- United States

- /

- Energy Services

- /

- NYSE:TTI

3 Promising Penny Stocks With Market Caps Under $700M

Reviewed by Simply Wall St

As the Dow Jones Industrial Average gains traction while the Nasdaq and S&P 500 experience slight declines, investors are keenly watching for signals from the Federal Reserve's anticipated interest rate cut. In such a fluctuating market, identifying promising investments can be challenging, yet opportunities abound for those who look beyond established giants. Though often seen as relics of past trading days, penny stocks continue to offer intriguing possibilities; when backed by solid financials, these smaller or newer companies can present unique growth prospects and hidden value for discerning investors.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.20 | $475.76M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.26 | $212.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.52 | $233.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.79 | $22.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.96824 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.80 | $85.42M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.95 | $651.74M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 381 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Commerce.com (CMRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Commerce.com, Inc. provides a software-as-a-service e-commerce platform for brands and retailers across multiple regions globally, with a market cap of $380.26 million.

Operations: The company generates revenue of $337.54 million from its Internet Information Providers segment.

Market Cap: $380.26M

Commerce.com, Inc. recently rebranded from BigCommerce Holdings, Inc., and has been active in enhancing its e-commerce platform through strategic partnerships and product launches. The company announced a collaboration with Metrolinx to improve its headless ecommerce experience on the BigCommerce platform, integrating advanced security features and multi-channel selling capabilities. Despite being unprofitable with a negative return on equity of -46.74%, Commerce.com shows financial stability through positive free cash flow growth and sufficient cash runway for over three years. Its short-term assets exceed both short- and long-term liabilities, indicating sound liquidity management amidst ongoing losses reduction efforts.

- Unlock comprehensive insights into our analysis of Commerce.com stock in this financial health report.

- Assess Commerce.com's future earnings estimates with our detailed growth reports.

Ceragon Networks (CRNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across various regions globally, with a market cap of $182.48 million.

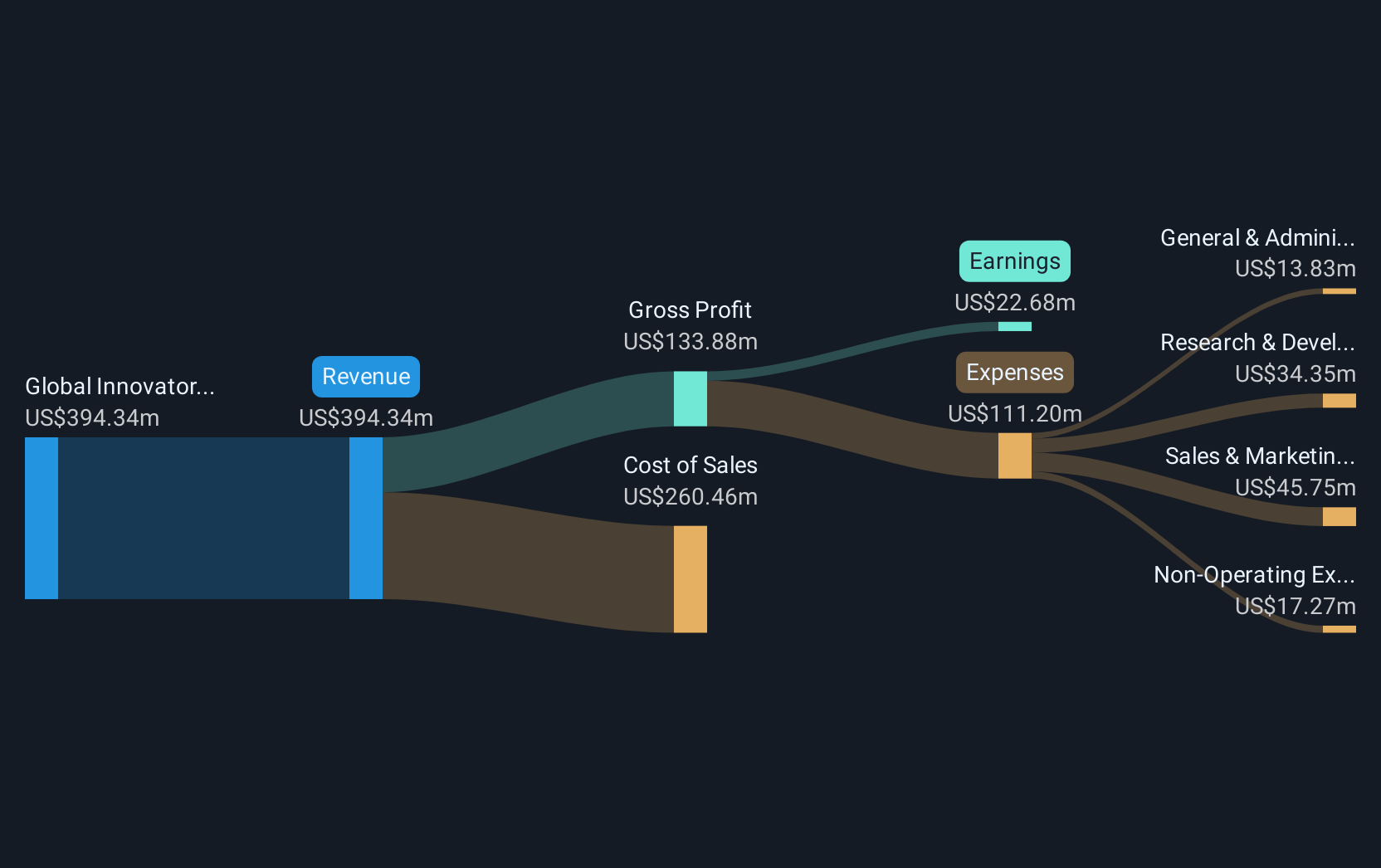

Operations: The company generates revenue of $380.52 million from its role as a global innovator and leading solutions provider in wireless transport.

Market Cap: $182.48M

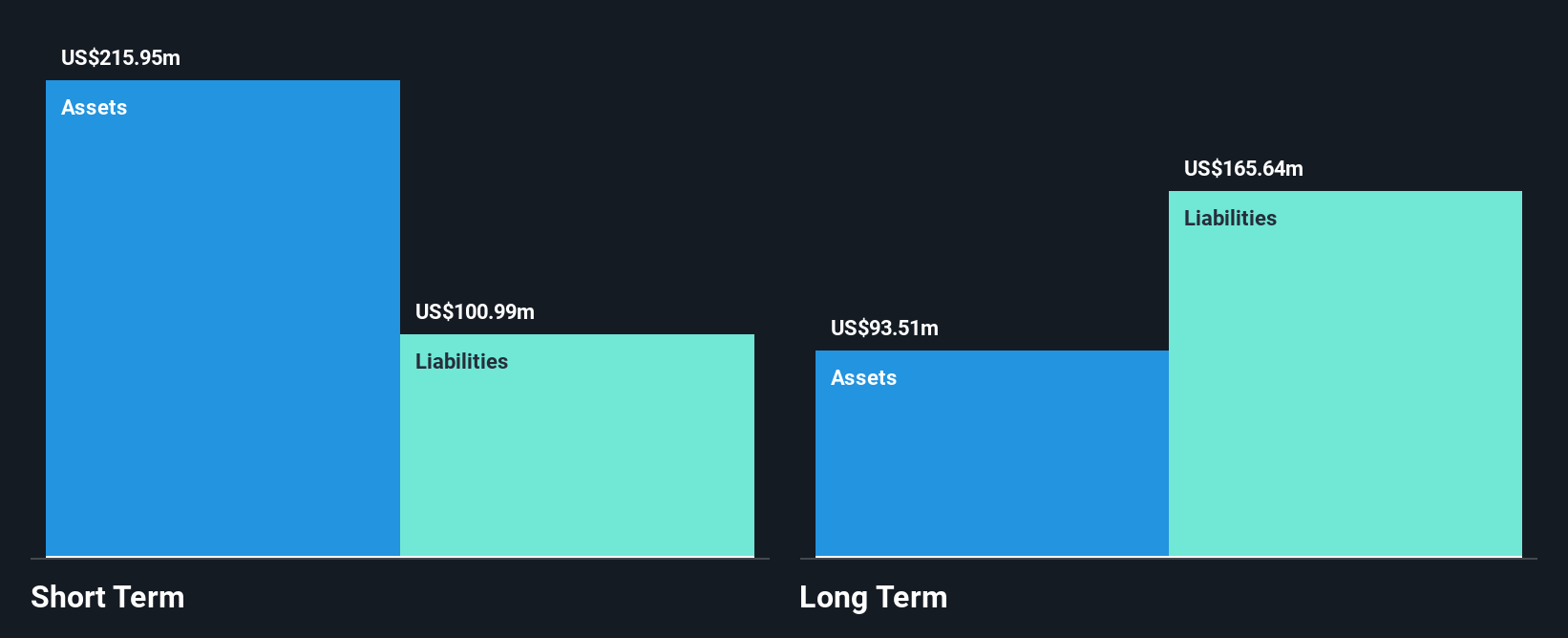

Ceragon Networks Ltd., with a market cap of US$182.48 million, is advancing its global presence through strategic projects and innovative product launches. Recent developments include a significant partnership to modernize a communications network for an EMEA power utility, projected to generate US$8 million in revenue, with 75% of orders already secured. Despite reporting a net loss for the first half of 2025 due to large one-off items impacting results, Ceragon maintains financial health with more cash than debt and short-term assets exceeding liabilities. Its new IP-50 EXP product positions it strongly in the 5G market expansion efforts.

- Take a closer look at Ceragon Networks' potential here in our financial health report.

- Evaluate Ceragon Networks' prospects by accessing our earnings growth report.

TETRA Technologies (TTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market cap of $651.74 million.

Operations: The company's revenue is derived from two main segments: Water & Flowback Services, which generated $270.75 million, and Completion Fluids & Products, contributing $336.46 million.

Market Cap: $651.74M

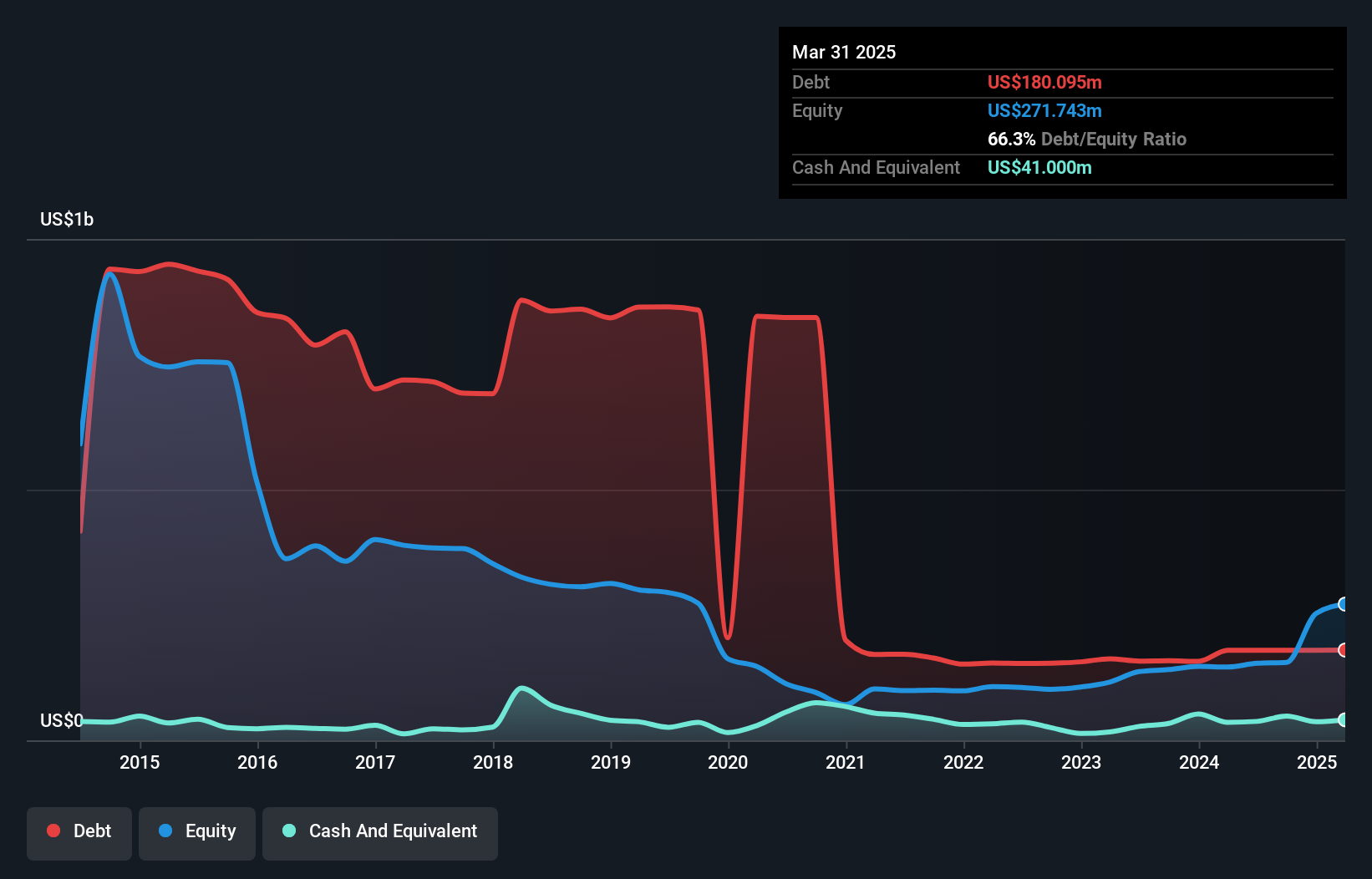

TETRA Technologies, Inc., with a market cap of US$651.74 million, has demonstrated significant financial improvement, reporting a net income increase to US$11.31 million for Q2 2025 from US$7.64 million the previous year. Their revenue streams from Water & Flowback Services and Completion Fluids & Products are robust, totaling over US$600 million annually. Despite being removed from several growth indices and facing earnings forecast declines of 75.8% annually over three years, TETRA's debt management is commendable with reduced debt-to-equity ratios and strong interest coverage by EBIT at 3.2x, reflecting sound financial health in the penny stock realm.

- Click here and access our complete financial health analysis report to understand the dynamics of TETRA Technologies.

- Gain insights into TETRA Technologies' future direction by reviewing our growth report.

Seize The Opportunity

- Embark on your investment journey to our 381 US Penny Stocks selection here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TETRA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>