- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

IPG Photonics (IPGP): Assessing Valuation After Strong Sales and Counter-UAV Tech Launch

Reviewed by Kshitija Bhandaru

Investors are watching IPG Photonics (IPGP) closely after the company announced better-than-expected revenues, marking its first year-over-year sales increase since 2022. Alongside the strong financials, the debut of its directed energy system for counter-UAV applications stands out as an important step in the company’s strategy to unlock value in new markets. These advances are catching the attention of those weighing whether the current growth can be sustained, or if there is more to come.

This recent momentum follows a strong Q2 across semiconductor manufacturing stocks, which saw revenues outpacing consensus expectations and share prices climbing since earnings were reported. For IPG Photonics, the company’s share price is up 12% for the year and nearly 19% over the past three months, even as its longer-term returns remain under pressure from earlier years. All eyes are now on whether renewed revenue growth and innovation can spark a lasting turnaround.

With the stock’s short-term gains stacking up, many are questioning if this is a genuine buying opportunity or if the market has already factored in IPG Photonics’ growth story.

Most Popular Narrative: Fairly Valued

According to the most widely followed analyst perspective, IPG Photonics is trading close to its fair value, reflecting a balanced market outlook regarding future growth and risks.

"New growth initiatives in medical (for example, thulium lasers for urology), semiconductor, and micromachining end-markets are gaining early traction, diversifying revenue streams and supporting higher margins over time as these higher-value verticals scale. Recent product innovations like the CROSSBOW directed energy system, validated with multiple unit deliveries and key partnerships (such as Lockheed Martin), open up opportunities in defense and critical infrastructure, supporting both revenue acceleration and improved operating leverage."

What is fueling this ‘fair value’ call for IPG Photonics? The answer may surprise you. At the core are bold, future-focused financial assumptions that hint at a profit turnaround and premium valuation metrics usually reserved for industry disruptors. Want to see which aggressive growth drivers shape this calculation and why analysts see a rerating on the horizon? The full narrative exposes the underlying numbers powering this cautiously optimistic view.

Result: Fair Value of $75.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, caution remains because core demand softness or continued high R&D costs could quickly derail the growth assumptions behind the current price outlook.

Find out about the key risks to this IPG Photonics narrative.Another View: What Does Our DCF Say?

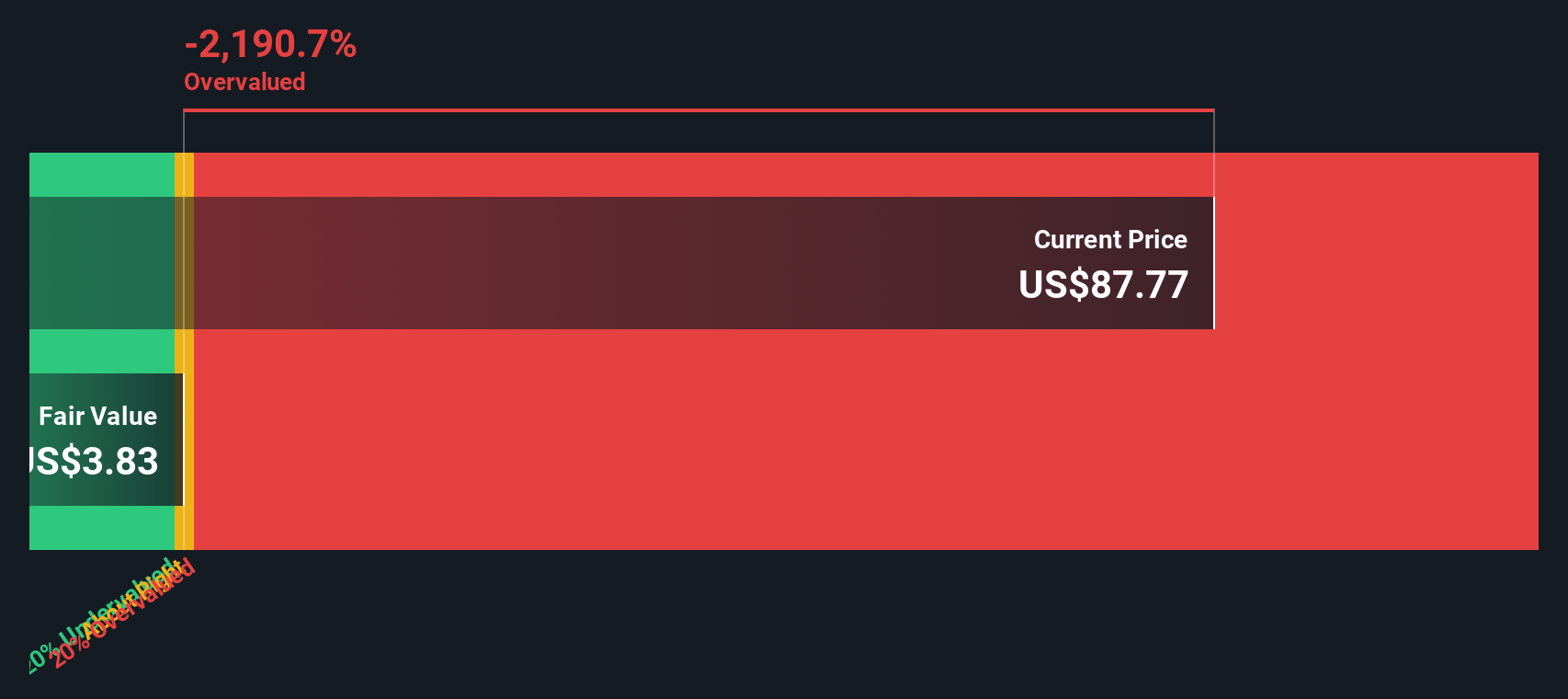

While the analyst consensus suggests IPG Photonics is fairly valued today, our DCF model presents a different perspective. It identifies the stock as overvalued based on its forecasted cash flows. Is the growth optimism built in too high?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IPG Photonics Narrative

For those who want to dig deeper and reach their own conclusions, there is plenty of room to build your own outlook using the available data. You can shape a fresh perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding IPG Photonics.

Looking for More Smart Investing Opportunities?

Why limit your strategy to just one stock? Give yourself the edge by hunting for fresh investment angles with Simply Wall Street’s powerful tools. You could spot tomorrow’s winners before the crowd does, so don’t let these ideas pass you by.

- Supercharge your search for reliable income and check out steady earners known for dividend stocks with yields > 3%. These can be ideal for building wealth through compounding payouts.

- Track exciting innovation trends and jump into the world of transformative technology with AI penny stocks as these fuel tomorrow’s AI breakthroughs.

- Unlock true market value by targeting shares priced under their fundamentals through our pick of undervalued stocks based on cash flows. This is ideal if you enjoy finding hidden gems before they attract wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives