- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

A Fresh Look at Itron (ITRI) Valuation Following New Smart Lighting and Utilities Partnerships

Reviewed by Kshitija Bhandaru

There’s been a surge of interest around Itron (ITRI) following its fresh joint marketing agreement with Current Lighting Solutions to roll out smarter, more efficient streetlights for cities and utilities. The partnership focuses on integrating Itron’s intelligent management controls with Current’s advanced LED luminaires, a combination city planners hope will boost safety and slash energy costs. On top of that, Itron just announced a major deal with the American Samoa Power Authority, bringing its smart metering and grid solutions to one of the most remote territories in the Pacific, making waves far beyond its usual markets.

These moves come at a time when Itron's stock is already in growth mode, up 17% over the past year and showing a solid 15% gain year-to-date. Three- and five-year total returns point to strong momentum, and recent partnerships suggest the company is positioned to ride the infrastructure modernization trend. The new alliances with Current and American Samoa highlight both Itron’s innovation and its growing presence in utility technology, even as price action in the past month has leveled out a bit.

So after this year’s impressive run, is Itron trading at a rare discount, or has the market already baked in all that future growth?

Most Popular Narrative: 13.4% Undervalued

The most widely followed narrative sees Itron as notably undervalued. This view is based on rising profit margins, a lower anticipated P/E, and expectations for strong future growth driven by structural changes and global demand.

Ongoing industry-wide digitalization and increased adoption of IoT by utilities are driving higher uptake of Itron's Outcomes (software and analytics) offerings. These offerings have higher margins and boost recurring revenue, supporting continued net margin and earnings expansion.

Want to uncover what’s fueling this bullish outlook? The narrative’s fair value is anchored on ambitious profit expansion and bold valuation assumptions that you might not expect outside of top growth tech stocks. Curious how much future growth and earnings power analysts are including in their target? Discover the numbers that shape this surprisingly optimistic price estimate.

Result: Fair Value of $144.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory delays and slower smart grid project rollouts could hamper Itron’s growth and potentially test the optimism behind that bullish valuation target.

Find out about the key risks to this Itron narrative.Another View: What Does Our DCF Model Say?

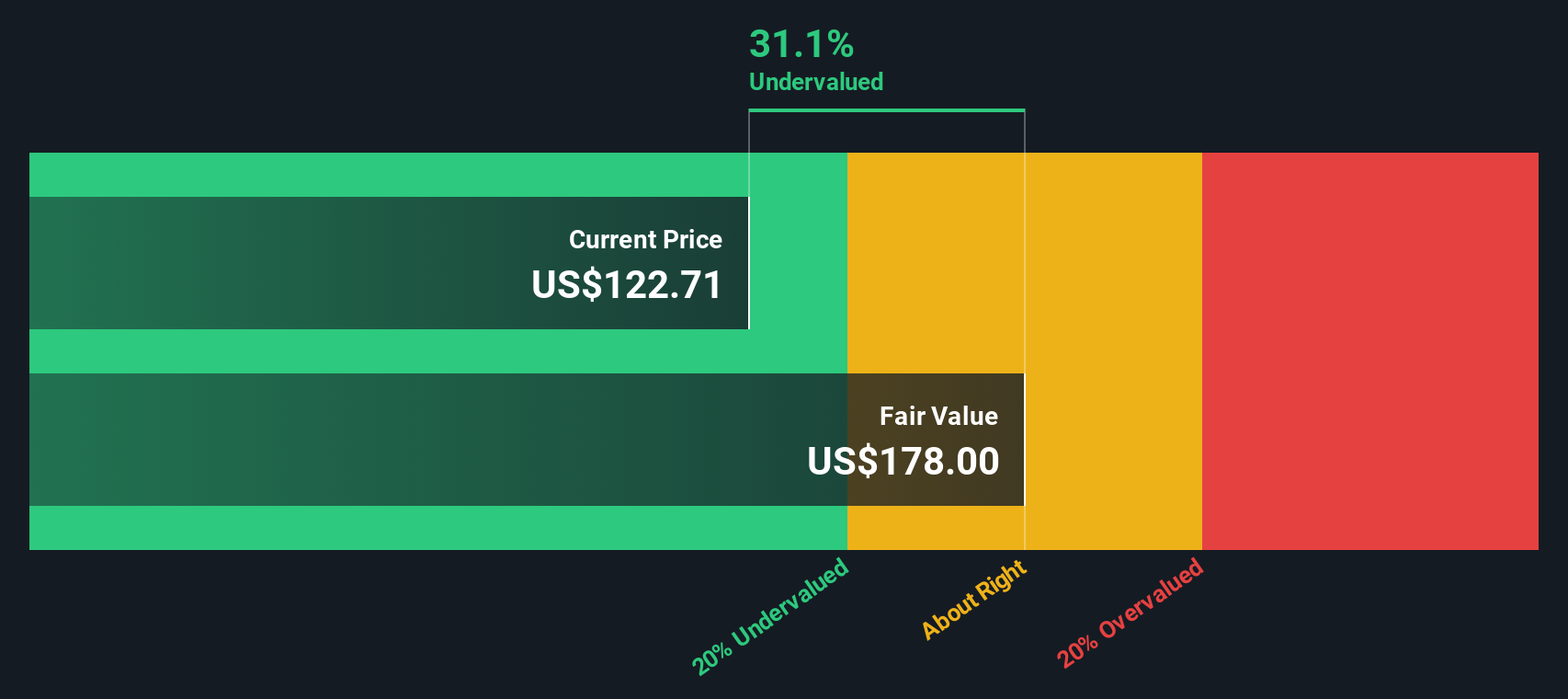

While analyst price targets point to Itron being undervalued, our SWS DCF model comes to a similar conclusion. But does this reinforce a compelling value case, or simply echo market optimism? Which view tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Itron Narrative

If you see things differently or simply want to dig into the numbers on your own terms, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Itron research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities are everywhere, but only those who act quickly get the best picks. Don’t let the next breakout stock pass you by when you can easily access fresh ideas tailored to your interests with these handpicked solutions:

- Uncover overlooked bargains by tapping into undervalued stocks based on cash flows, where underestimated companies may hold tomorrow’s biggest gains.

- Ride the AI wave by chasing growth stories linked to AI penny stocks, featuring businesses fueling the technology that is changing industries.

- Boost your portfolio’s cash flow with dividend stocks with yields > 3%, connecting you directly to companies offering steady yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives