- United States

- /

- Aerospace & Defense

- /

- OTCPK:DUKR

Discovering US Penny Stocks In February 2025

Reviewed by Simply Wall St

The U.S. stock market recently experienced a significant downturn, with major indices like the Dow Jones and Nasdaq Composite suffering their largest weekly losses in months. Amid this broader market volatility, investors may find themselves exploring alternative avenues for growth, such as penny stocks. Although often associated with smaller or newer companies, penny stocks can still offer substantial opportunities when backed by strong financials and solid fundamentals. In this article, we explore three promising penny stocks that stand out due to their balance sheet strength and potential for impressive returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.54M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86403 | $6.28M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.73 | $392.77M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2799 | $10.3M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.73 | $82.81M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $47.52M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.86 | $77.35M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.14 | $155.17M | ★★★★★☆ |

Click here to see the full list of 721 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

One Stop Systems (NasdaqCM:OSS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: One Stop Systems, Inc. designs, manufactures, and markets high-performance computing and storage hardware and software for edge deployments globally, with a market cap of $82.77 million.

Operations: The company's revenue is divided into two segments: Bressner, generating $28.79 million, and the combined operations of One Stop Systems, Inc. and Concept Development Inc., contributing $23.92 million.

Market Cap: $82.77M

One Stop Systems, Inc. has secured significant contract renewals with the U.S. Department of Defense, including a $4 million contract for the P-8A Poseidon Aircraft and a $2 million renewal for the Virginia Class Submarine, enhancing its revenue outlook. Despite being unprofitable and experiencing high share price volatility, OSS maintains a strong cash position with assets exceeding liabilities and reduced debt levels over five years. The company is poised for revenue growth at 9.47% annually but remains challenged by an inexperienced management team and board while not expected to achieve profitability in the near term.

- Click to explore a detailed breakdown of our findings in One Stop Systems' financial health report.

- Review our growth performance report to gain insights into One Stop Systems' future.

MacroGenics (NasdaqGS:MGNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MacroGenics, Inc. is a biopharmaceutical company that focuses on developing, manufacturing, and commercializing antibody-based therapeutics for cancer treatment in the United States with a market cap of $173.23 million.

Operations: The company's revenue segment is primarily derived from developing and commercializing monoclonal antibody-based therapeutics, generating $141.33 million.

Market Cap: $173.23M

MacroGenics, Inc. presents an interesting case within the penny stock landscape due to its focus on antibody-based cancer therapeutics, generating US$141.33 million in revenue. Despite being unprofitable with a negative return on equity and earnings forecasted to decline by 13.1% annually over the next three years, it remains debt-free and has a seasoned management team with an average tenure of 7.7 years. The company boasts sufficient cash runway for more than three years based on current free cash flow, although profitability is not anticipated soon, offering both potential and risk for investors seeking exposure in biotech innovation.

- Dive into the specifics of MacroGenics here with our thorough balance sheet health report.

- Learn about MacroGenics' future growth trajectory here.

DUKE Robotics (OTCPK:DUKR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DUKE Robotics Corp. is a robotics company operating in Israel and Europe, with a market cap of $14.64 million.

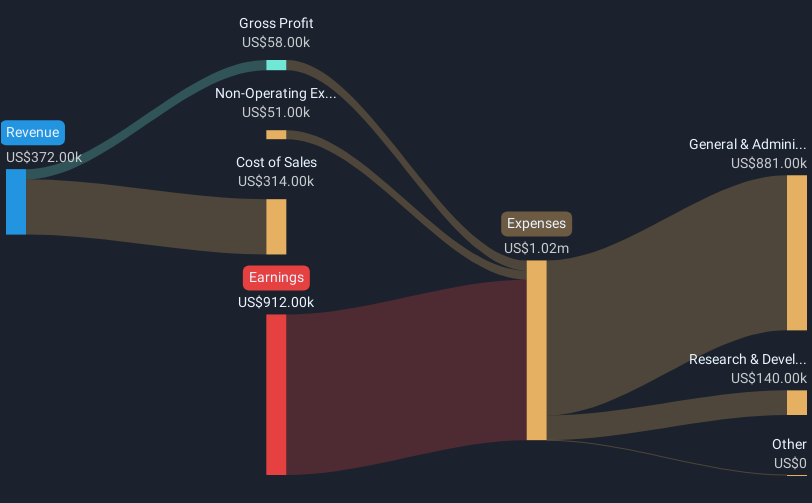

Operations: DUKE Robotics Corp. has not reported any specific revenue segments.

Market Cap: $14.64M

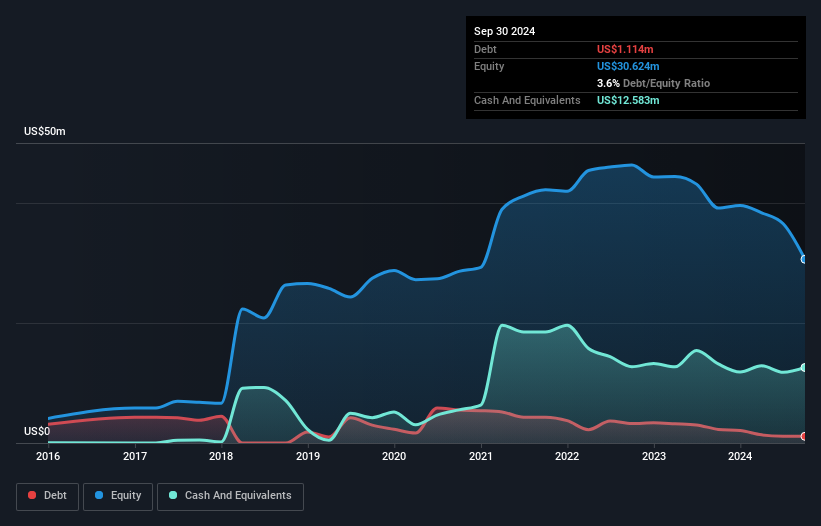

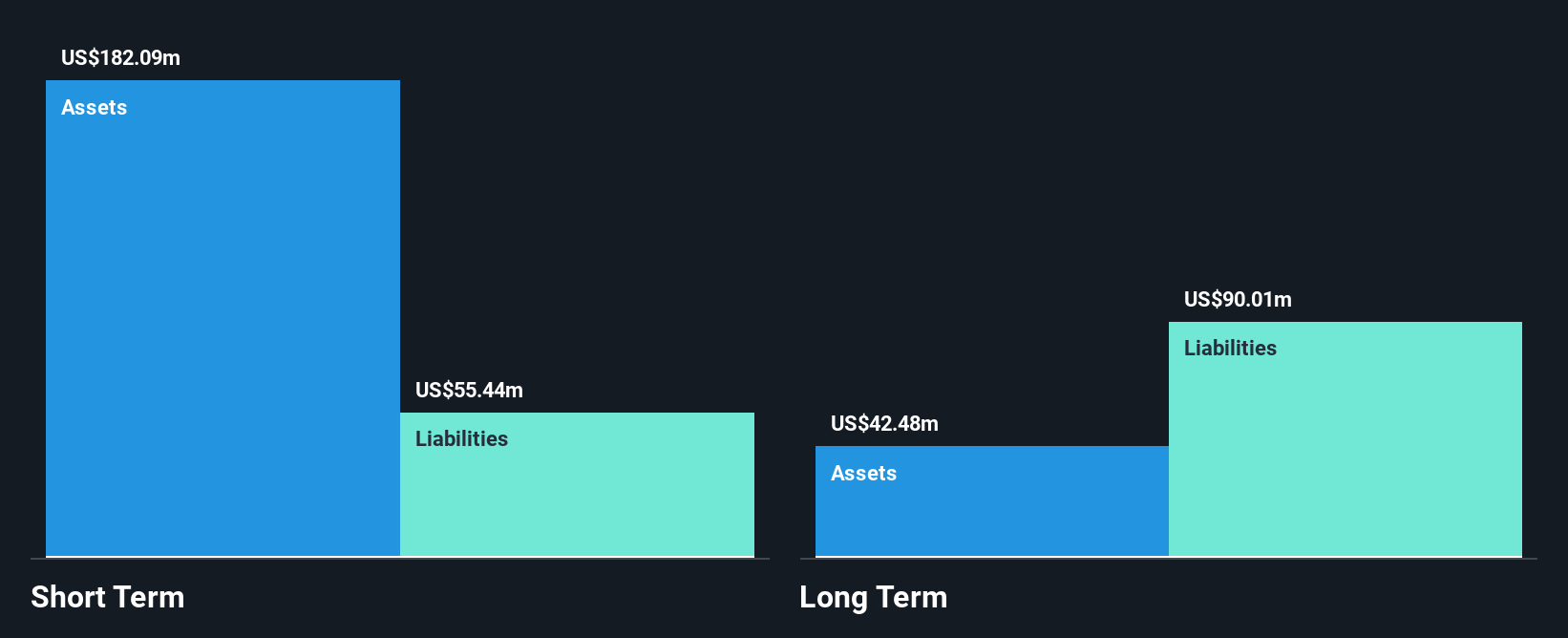

DUKE Robotics Corp. operates as a pre-revenue entity with less than US$1 million in revenue, focusing on its IC Drone technology for utility maintenance. The company recently expanded into Greece, establishing a subsidiary to leverage the country's infrastructure development and substantial EU funding for energy projects. Despite high volatility and negative return on equity, DUKE's short-term assets cover both its short- and long-term liabilities, indicating financial stability. Its management team is experienced with improved shareholder equity over five years. With sufficient cash runway for 1.4 years, DUKE aims to capitalize on global expansion opportunities in the civilian sector.

- Navigate through the intricacies of DUKE Robotics with our comprehensive balance sheet health report here.

- Examine DUKE Robotics' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Dive into all 721 of the US Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DUKE Robotics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DUKR

DUKE Robotics

Operates as a robotics company in Israel and the United States.

Flawless balance sheet low.

Market Insights

Community Narratives