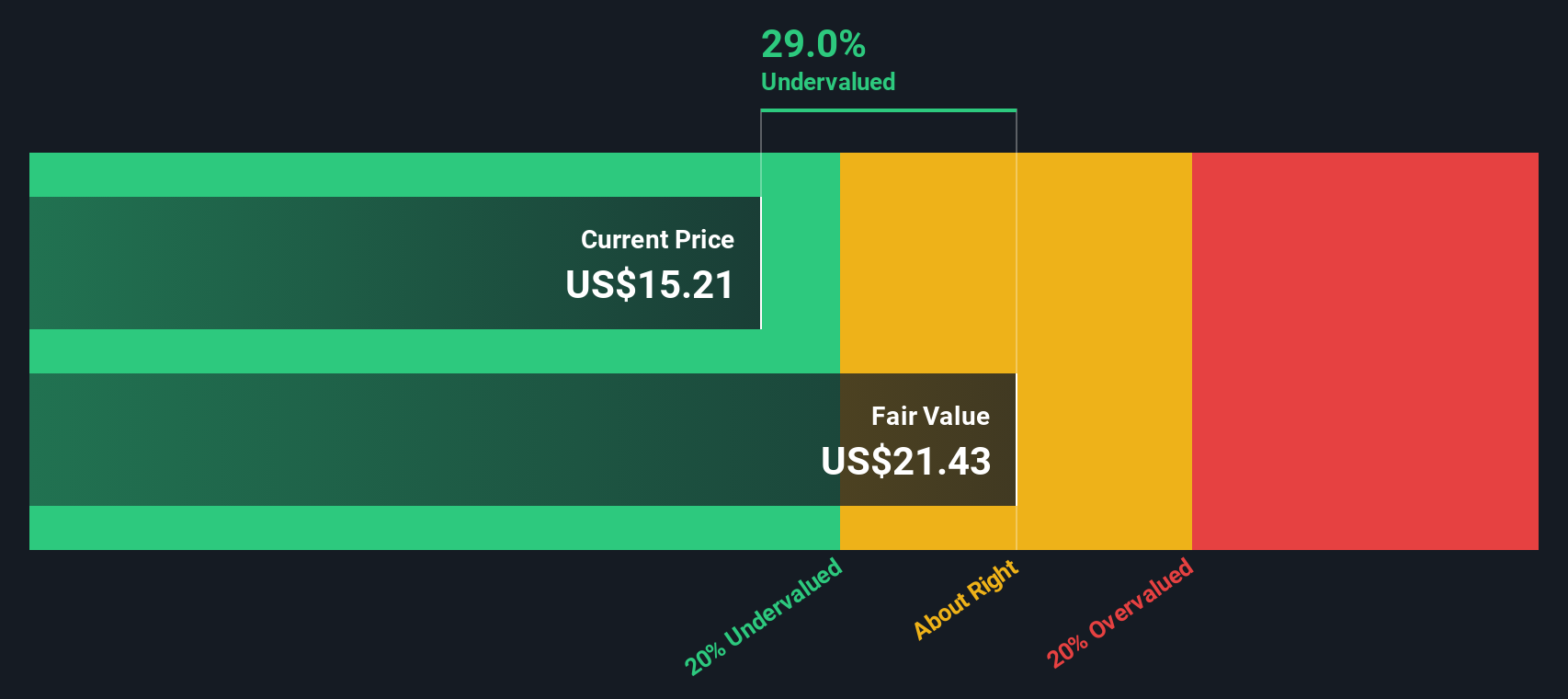

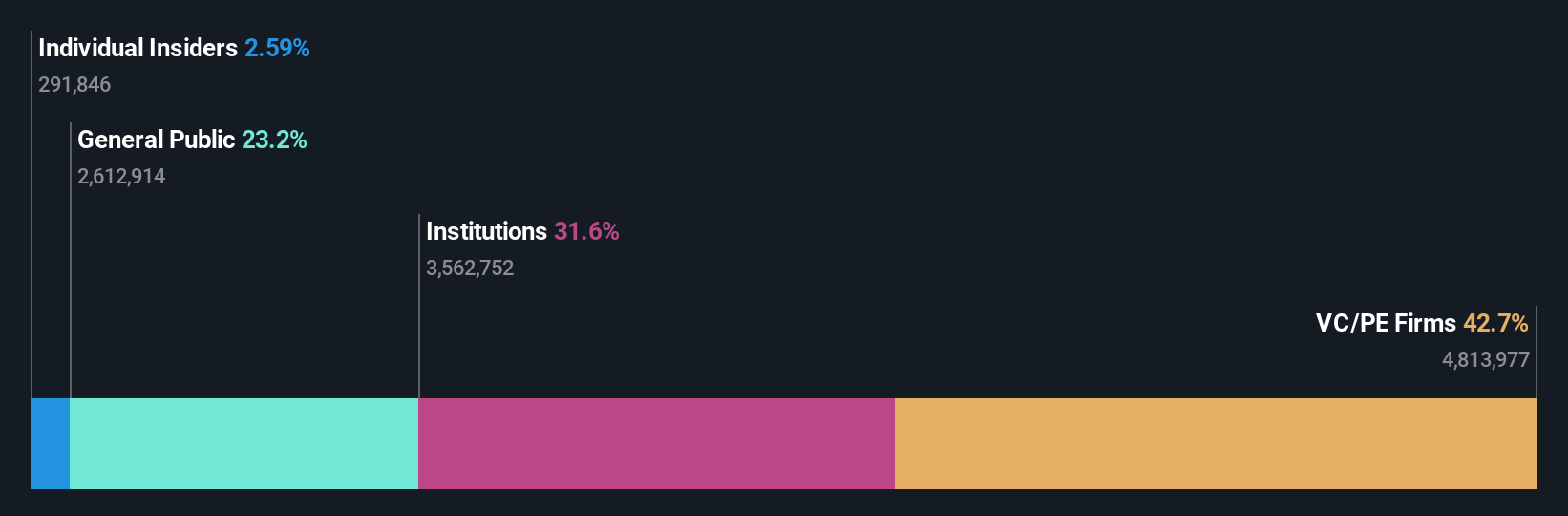

Equity Bancshares (NYSE:EQBK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Equity Bancshares is a financial services company primarily engaged in banking operations, with a focus on providing various banking products and services.

Operations: The primary revenue stream is derived from its banking operations, with a recent quarter showing revenue of $157.76 million. Operating expenses have been significant, reaching $138.00 million in the same period. The net income margin has shown variability, most recently recorded at 10.99%.

PE: 43.1x

Equity Bancshares, a smaller player in the financial sector, is making strategic moves with its recent $80 million equity offering aimed at fueling growth through acquisitions and organic expansion. Despite a dip in profit margins from 24.8% to 11%, insider confidence is evident as insiders have been purchasing shares over the past year. The company's dividend affirmation of US$0.15 per share further underscores its commitment to shareholder returns while positioning for potential future growth opportunities.

- Click to explore a detailed breakdown of our findings in Equity Bancshares' valuation report.

Understand Equity Bancshares' track record by examining our Past report.

Taking Advantage

- Reveal the 45 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQBK

Equity Bancshares

Operates as the bank holding company for Equity Bank that provides a range of banking, mortgage banking, and financial services to individual and corporate customers.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives