- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

Freightos Leads 3 Prominent US Penny Stocks

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market has shown resilience, with major indexes like the S&P 500 posting weekly gains and nearing record highs. For investors eyeing opportunities in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area. These stocks often represent underappreciated growth potential at lower price points, particularly when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 702 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Freightos (NasdaqCM:CRGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freightos Limited operates a vendor-neutral booking and payment platform for international freight, with a market cap of approximately $203.85 million.

Operations: Freightos Limited has not reported any specific revenue segments.

Market Cap: $203.85M

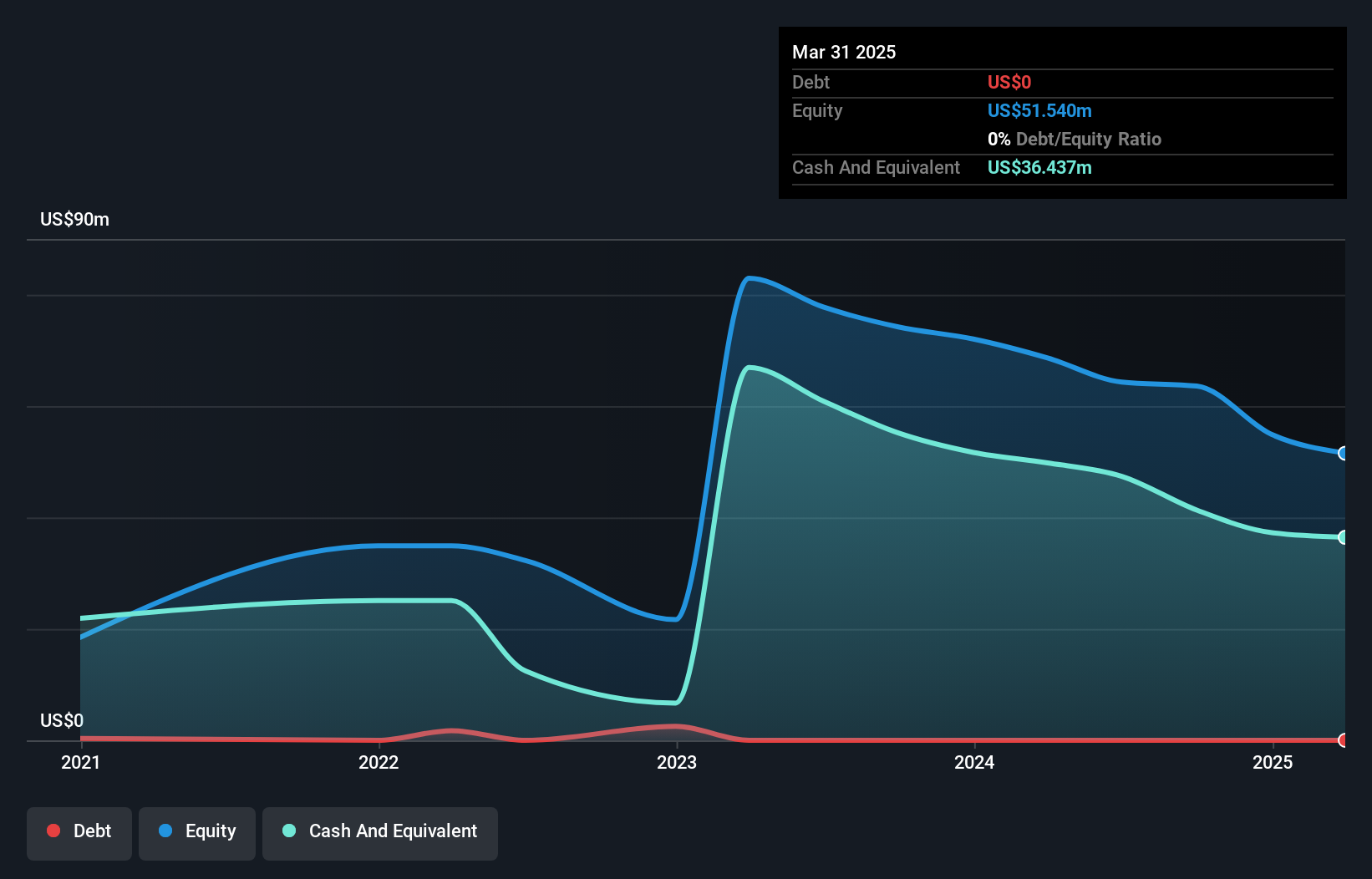

Freightos Limited, with a market cap of US$203.85 million, operates in the international freight booking sector and is currently unprofitable. Despite this, it shows potential for growth with forecasted revenue increases of 22.17% annually. The company remains debt-free and has sufficient cash runway for over three years if its free cash flow continues to reduce at historical rates. Recent strategic partnerships with Norwegian Cargo and WestJet Cargo enhance Freightos' digital booking capabilities, potentially expanding its market reach. However, the stock's high volatility may pose risks to investors seeking stability in penny stocks.

- Get an in-depth perspective on Freightos' performance by reading our balance sheet health report here.

- Learn about Freightos' future growth trajectory here.

Genasys (NasdaqCM:GNSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genasys Inc. designs, develops, and commercializes critical communications hardware and software solutions for alerting, informing, and protecting people across various regions worldwide with a market cap of $151.87 million.

Operations: The company generates revenue from its hardware segment, which accounts for $18.35 million, and its software segment, contributing $13.80 million.

Market Cap: $151.87M

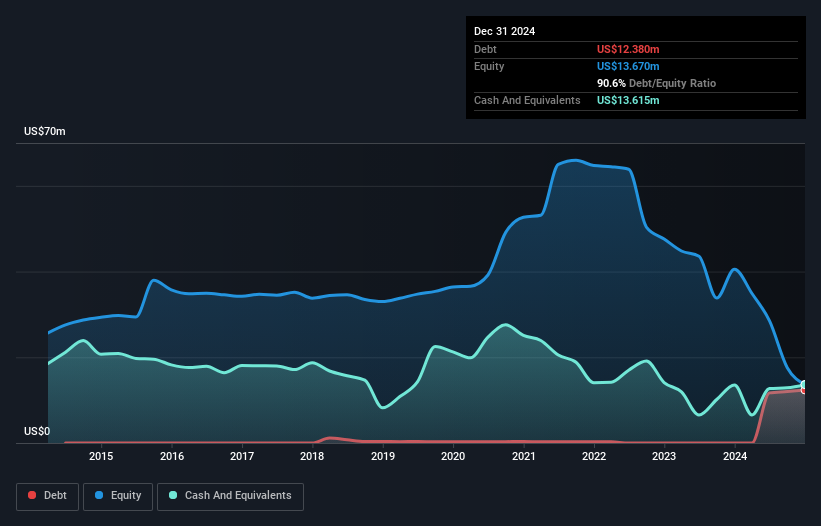

Genasys Inc., with a market cap of US$151.87 million, is unprofitable but shows potential for revenue growth, forecasted at 61.85% annually. The company reported a net loss of US$4.08 million in its recent earnings, though this was an improvement from the previous year. It has more cash than debt and short-term assets exceeding liabilities, indicating financial resilience despite high volatility and increased debt-to-equity ratio over five years. Recent board changes aim to strengthen governance as Genasys navigates challenges in its critical communications sector while maintaining sufficient cash runway for over a year under stable conditions.

- Navigate through the intricacies of Genasys with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Genasys' future.

EVgo (NasdaqGS:EVGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EVgo, Inc. operates a direct current fast charging network for electric vehicles in the United States with a market cap of $919.58 million.

Operations: The company generates revenue from its electric utilities segment, amounting to $239.31 million.

Market Cap: $919.58M

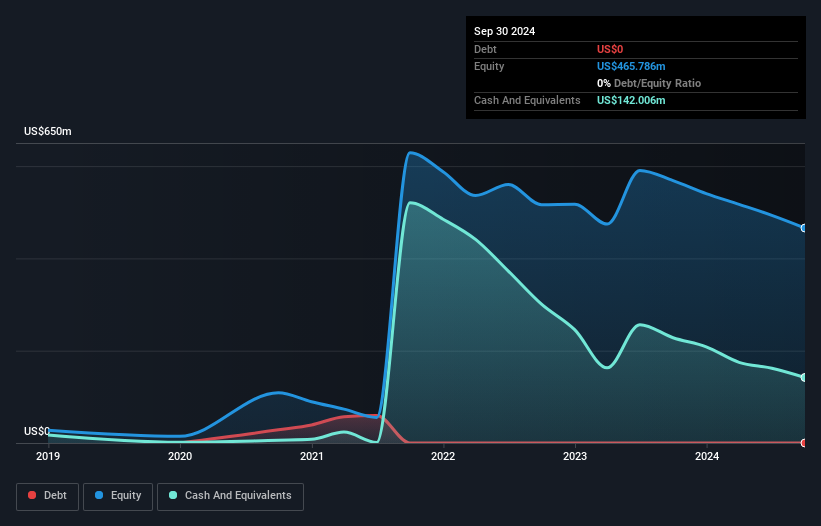

EVgo, Inc., with a market cap of US$919.58 million, is navigating the penny stock landscape amid significant developments. Despite being unprofitable and facing high volatility, its revenue from electric utilities stands at US$239.31 million. The company recently secured a substantial US$1.25 billion loan facility from the U.S. Department of Energy to expand its fast charging network significantly by 2029. EVgo's partnership with Meijer aims to enhance public charging infrastructure across multiple states, further supported by a completed follow-on equity offering worth US$115 million to bolster its financial position and growth initiatives in the EV sector.

- Click to explore a detailed breakdown of our findings in EVgo's financial health report.

- Evaluate EVgo's prospects by accessing our earnings growth report.

Seize The Opportunity

- Reveal the 702 hidden gems among our US Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles (EVs) in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives