- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Could Ondas Holdings' (ONDS) Defense Pivot Reveal a New Path for Long-Term Institutional Growth?

Reviewed by Sasha Jovanovic

- Ondas Holdings recently made a series of announcements, including welcoming Brigadier General Patrick Huston (ret.) to the Ondas Autonomous Systems Advisory Board, placing an initial order of 500 NDAA-compliant Wasp drones from Rift Dynamics for U.S. defense distribution, making a strategic investment in Kopin Corporation to advance MicroLED and AI display technologies, and being added to the S&P Global BMI Index.

- These developments highlight Ondas Holdings’ intensified focus on defense technology and its efforts to expand influence within institutional investor circles and government procurement channels.

- We'll explore how the appointment of a decorated defense advisor could influence Ondas Holdings' investment narrative and future opportunities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ondas Holdings Investment Narrative Recap

To be a shareholder in Ondas Holdings right now, you need to see long-term value in its focus on autonomous systems for defense and believe the company can capture substantial contracts and drive high-revenue growth, especially from its Ondas Autonomous Systems unit. The recent addition of Brigadier General Patrick Huston to the Advisory Board adds leadership credibility and regulatory insight, but does not fundamentally shift the key short-term catalyst: accelerating contract wins and revenue ramp in defense and homeland security. The biggest risk remains whether actual revenues will scale quickly enough to offset the company’s high operating losses and debt obligations; these announcements do not materially change this central concern.

Of the recent announcements, Ondas’ initial order for 500 NDAA-compliant Wasp drones from Rift Dynamics stands out as closely tied to the core catalyst of expanding its defense presence. The ability to ramp manufacturing for large, recurring government orders directly impacts whether the company’s expanded defense footprint can translate into meaningful revenue gains, something investors are closely watching given the forecasted growth from defense contracts.

However, investors should also be aware that volatility in gross margins, as platform adoption and customer mix continue to shift, could result in swings to profitability that...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings' outlook projects $151.6 million in revenue and $16.3 million in earnings by 2028. This scenario requires a 141.1% annual revenue growth and an earnings increase of $63.2 million from the current earnings of -$46.9 million.

Uncover how Ondas Holdings' forecasts yield a $5.90 fair value, a 36% downside to its current price.

Exploring Other Perspectives

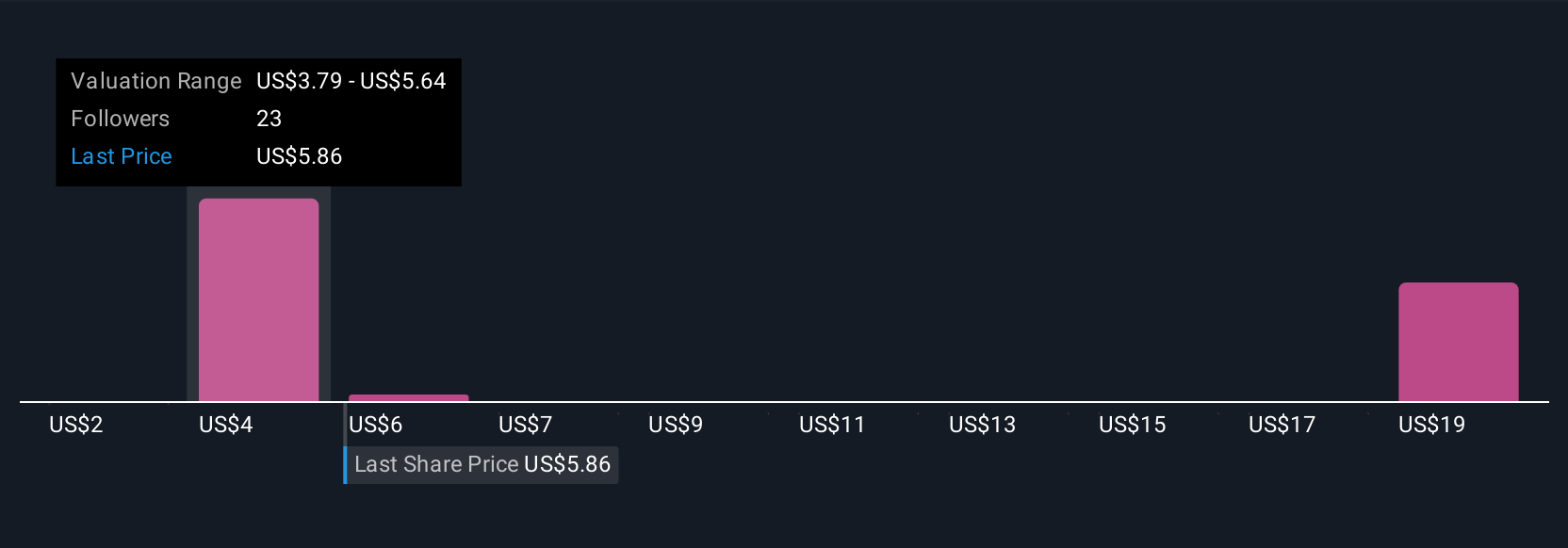

Ten members of the Simply Wall St Community estimate Ondas Holdings’ fair value between US$1.03 and US$16.20, reflecting broad differences in outlook. In the context of Ondas’ need to scale revenues quickly to cover high operating expenses, consider how varying expectations around defense contract momentum could shape future valuations.

Explore 10 other fair value estimates on Ondas Holdings - why the stock might be worth less than half the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)