- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

A Look at IPG Photonics (IPGP) Valuation Following CROSSBOW MINI High-Energy Laser Debut in Defense Sector

Reviewed by Simply Wall St

If you have been watching IPG Photonics (IPGP) lately, you probably caught wind of the company’s big reveal: the first public display of its CROSSBOW MINI 3 kW high-energy laser system at the DSEI UK defense expo. This is not just a new product; it is a high-profile bet on directed-energy solutions for countering drone threats. The event caught investor attention, especially since the CROSSBOW MINI system is already demonstrating real-world success and seems positioned for both immediate deployment and future growth in the defense market.

The timing of this announcement comes after a stretch of meaningful momentum for IPG Photonics’ stock. Over the past year, shares have gained nearly 33%. Recent months have also been positive, with a 22% advance in the past three months and a 10% gain just this month. While the long-term picture shows the stock still recovering from deeper declines seen over the past three and five years, the latest product news and stronger recent buying suggest investors are reevaluating IPG’s place in the rapidly evolving defense tech landscape.

With all this in mind, investors may be considering whether IPG Photonics is presenting a compelling entry point at current prices or if the market is already anticipating significant growth driven by the CROSSBOW product line.

Most Popular Narrative: 3% Overvalued

The most widely followed narrative suggests that IPG Photonics is currently trading slightly above its estimated fair value. This reflects optimism but also caution about future performance. This assessment is based on consensus expectations that consider projected growth in revenue and profit margins, along with industry and company-specific factors.

Recent product innovations such as the CROSSBOW directed energy system, validated with multiple unit deliveries and key partnerships (for example, Lockheed Martin), open up opportunities in defense and critical infrastructure. These factors support both revenue acceleration and improved operating leverage.

Curious about the numbers shaping this verdict? Hints of aggressive growth in new markets, a bold turnaround in earnings, and industry-defying profit targets fuel this price call. Want to see how these projections stack up against traditional industry standards? Discover what underpins this valuation and what makes it tick.

Result: Fair Value of $80.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing geopolitical tensions and continued weakness in core markets could derail growth expectations. These factors may serve as potential catalysts for a revised outlook.

Find out about the key risks to this IPG Photonics narrative.Another View: SWS DCF Model Offers a Different Perspective

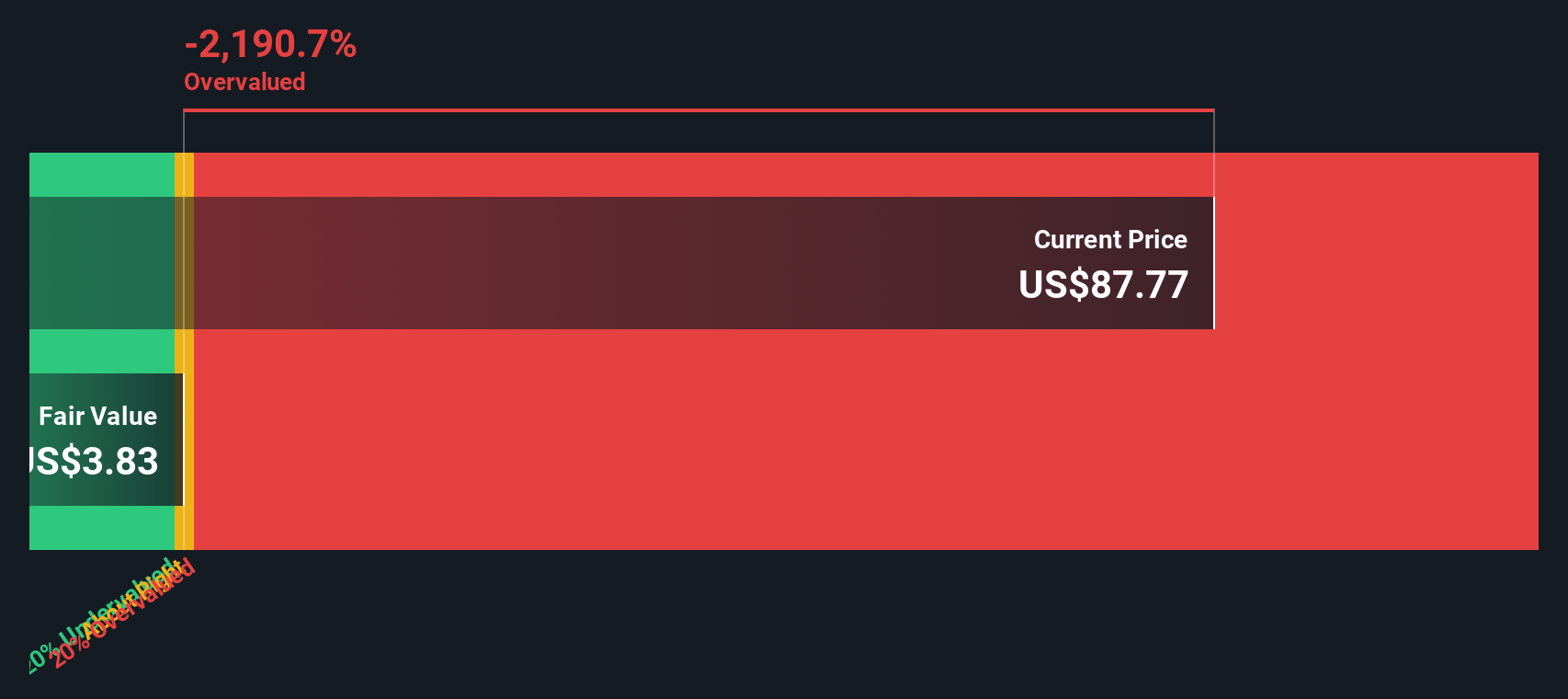

While the analyst consensus sees IPG Photonics as slightly overvalued, our DCF model paints a much starker picture, suggesting the shares could be significantly above intrinsic value. Which approach truly reflects market reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IPG Photonics Narrative

If you see the story differently or want to dig into the details on your own terms, you can craft a custom narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding IPG Photonics.

Looking for More Smart Investment Opportunities?

Don’t let your investing journey stop here. Take the lead and uncover hidden gems or market movers that others are missing. The next standout winner for your portfolio could be just a click away.

- Accelerate your search for steady income and scan the market for top-yield performers. Let dividend stocks with yields > 3% guide you to stocks rewarding their shareholders.

- Tap into innovation at the frontier of medicine by checking out healthcare AI stocks, where artificial intelligence meets healthcare breakthroughs.

- Unearth undervalued opportunities before they make headlines by starting with undervalued stocks based on cash flows for compelling stocks with strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)