- United States

- /

- Retail REITs

- /

- NYSE:BFS

3 Undervalued Small Caps With Insider Action To Consider

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months, it has experienced a notable rise of 16%, with earnings forecasted to grow by 15% annually. In this context of steady growth and potential opportunities, identifying small-cap stocks that are perceived as undervalued and have insider activity can be an intriguing strategy for investors seeking to capitalize on emerging prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 30.68% | ★★★★★★ |

| Citizens & Northern | 11.0x | 2.7x | 49.17% | ★★★★★☆ |

| Southside Bancshares | 10.5x | 3.5x | 43.33% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 36.53% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.1x | 35.18% | ★★★★★☆ |

| S&T Bancorp | 10.8x | 3.6x | 45.71% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 28.40% | ★★★★☆☆ |

| Shore Bancshares | 9.8x | 2.5x | -12.39% | ★★★☆☆☆ |

| Farmland Partners | 6.9x | 8.4x | -33.50% | ★★★☆☆☆ |

| BlueLinx Holdings | 20.5x | 0.2x | -139.25% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Harmonic (HLIT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harmonic is a company that specializes in providing video delivery and broadband solutions, with a market cap of approximately $1.37 billion.

Operations: The company generates revenue primarily from its Video and Broadband segments, with the latter contributing a larger share. Over recent periods, the gross profit margin has shown variability, reaching 55.40% in mid-2025. Operating expenses have been significant, with research and development consistently being a notable cost component.

PE: 14.8x

Harmonic, a key player in the video streaming and broadband sector, recently reported Q2 2025 earnings with revenue of US$138.03 million and net income of US$2.87 million, marking a turnaround from last year's losses. Insider confidence is evident as they repurchased 1.6 million shares between March and June 2025 for US$14 million. The company's innovative solutions like hybrid cloud streaming and advanced broadband platforms position it well for future growth despite current challenges in achieving consistent profitability.

- Get an in-depth perspective on Harmonic's performance by reading our valuation report here.

Explore historical data to track Harmonic's performance over time in our Past section.

Shore Bancshares (SHBI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shore Bancshares operates as a community banking organization with a focus on providing financial services, and it has a market capitalization of approximately $0.22 billion.

Operations: The company generates its revenue primarily from community banking, with a recent quarterly revenue of $208.21 million. Operating expenses are significant, with general and administrative expenses often comprising the largest portion. The net income margin has shown variability, reaching 25.81% in the latest period analyzed.

PE: 9.8x

Shore Bancshares, a smaller player in the U.S. financial sector, showcases potential for value seekers. Recent earnings reveal net interest income of US$47.25 million for Q2 2025, up from US$42.14 million last year, with net income rising to US$15.51 million from US$11.23 million in the same period. Insider confidence is evident with recent share purchases, suggesting optimism about future growth prospects as earnings are projected to grow nearly 8% annually.

Saul Centers (BFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saul Centers operates as a real estate investment trust focusing on shopping centers and mixed-use properties, with a market capitalization of $1.16 billion.

Operations: The company generates revenue primarily from Shopping Centers and Mixed-Use Properties, with recent quarterly revenue reaching $267.61 million. The Gross Profit Margin has seen fluctuations, with a notable figure of 73.76% in September 2024. Operating expenses include significant allocations to General & Administrative costs, which were $24.90 million for the same period.

PE: 22.0x

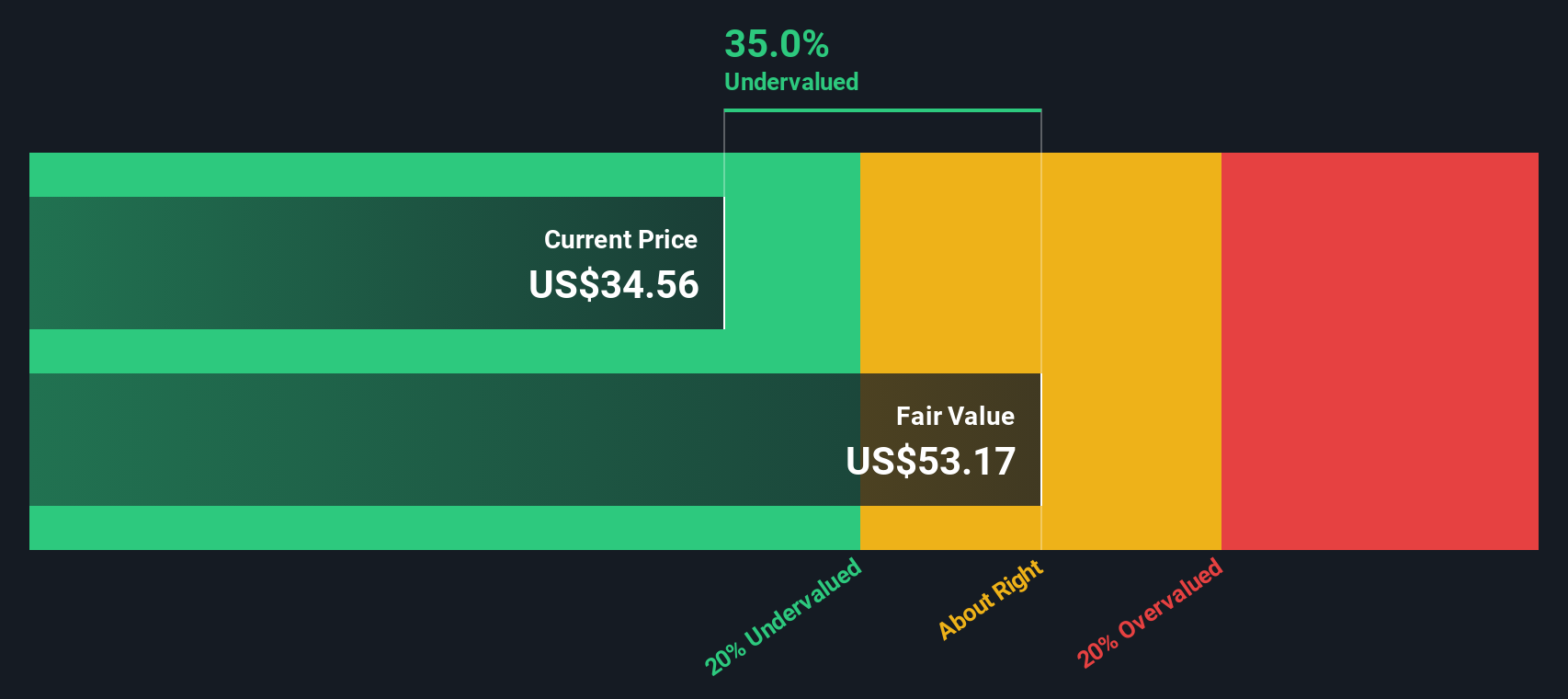

Saul Centers, a smaller player in the U.S. market, shows signs of being undervalued despite some financial challenges. The company's recent quarterly earnings reveal sales of US$70.55 million, an increase from US$65.3 million year-over-year, though net income dropped to US$9.8 million from US$13.63 million previously. Insider confidence is evident as Chairman & CEO Bernard Saul purchased 10,000 shares for approximately US$334,885 in May 2025. While interest payments aren't fully covered by earnings and funding relies on external borrowing, projected annual earnings growth of 12% suggests potential value for investors seeking growth opportunities within this segment.

- Click here and access our complete valuation analysis report to understand the dynamics of Saul Centers.

Examine Saul Centers' past performance report to understand how it has performed in the past.

Summing It All Up

- Investigate our full lineup of 70 Undervalued US Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFS

Saul Centers

As of March 31, 2025, 93.9% of the commercial portfolio was leased compared to 94.6% as of March 31, 2024.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives