- United States

- /

- Communications

- /

- NasdaqGS:CRNT

May 2025 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The U.S. stock market is experiencing a notable upswing, with the S&P 500 poised for its longest winning streak since 2004, driven by strong employment data and potential trade talks with China. For investors seeking opportunities beyond the established giants, penny stocks—despite their somewhat outdated name—remain an intriguing area of exploration. These smaller or newer companies can offer surprising value when underpinned by solid financials, providing a chance to uncover hidden potential in an evolving market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.37 | $355.42M | ✅ 4 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.324 | $1.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.31 | $1.27B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.06 | $17.59M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.2841 | $9.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.75 | $47.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.33 | $70.93M | ✅ 5 ⚠️ 3 View Analysis > |

| BAB (OTCPK:BABB) | $0.81485 | $5.95M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.53 | $81.59M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.75 | $70.6M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 750 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Baozun (NasdaqGS:BZUN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baozun Inc. provides comprehensive e-commerce solutions in China and has a market cap of approximately $150.72 million.

Operations: The company's revenue is primarily derived from its E-Commerce segment, which generated CN¥8.07 billion, and its Brand Management segment, contributing CN¥1.47 billion.

Market Cap: $150.72M

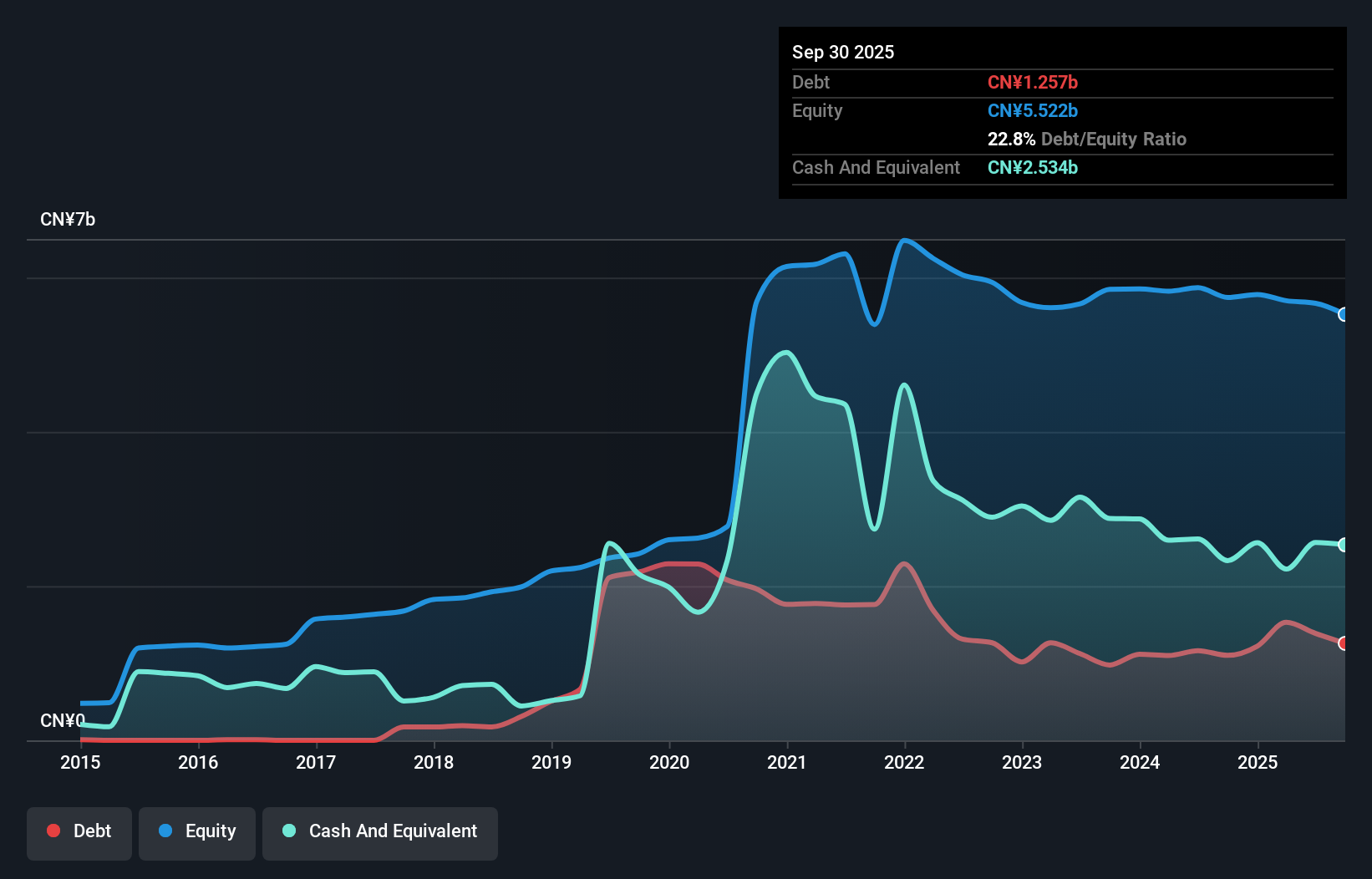

Baozun Inc., with a market cap of approximately $150.72 million, is navigating challenges typical of penny stocks. Despite being unprofitable and having a negative return on equity, the company has shown resilience by reducing its debt-to-equity ratio from 88% to 21.1% over five years and maintaining more cash than total debt. Baozun's revenue for 2024 was CN¥9.42 billion, an increase from the previous year, although it reported a net loss of CN¥185.2 million. Recent executive changes may influence future strategy as the company continues its business transformation efforts in e-commerce and brand management sectors.

- Click to explore a detailed breakdown of our findings in Baozun's financial health report.

- Explore Baozun's analyst forecasts in our growth report.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across multiple regions, with a market cap of approximately $193.87 million.

Operations: The company generates $394.19 million in revenue from its role as a global innovator and leading solutions provider of wireless transport.

Market Cap: $193.87M

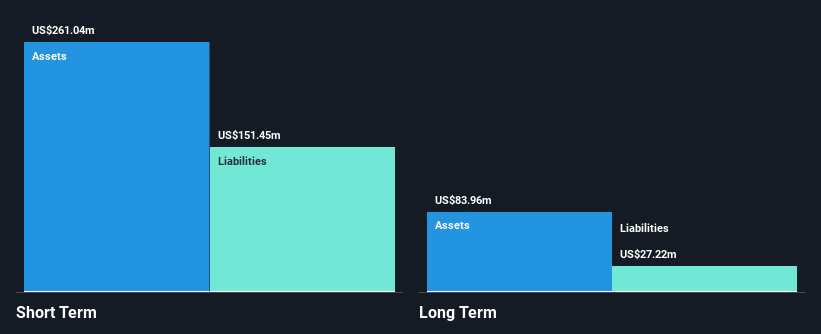

Ceragon Networks Ltd., with a market cap of US$193.87 million, is positioned as a robust player in the wireless transport sector. The company reported significant earnings growth of 286.9% over the past year, surpassing industry averages, and maintains high-quality earnings with a price-to-earnings ratio of 8.5x, indicating good value relative to peers. Ceragon's financial health is bolstered by short-term assets exceeding liabilities and more cash than debt. Recent strategic moves include acquiring E2E by Ceragon and securing a $4.1 million contract in North America, enhancing its portfolio in mission-critical network solutions for diverse industries globally.

- Click here to discover the nuances of Ceragon Networks with our detailed analytical financial health report.

- Gain insights into Ceragon Networks' future direction by reviewing our growth report.

Elite Pharmaceuticals (OTCPK:ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release and generic products with a market cap of $441.84 million.

Operations: Elite Pharmaceuticals generates revenue primarily from its Abbreviated New Drug Applications (ANDA) segment, totaling $70.00 million.

Market Cap: $441.84M

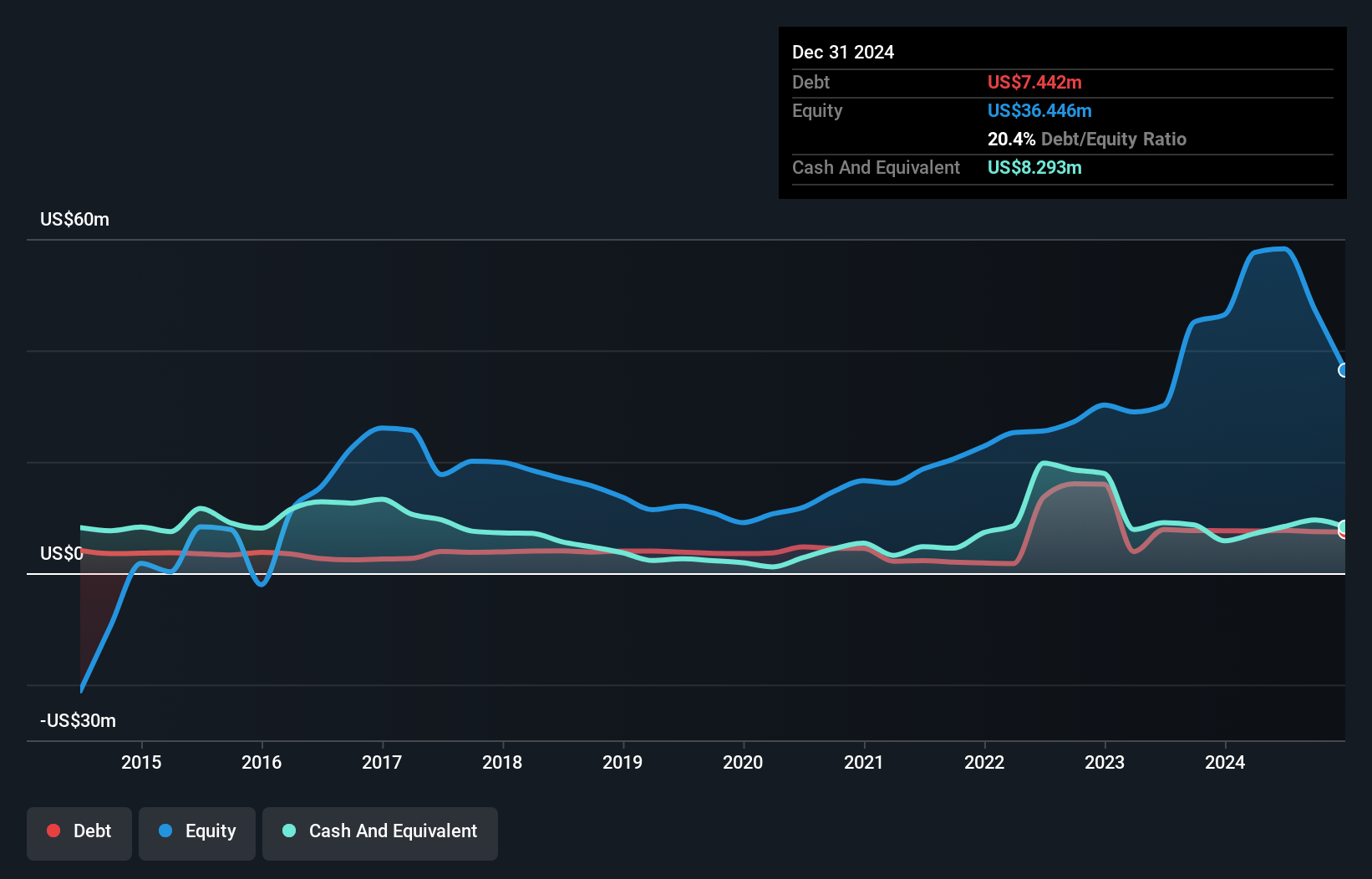

Elite Pharmaceuticals, Inc., with a market cap of US$441.84 million, faces challenges as it reported a net loss of US$10.89 million in the recent quarter despite generating US$14.36 million in revenue. The company remains unprofitable but has reduced losses over five years by 14.5% annually and maintains more cash than debt, ensuring a cash runway exceeding three years due to positive free cash flow growth. Its seasoned management and board bring extensive experience, while its debt-to-equity ratio has improved significantly over the past five years, reflecting prudent financial management amidst ongoing operational hurdles.

- Unlock comprehensive insights into our analysis of Elite Pharmaceuticals stock in this financial health report.

- Understand Elite Pharmaceuticals' track record by examining our performance history report.

Where To Now?

- Unlock our comprehensive list of 750 US Penny Stocks by clicking here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ceragon Networks, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNT

Ceragon Networks

Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives