- United States

- /

- Commercial Services

- /

- NYSE:SCS

Undiscovered Gems in the US Market April 2025

Reviewed by Simply Wall St

In the midst of a volatile U.S. market, where major indices like the Dow Jones and S&P 500 have experienced mixed results due to tariff uncertainties, investors are keeping a close eye on small-cap stocks that often fly under the radar. As economic indicators continue to shape broader market sentiment, identifying promising small-cap companies can offer unique opportunities for growth in an unpredictable landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.17% | 5.42% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products across several countries including Israel, Brazil, Argentina, Colombia, Mexico, Ecuador, and the United States with a market cap of $687.92 million.

Operations: With a market cap of $687.92 million, Ituran Location and Control Ltd. generates revenue primarily from telematics services, contributing $242.49 million, and telematics products at $93.77 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Ituran Location and Control, a small cap player in vehicle telematics, is showing promising signs of growth. The company has been growing earnings at 34% annually over the past five years and maintains high-quality earnings. With more cash than total debt, Ituran's financial health seems robust. Recent partnerships with OEMs could drive subscriber growth by up to 200,000 in 2025, particularly in South America and Israel's motorcycle segment. Despite currency volatility risks and lower-margin contracts potentially affecting profitability, analysts project revenue growth of 6.7% annually with profit margins increasing from 16% to 16.7%.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc., through its subsidiaries, offers investment advisory services in the United States and has a market capitalization of approximately $732.72 million.

Operations: Associated Capital Group generates revenue primarily from investment advisory and asset management services, totaling $13.18 million.

Associated Capital Group, a financial services firm, is showing signs of potential with its price-to-earnings ratio at 16.8x, lower than the industry average of 23.9x. Over the last five years, earnings have grown by 6.6% annually despite a recent large one-off gain of US$42.8 million impacting results for December 2024. The company remains debt-free and has been actively repurchasing shares, completing a significant buyback program by acquiring over 2.61 million shares for US$90.68 million since December 2015. Leadership changes are underway with Douglas R. Jamieson retiring as CEO in March 2025 while Patrick Huvane steps in as interim CEO.

Steelcase (NYSE:SCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Steelcase Inc. is a company that offers a range of furniture and architectural products and services both in the United States and internationally, with a market cap of approximately $1.12 billion.

Operations: Steelcase generates revenue primarily from its Americas segment, contributing $2.47 billion, and its International segment, adding $700.80 million.

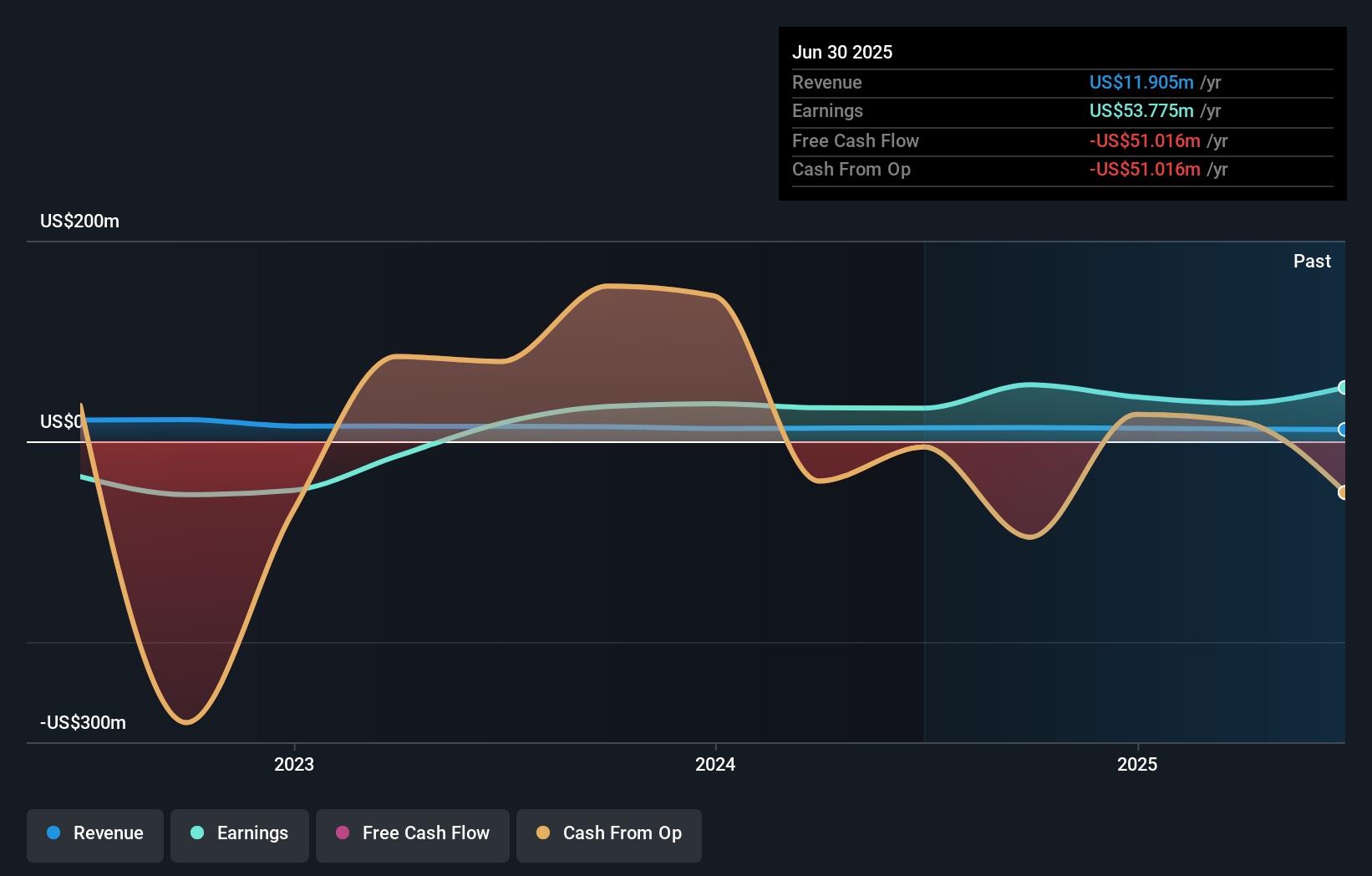

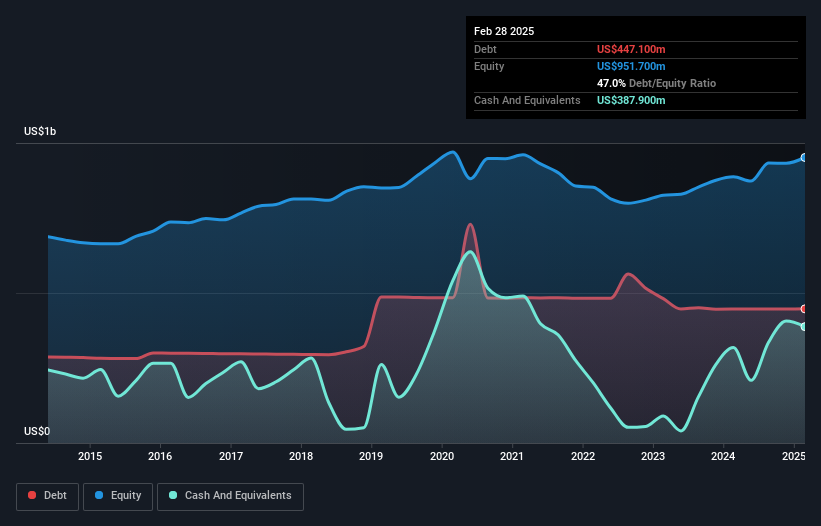

Steelcase, a notable player in the office furniture industry, has shown promising growth with earnings rising 48.7% over the past year, outpacing the sector's average of 4.6%. Its net debt to equity ratio stands at a satisfactory 6.2%, indicating manageable leverage. The company’s interest payments are well covered by EBIT at 9.4 times, reflecting strong financial health. Recent buybacks saw Steelcase repurchase approximately 1.84% of shares for $26.5 million, enhancing shareholder value amidst trading at an estimated 51% below fair value—suggesting potential upside from its current valuation around US$9.62 per share.

Next Steps

- Investigate our full lineup of 289 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Steelcase, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCS

Steelcase

Provides a portfolio of furniture and architectural products and services in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives