- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LPTH

LightPath Technologies, Inc. (NASDAQ:LPTH) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

LightPath Technologies, Inc. (NASDAQ:LPTH) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 52% in the last year.

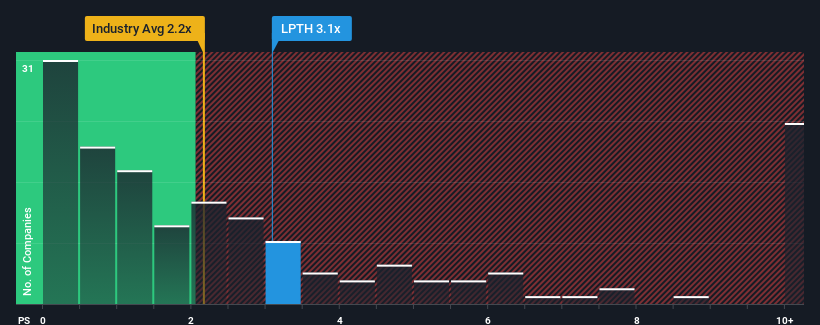

Although its price has dipped substantially, you could still be forgiven for thinking LightPath Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.1x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for LightPath Technologies

How LightPath Technologies Has Been Performing

While the industry has experienced revenue growth lately, LightPath Technologies' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think LightPath Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like LightPath Technologies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 14% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 43% over the next year. With the industry only predicted to deliver 9.8%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that LightPath Technologies' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does LightPath Technologies' P/S Mean For Investors?

There's still some elevation in LightPath Technologies' P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that LightPath Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for LightPath Technologies (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on LightPath Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LPTH

LightPath Technologies

Designs, develops, manufactures, and distributes optical systems and assemblies in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion