- United States

- /

- Communications

- /

- NasdaqCM:LTRX

Lantronix And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with major indices like the S&P 500 reaching record highs, investors are increasingly exploring diverse investment avenues. Penny stocks, often associated with smaller or newer companies, remain a relevant area of interest despite their somewhat outdated label. These stocks can offer unique growth opportunities at lower price points, particularly when supported by strong financial fundamentals and resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88224 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $4.00 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.75 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2998 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.41 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.25 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9174 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lantronix (NasdaqCM:LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. develops, markets, and sells industrial and enterprise IoT products and services across multiple regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific Japan with a market cap of $135.05 million.

Operations: Lantronix generates revenue of $161.72 million from its Computer Networks segment.

Market Cap: $135.05M

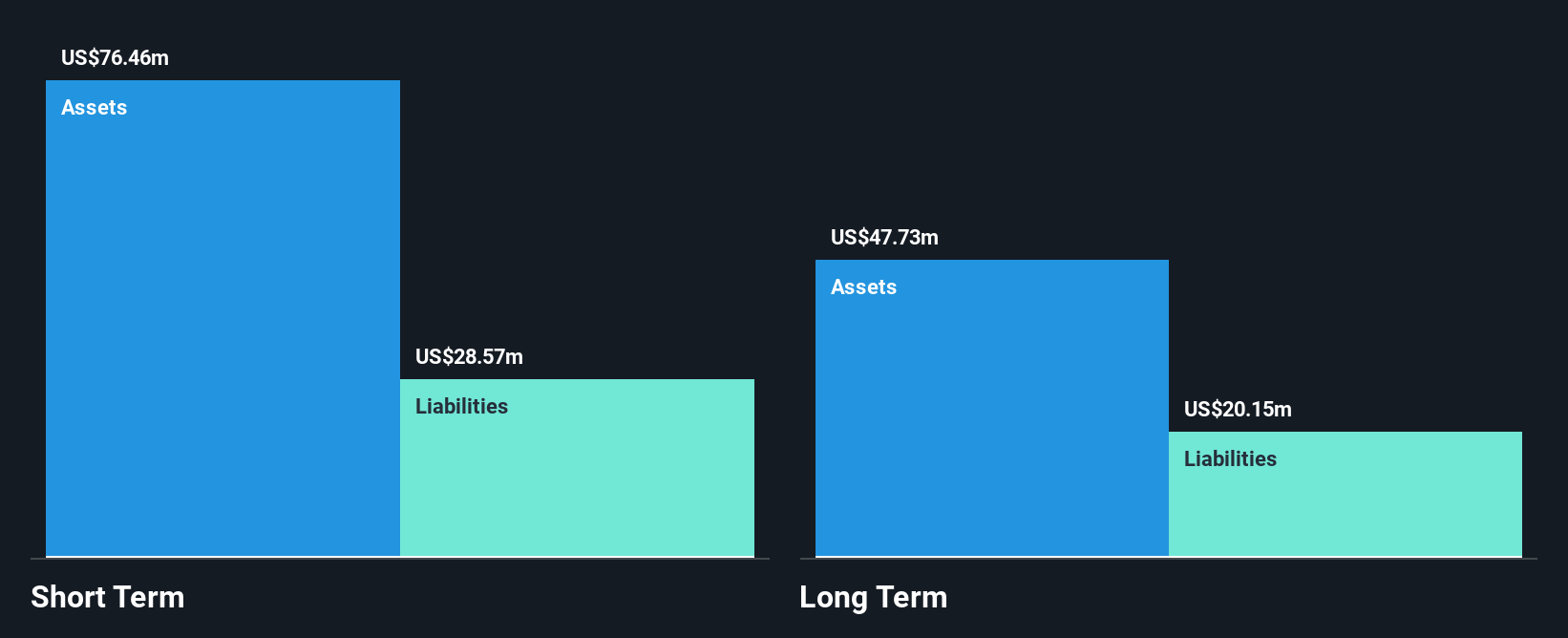

Lantronix is navigating the penny stock landscape with a focus on Industrial IoT, recently appointing Daniel Quant as head of the IIoT division to integrate AI into its products. Despite being unprofitable, Lantronix has reduced losses over five years and maintains a positive cash flow with runway for over three years. The company reported first-quarter sales of US$34.42 million but sustained a net loss of US$2.5 million. Its short-term assets exceed liabilities, and it trades below estimated fair value, suggesting potential for growth despite high volatility and management's brief tenure.

- Click here to discover the nuances of Lantronix with our detailed analytical financial health report.

- Understand Lantronix's earnings outlook by examining our growth report.

Nano Dimension (NasdaqCM:NNDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nano Dimension Ltd. provides additive manufacturing solutions both in Israel and internationally, with a market cap of approximately $510.82 million.

Operations: The company generates revenue from its Printers & Related Products segment, which amounts to $57.66 million.

Market Cap: $510.82M

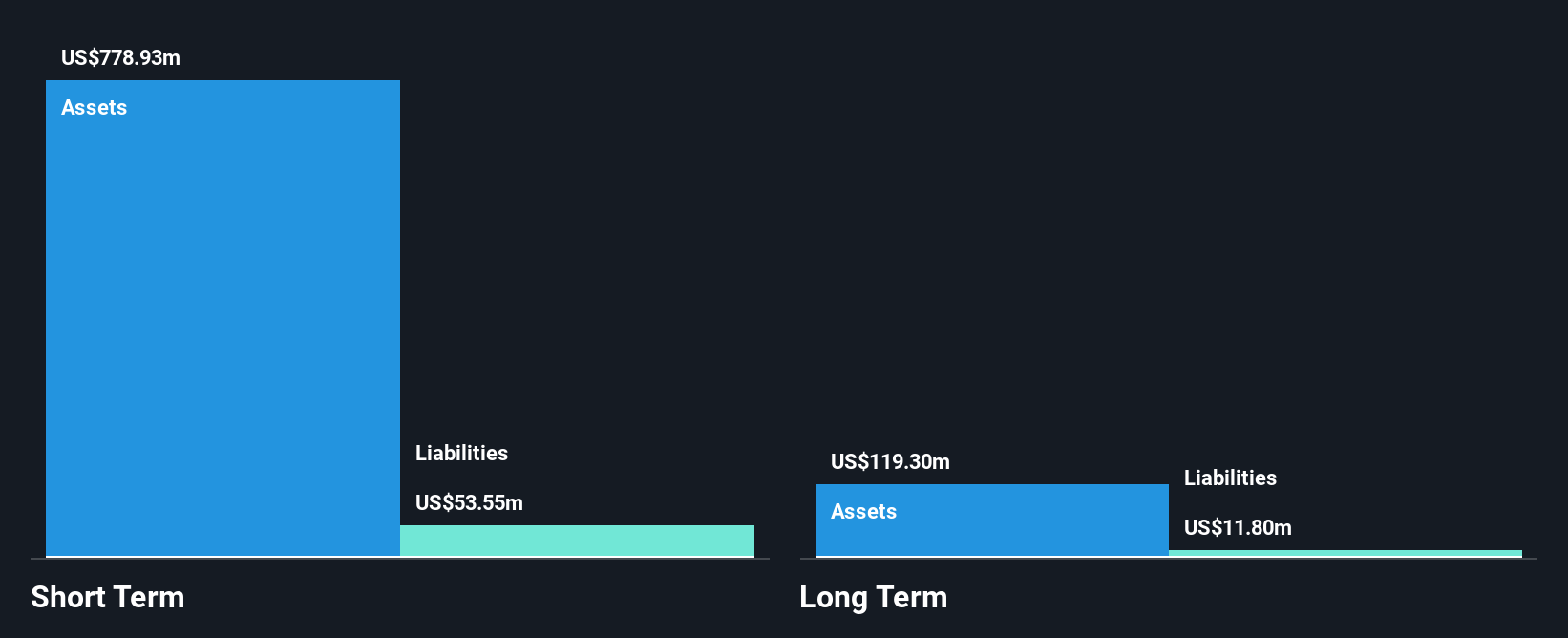

Nano Dimension, with a market cap of approximately US$510.82 million, faces challenges typical in the penny stock realm. The company is unprofitable and has experienced increased losses over the past five years, despite generating US$57.66 million in revenue from its Printers & Related Products segment. Nano Dimension's substantial short-term assets of US$797.6 million comfortably cover both short and long-term liabilities, providing a solid cash runway for over three years even if cash flow decreases at historical rates. Recent leadership changes and ongoing legal disputes with Desktop Metal could impact strategic direction and investor confidence moving forward.

- Unlock comprehensive insights into our analysis of Nano Dimension stock in this financial health report.

- Understand Nano Dimension's track record by examining our performance history report.

PLAYSTUDIOS (NasdaqGM:MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms both in the United States and internationally, with a market cap of $220.69 million.

Operations: The company's revenue is primarily derived from its Playgames segment, which generated $298.75 million, while the Playawards segment contributed a minimal $0.005 million.

Market Cap: $220.69M

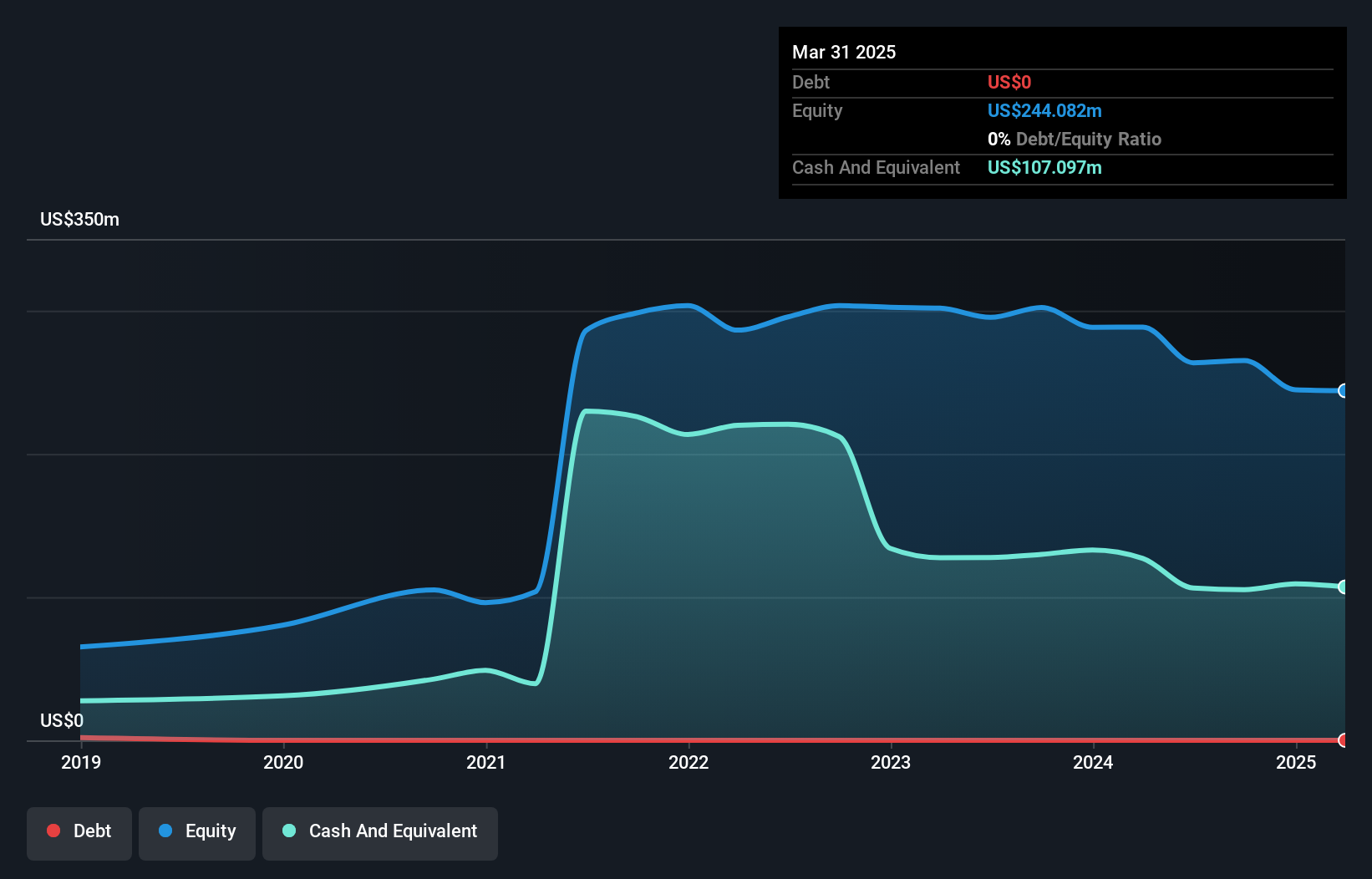

PLAYSTUDIOS, Inc., with a market cap of US$220.69 million, operates in the challenging penny stock sector, facing profitability issues despite generating US$298.75 million from its Playgames segment. The company reported a net loss of US$3.1 million for Q3 2024 and has seen increased losses over five years at an annual rate of 63.5%. However, PLAYSTUDIOS is debt-free and maintains a robust cash position with short-term assets exceeding liabilities significantly, ensuring a cash runway for over three years even if free cash flow decreases slightly annually. Its experienced management team supports strategic stability amidst these challenges.

- Take a closer look at PLAYSTUDIOS' potential here in our financial health report.

- Evaluate PLAYSTUDIOS' prospects by accessing our earnings growth report.

Key Takeaways

- Discover the full array of 709 US Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LTRX

Lantronix

Develops, markets, and sells industrial and enterprise internet of things (IoT) products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific Japan.

Excellent balance sheet with concerning outlook.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion