- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Ituran Location and Control (NASDAQ:ITRN) Has Announced A Dividend Of $0.15

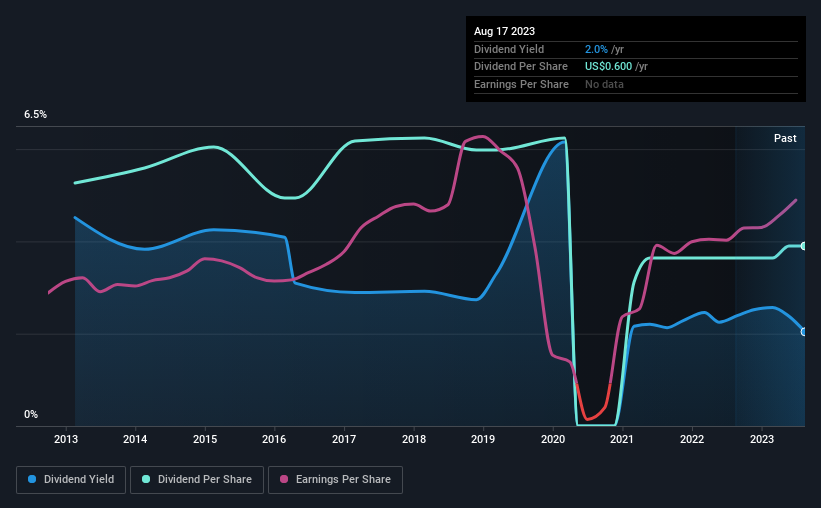

Ituran Location and Control Ltd.'s (NASDAQ:ITRN) investors are due to receive a payment of $0.15 per share on 11th of October. This means the annual payment will be 2.0% of the current stock price, which is lower than the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Ituran Location and Control's stock price has increased by 33% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Ituran Location and Control

Ituran Location and Control's Payment Has Solid Earnings Coverage

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, Ituran Location and Control's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 12.1%. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the annual payment back then was $0.81, compared to the most recent full-year payment of $0.60. This works out to be a decline of approximately 3.0% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Ituran Location and Control May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. However, Ituran Location and Control's EPS was effectively flat over the past five years, which could stop the company from paying more every year. If Ituran Location and Control is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

In Summary

Overall, a consistent dividend is a good thing, and we think that Ituran Location and Control has the ability to continue this into the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Ituran Location and Control has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITRN

Ituran Location and Control

Provides location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)